From the following transactions ,state the nature of accounts and state which account will be debited and which account will be credited :

₹1.Mohan started business with cash5,00,0002.Purchased goods for cash1,00,0003.Sold goods for cash1,50,0004.Received interest from Ram in cash5005.Sold goods to Ashok60,0006.Purchased furniture for cash50,0007.Paid wages20,000

Similar Questions

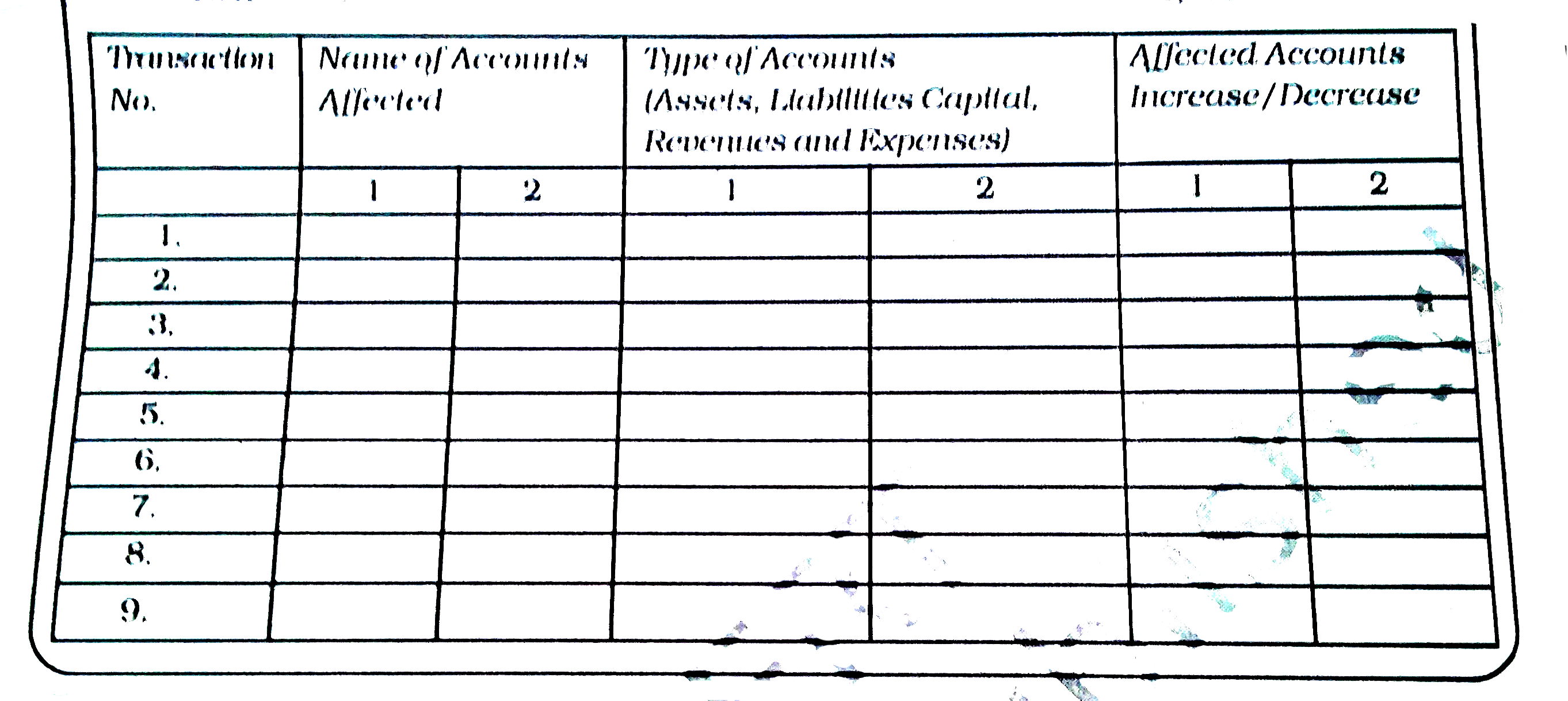

Analyse the following transactions , state the nature of accounts and state which account will be debited and which account will be credited on the basis of Modern Classification of Accounts :

₹1.Dinesh started business with cash5,00,0002.Borrowed from Naresh1,00,0003.Purchased furniture for cash from Raj Furniture House20,0004.Purchased furniture from Delhi Safe40,0005.Purchased goods for cash15,0006.Purchased goods from Mahesh30,0007.Sold goods for cash to Karim25,0008.Sold goods to shyam on credit30,0009.Cash received from Shyam20,00010.Cash paid to Mahesh10,000

View SolutionFrom the following transactions, state the nature of accounts and state which account will be debited and which account will be credited :

1. Sahdev started business with cash Rs. 5,00,000.

2. Purchased goods for cash Rs. 20,000.

3. Purchased goods from Raghubir on credit for Rs.25,000.

4. Purchased furniture from Fancy Furniture House for Rs.1,50,000 on credit.

5. Sold goods for cash R. 30,000.

6. Sold goods to Yuvraj on credit for Rs. 50,000.

7. Cash paid to Raghubir Rs. 20,000.

8. Cash received from Yuvraj Rs. 15,000.

9. Paid rent Rs. 10,000.

View SolutionAnalyse the following transactions, state the nature of accounts and state which account will be debited and which account will be credited:

₹1.Anuj started business with cash1,00,0002.Deposited cash into bank for opening an account50,0003.Withdrew cash for personal use5,0004.Withdrew cash from bank for office use10,0005.Received a cheque from debtor Shyam5,0006.Deposited Shyam's cheque next day.7.Paid to a creditor Mahesh by cheque10,0008.Paid salary to staff20,0009.Paid rent by cheque6,00010.Paid interest on loan5,000

View SolutionFrom the following tansaction, state the nature of accounts and state the accounts which will be debited and credited:

1. Ganesh started business with Cash Rs.2,00,000.

2. Purchased goods for Cash Rs. 60,000.

3. Sold goods for cash Rs.75,000.

4. Purchased goods from Nakul on Credit for Rs. 80,000.

5. Sold goods to Bhushan on Credit fro Rs. 50,000.

6. Paid Cash to Nakul Rs. 20,000.

7. Received Cash from Bhushan Rs. 10,000.

8. Paid salary Rs. 20,000.

View SolutionOpen a 'T' shape Cash Account with the following transactions :

₹(i)Mohan started business with cash40,000(ii)Purchased goods20,000(iii)Sold goods24,000(iv)Paid rent 400(v)Paid salaries600(vi)Drew for personal use1,000

View SolutionState the title of the accounts affected, type of account and the account to be debited and account to be credited :

1. Bhanu commenced business with cash 1,00,000

2. Purchased goods on credit from Ramesh 40,000

3. Sold goods for cash 30,000

4. Paid salaries 3,000

5. Furniture purchased for cash 10,000

6. Borrowed from bank 50,000

7. Sold goods to Sarita 10,000

8. Cash paid to Ramesh on account 20,000

9. Rent paid 1,500

View SolutionPut the following on the proper side of a Cash Account , a Debtor's Account and a Creditor's Account :

₹(i)Sold goods to Sanjay on credit50,000(ii)Sold goods to Mohan for cash20,000(iii)Purchased goods from Ram on credit 25,000(iv)Cash received from Sanjay19,000(v)Goods returned by Sanjay2,000(vi)Paid rent500(vii)Cash paid to Ram15,000

View SolutionPrepare 'Accounting Equation' from the following :

(a) Started business with cash Rs.1,00,000.

(b) Purchased goods for cash Rs.20,000 and on credit Rs.30,000.

(c ) Sold goods for cash costing Rs. 10,000 and on credit costing Rs. 15,000 both at a prodit of 20%.

View SolutionWrite the following transactions in Debtor's Account , Creditor's Account and Cash Account :

₹1.Cash sales50,0003.Cash received from X56,0005.Paid to Y30,000∣∣ ∣ ∣ ∣∣₹2.Sold goods to X on credit80,0004.Purchase goods from Y on credit44,0006.Cash purchases from Y16,000

View SolutionWhat will be the effect of the following on the Accounting Equation ?

(i) Harish started business with cash ₹ 18,000

(ii) Purchased goods for cash ₹ 5, 000 and on credit ₹ 2,000

(iii) Sold goods for cash ₹ 4,000 (costing ₹ 2,400)

(iv) Rent paid ₹ 1,000 and rent outstanding ₹ 200

View Solution