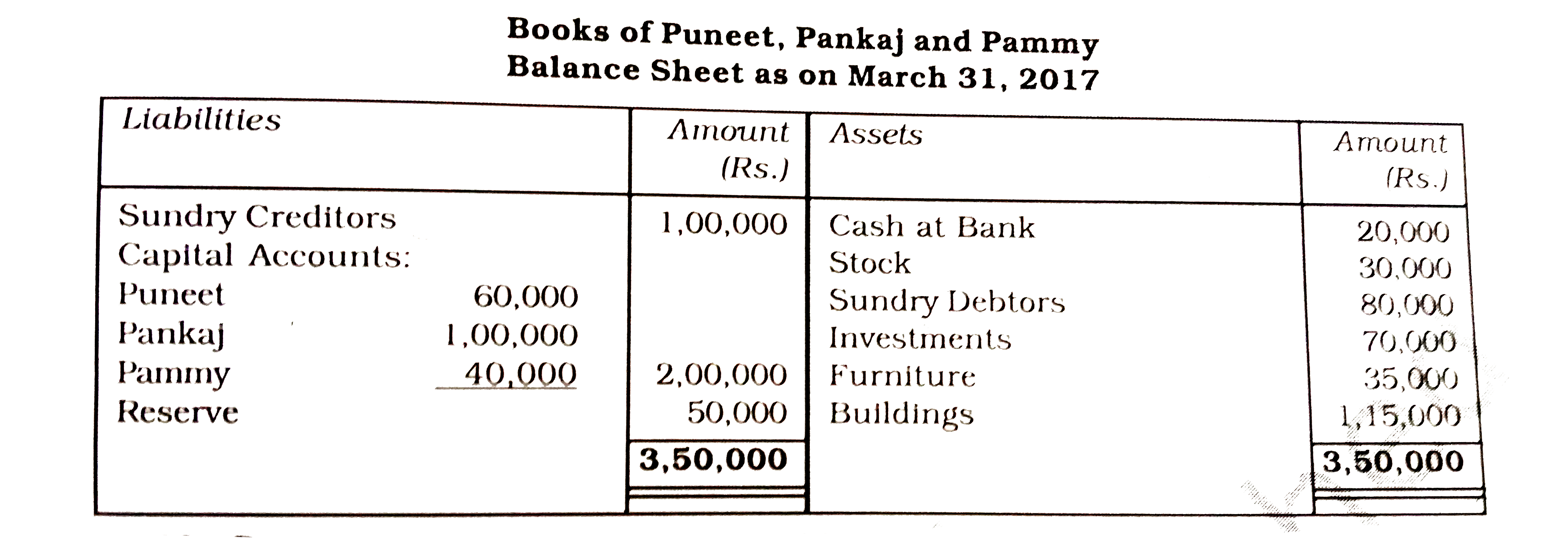

Puneet, Pankaj and Pammy are partners in a business sharing profits and losses in the ratio of 2:2:1 respectively. Their balance sheet as on March 31, 2017 was as follows:

Mr. Pammy died on September 30, 2017. The partnership deed provided the following:

(i) The deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit.

(ii) He will be entitled to his share of goodwill of the firm calculated on the basis of 3 years’ purchase of average of last 4 years’ profit. The profits for the last four financial years are given below:

The drawings of the deceased partner up to the date of death amounted to Rs. 10,000. Interest on capital is to be allowed at 12% per annum.

Surviving partners agreed that Rs. 15,400 should be paid to the executors immediately and the balance in four equal yearly instalments with interest at 12% p.a. on outstanding balance.

Show Mr. Pammy’s Capital account, his Executor’s account till the settlement of the amount due.

The correct Answer is:Total amount due is Rs. 75,400

Step by step video, text & image solution for Puneet, Pankaj and Pammy are partners in a business sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Their balance sheet as on March 31, 2017 was as follows: Mr. Pammy died on September 30, 2017. The partnership deed provided the following: (i) The deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit. (ii) He will be entitled to his share of goodwill of the firm calculated on the basis of 3 years’ purchase of average of last 4 years’ profit. The profits for the last four financial years are given below: The drawings of the deceased partner up to the date of death amounted to Rs. 10,000. Interest on capital is to be allowed at 12% per annum. Surviving partners agreed that Rs. 15,400 should be paid to the executors immediately and the balance in four equal yearly instalments with interest at 12% p.a. on outstanding balance. Show Mr. Pammy’s Capital account, his Executor’s account till the settlement of the amount due. by Accounts experts to help you in doubts & scoring excellent marks in Class 12 exams.

Updated on:21/07/2023Similar Questions

Why heirs of retring/deceased partner are entitled to share of goodwill of the firm ?

View SolutionA and B are partners in a business sharing profits and losses in the ratio of 7 : 3 respectively. They admit C as a new partner. A sacrificed 1/7th share of his profit and B sacrificed 1/3rd of his share in favour of C. The new profit sharing ratio of A, B and C will be :

View Solution

Knowledge Check

A, B and C were partners sharing profits and losses in the ratio of 2:2:1. Books are closed on 31st March every year. C dies on 5th November, 2018. Under the partnership deed, the executors of the deceased partner are entitled to his share of profit to the date of death, calculated on the basis of last year's profit.Profit for the year ended 31st March, 2018 was Rs. 2,40,000. C's share of profit will be :

ARs. 28,000BRs. 32,000CRs. 28,800DRs. 48,000A, B and C are the partner sharing profits in the ratio 3:2:1 , C retires . What will be the new profit - sharing ratio?

A1:3B3:2C1:1DNone of these.

A, B and C were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. The partners decide to share future profits and losses in the ratio of 2 : 2 : 1. Indicate each partner's gain or sacrifice due to change in ratio.

View SolutionA and B were partners in a firm sharing profits and losses in the ratio of 3:2. They admit C into the partnership with 1/6 share in the profits. Calculate the new profit sharing ratio?

View SolutionPranav, Karan and Rahim were partnere in a firm sharing parofits and losses in the ratio of 2:2:1. on 31st March, 2017 their Balance Sheet was as follows:

Karan died on 12th June, 2017. According to the Partnership Deed, the legal representatives of the deceased partner ware entitled to the following:

(i) Balance in his Capital Account.

(ii) Interest on Capital @12% p.a.

(iii) Share of goodwill. Goodwill of the firm on Karan's death was valued at Rs 60,000.

(iv) Share in the profit of the firm till the date of his death, calculated on the basis of last year's profit. The profit of the firm for the year ended 31st March, 2017 was Rs 5,00,000.

Prepare Karan's Capital Account to be presented to his representatives.

View SolutionX, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. They admit A into partnership and give him 1/5th share of profits. Find the new profit-sharing ratio.

View SolutionX and Y are partners in a firm sharing profits and losses in the ratio of 3 : 2. Z is admitted as partner with 1/4th share in profit. Z acquired his share from X and Y in the ratio of 2 : 1.

Calculate new profit-sharing ratio.

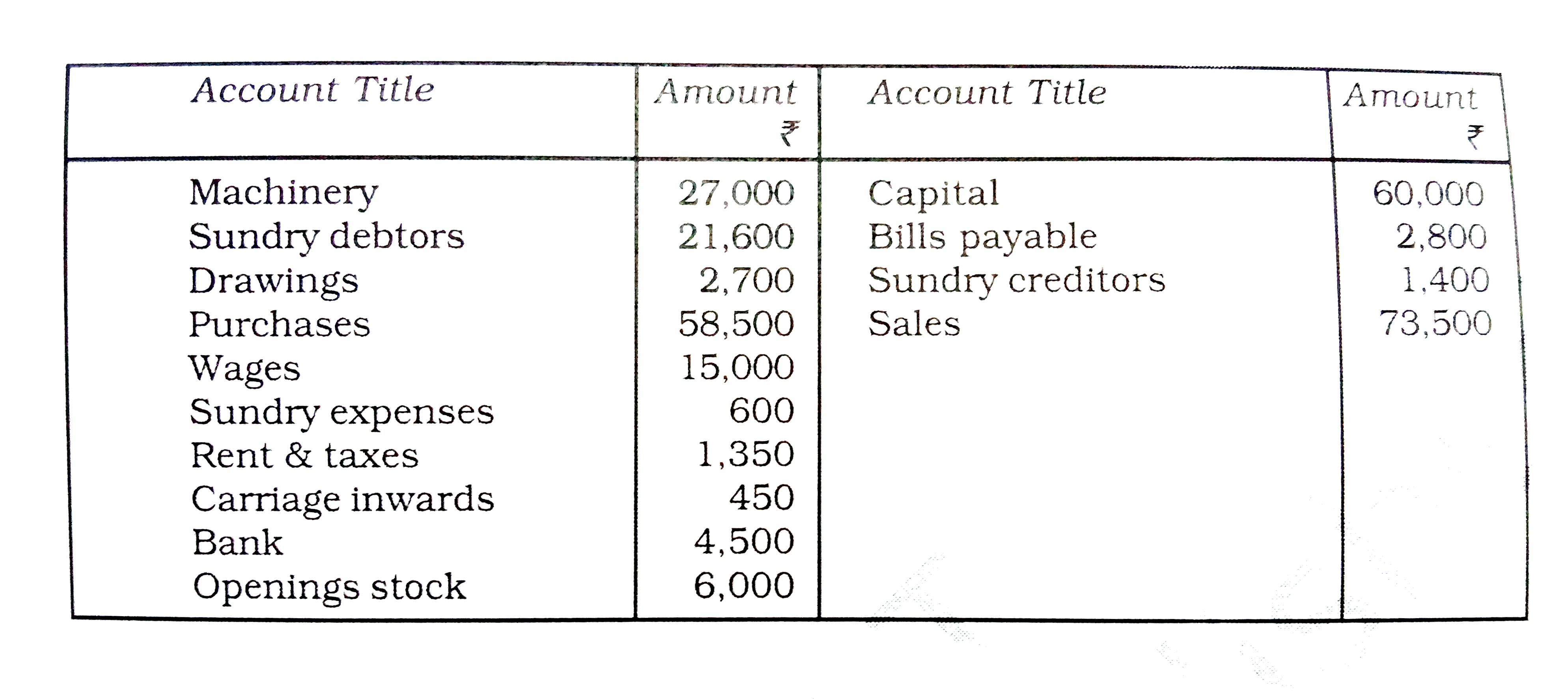

View SolutionPrepare trading and profit and loss account and balance sheet as on March 31, 2017 :

Closing stock as on March 31, 2017 Rs. 22,400

View Solution