Conmputer the income tax payable by Mr Ardeshar. (Do not take cess into consideration ) Age 62 years, taxble income ₹ 7,20,000 .

The correct Answer is:54000

Topper's Solved these Questions

- PRACTICE QUESTION BASEDBOOK - NAVNEET PUBLICATION - MAHARASHTRA BOARDCHAPTER - PRACTICE QUESTION BASEDEXERCISE - STATISTICS

13 Videos

- PRACTICE QUESTION BASEDBOOK - NAVNEET PUBLICATION - MAHARASHTRA BOARDCHAPTER - PRACTICE QUESTION BASEDEXERCISE - LINEAR EQUATIONS IN TWO VARIABLES

11 Videos

- MODEL QUESTION PAPERBOOK - NAVNEET PUBLICATION - MAHARASHTRA BOARDCHAPTER - MODEL QUESTION PAPEREXERCISE - SOLVE THE FOLLOWING SUBQUESTIONS: (ANY ONE)

2 Videos

- PRACTICE QUESTIONS BASEDBOOK - NAVNEET PUBLICATION - MAHARASHTRA BOARDCHAPTER - PRACTICE QUESTIONS BASEDEXERCISE - SURFACE AREA AND VOLUME

17 Videos

Similar Questions

Write the upper classs limit and the lower class limit of the class 35-40.

View Solutionwrite any two solutions of the equations x+y=7.

View Solution

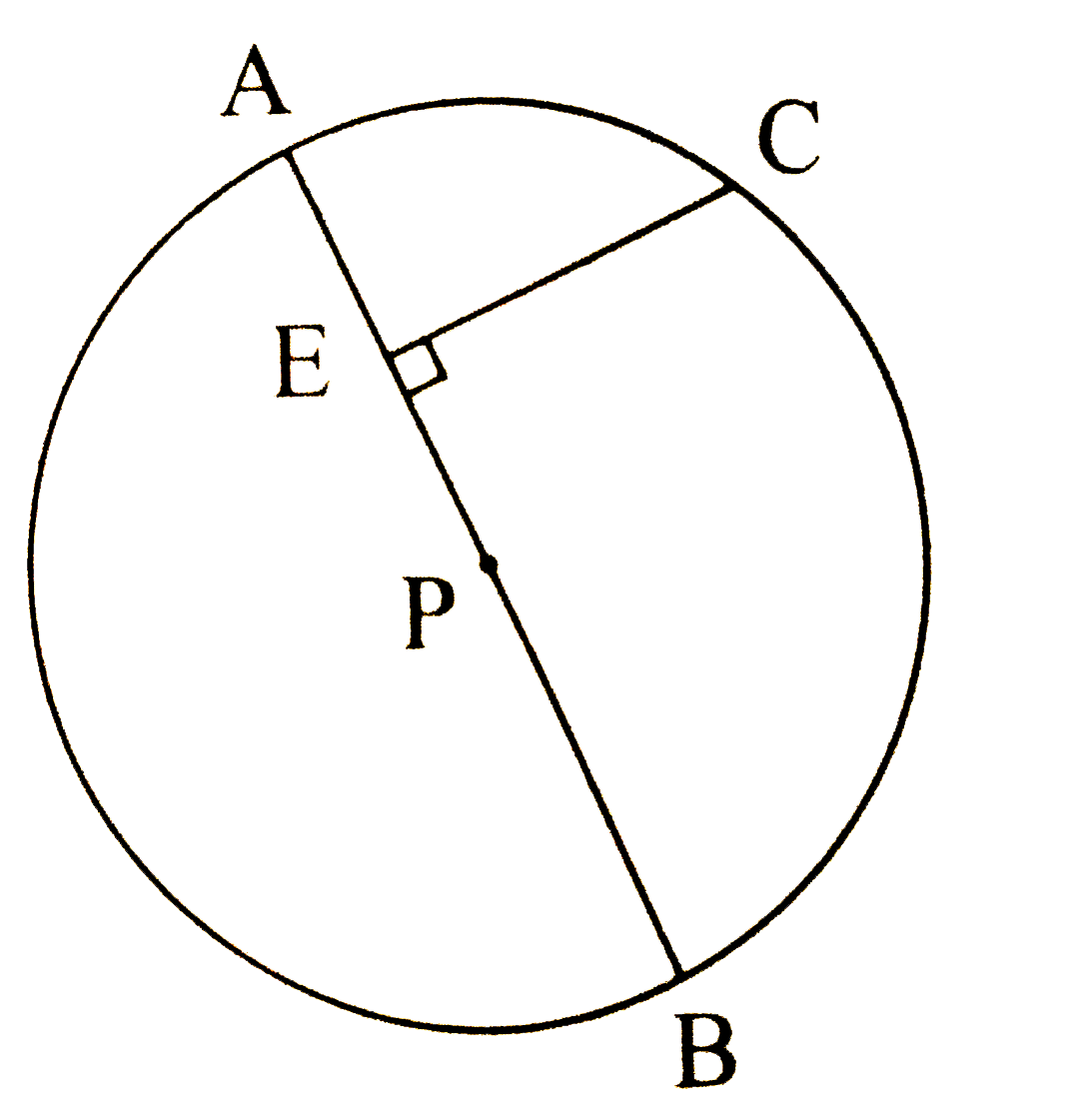

In the above figure, seg AB is a diameter of a circle with centre P.C is any point on the circle. Seg CE ⊥ seg AB. Prove that CE is the geometric mean of AE and EB. Write the proof with the help of folloing steps:

(a) Draw ray CE. It intersects the circle at D.

(b) Show that CE = ED.

Write the result using theorem of intersection of chords insides a circle.

(d) Using CE = ED, complete the proof.

View SolutionFind the volume of cube of length 10 cm .

View Solutionदेय आयकर रु 2,000 पर शिक्षा उपकर 3% की दर से होगा -

View Solutionशिक्षा उपकर कुल देय आयकर पर लगता है।

View SolutionIs income tax applicatble for income upto Rs. 2,50,000 . How many income tax is payable for income slabs from 25,000 to 5,00,000 . Also write the percentage of education cess, secondary and higher secondary eduation cess ?

View SolutionHow much education cess is payable on the income tax of Rs. 12,000 ?

View SolutionMr., Ajit's payable amount of income tax is Rs. 8000. He has to pay education cess at 3% on income tax. How much total income tax will he have to pay ?

View SolutionCompute the income tax payable by following individual : Mr. Kadam who is 35 years old and has taxable income of Rs. 13,35,000

View SolutionCompute the income tax payable by following individual : Mr. Khan is 65 years of age and his taxable income is Rs. 4,50,000.

View SolutionCompute the income tax payable by following individual Miss Varsha (Age 26 years) has a taxable income of Rs. 2,30,000.

View SolutionWhat will be education cess payable on income tax of Rs. 5000?

View SolutionCompute income tax payable by Mr. Pathak who is 65 year old. His taxable income is Rs.450000.

View SolutionMr. Kadam who is 35 year old has taxable income of Rs. 1335000. compute the income tax payable by him.

View SolutionCalculate the income tax payable by the following person. Mr. Kadam is 35 years old and has a taxable income of Rs. 13,35,000.

View Solution