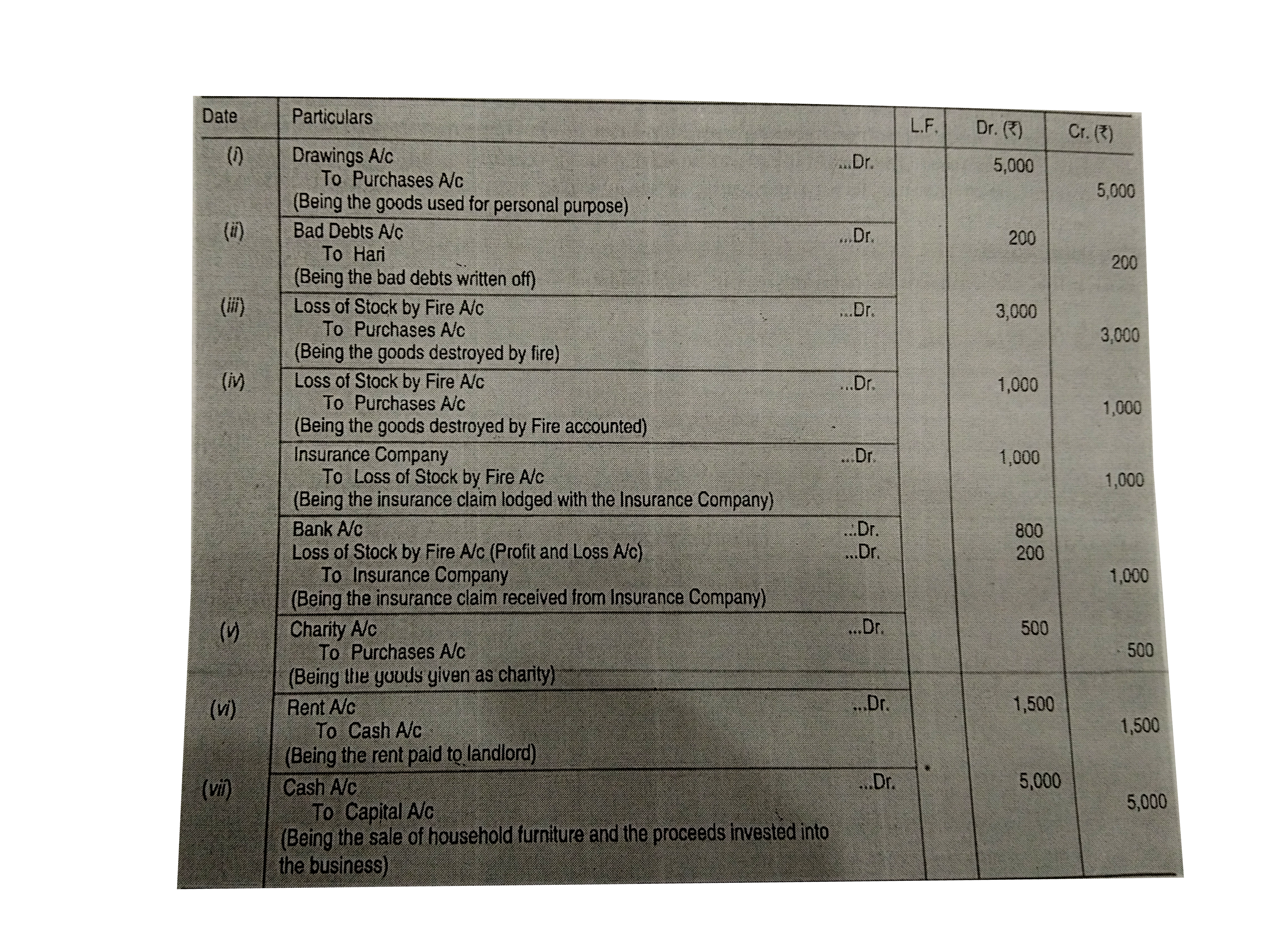

Journalise the following:

(i) Goods purchased for Rs. 5,000 were used by the proprietor for personal purposes.

(ii) Rs. 200 due from Hari are bad debts.

(iii) Goods uninsured of Rs. 3,000 (purchase cost) were destroyed by fire.

(iv) Goods costing Rs. 1,000 damaged by fire and Insurance Company accepted claim of Rs. 800 and cheque is received from the Insurance Company.

(v) Goods costing Rs. 500 given as charity (Sales Price Rs. 600).

(vi) Paid landlord Rs. 1,500 for rent.

(vii) Sold household furniture for Rs. 5,000. The proceeds were invested into business.

Topper's Solved these Questions

Similar Questions

Journalise the following.

(i) Goods purchased for Rs. 5,000 were used by the proprietor for personal purposes.

(ii) Rs. 200 due from Hari are bad debts. (It is not subject the levy of GST.)

(iii) Goods uninsured of Rs. 3,000 (purchase cost) were destroyed by fire.

(iv) Goods costing Rs. 1,000 damaged by fire and Insurance Company accepted claim of Rs. 800 and cheque is received from the Insurnace Company.

(v) Goods costing Rs. 500 given as charity (Sales Price Rs. 600).

(vi) Paid landlord Rs. 1,500 for rent.

(vii) Sold household furniture for Rs. 5,000. It is not subject to levy of GST being personal asset of the proprietor. The proprietor. The proceeds were invested into business.

All transactions (except otherwise stated) are subject to levy of CGST and SGST @9% each.

View SolutionJournalise the following in the books of Amit, Saini, Gurugram (Haruana):

(i) Goods of Rs. 5,000 were taken by him for personal use.

(ii) Rs. 2,000 due from Sohan were bad debts.

(iii) Goods of Rs. 6,000 were destroyed by fire and were not insured.

(iv) Paid Rs. 4,000 in cash as wages on installation of machine. (GST is not to be levied).

(v) Sold goods to Arjun of Delhi of list price Rs. 20,000. Trade discount @ 10% and cash discount of 5% was allowed. He paid the amount on the same day and availed the cash discount.

(vi) Received Rs. 2,000 from Ramesh, whose account was written off as bad debts.

(vii) Goods costing Rs. 1,000 given as charity.

(viii) Received Rs. 9,750 from Ramesh in full settlement of his account of Rs. 10,000.

(ix) Paid rent in advance Rs. 4,000.

CGST and SGST is to be levied on intra-state sale @ 6% each and IGST @ 12% on inter-state sale.

View Solution

Knowledge Check

Goods of Rs. 1,000 taken by the proprietor for personal use should be credited to

ASales AccountBProprietor's Personal Expenses AccountCPurchases AccountDDrawing AccountGoods of Rs. 1,000 taken by the proprietor for personal use should be credited to

ASales Account.BProprietor's Personal Expenses Account.CPurchases Account.DNone of these.

On 28th March, 2019, stocks costing Rs80,000 were destroyed by fire. These goods were purchased paying IGST @12% . The stock was insured and the insurance company admitted claim of Rs85,000 only. Give necessary Journal entries and show how it will be shown in the Final accounts.

View SolutionOn 28th March, 2019, stocks costing Rs80,000 were destroyed by fire. These goods were purchased paying IGST @12% . The stock was insured and the insurance company admitted claim of Rs85,000 only. Give necessary Journal entries and show how it will be shown in the Final accounts.

View SolutionPass Journal entries in the books of Puneet, Delhi for the following:

(i) Received an order from Karan & Co. for supply of goods of Rs. 50,000.

(ii) Received an order from AK & Co. for goods of Rs. 1,00,000 along with a cheque for Rs. 25,000 as advance.

(iii) Paid to staff Rs. 40,000 against outstanding salary of Rs. 60,000.

(iv) Sold goods to Bharat, Kaithal (Haryana) of Rs. 10,000 plus IGST @ 12% out of which 1/5th were returened being defective.

(v) Chaque of Rs. 20,000 issued by Feroz was dishonoured.

(vi) Received 40 paise in a reupee form Feroz against the above dues.

(vii) Received a cheque of Rs. 25,000 from Mohan after banking hours.

(viii) Purchased goods form Barun of Chandigarh of Rs. 10,000 plus IGST @ 12% and sold them to Arun of Shimla (HP) at Rs. 22,400, including IGST @ 12%.

(ix) Arun returned goods of Rs. 6,720, including IGST which were returned to Barun.

(x) ABC & Co. purchased 10TV sets @ Rs. 20,000 per set and paid IGST @ 12% It sold all the sets @ Rs. 25,000 per set plus CGST and SGST @ 6% each.

(xi) Paid insurance of Rs. 12,000 plus CGST and SGST @ 6% each for a period of one year.

(xii) Sold personal car for Rs. 1,00,000 and invested the amount in the firm.

(xiii) Goods costing Rs. 1,00,000 were destroyed in fire. Insurance company admitted the claim for Rs. 75,000. These goods were purchased within Delhi.

(xiv) Purchased machinery for Rs. 56,000 including IGST of Rs. 6,000 and paid cartage thereon Rs. 5,000 and installation charges Rs. 10,000.

(xv) Goods costing Rs. 40,000 sold to Mr. X at a profit of 20% on sales less 10% Trade Discount plus CGST and SGST @ 6% each and received a cheque under 2% cash discount.

(xvi) Purchased machinery from New Machinery House for Rs. 50,000 and paid it by means of a bank draft purchased from bank. Paid bank charges Rs. 500.

View SolutionRecord the following transactions in a Journal :

(i) Withdrawn goods conting Rs. 5,000 for personal use.

(ii) Goods costing Rs. 500 given as charity.

(iii) A cheque for Rs. 5,000 received from Rajib was deposited into bank, returned dishonoured.

View SolutionRagini has insured her house for Rs. 5,00,000 against the fire. There is a fire and Ragini suffers a loss of Rs. 1,00,000. How much amount she can recover from the insurer ?

View SolutionPass the Journal entries to rectify the following errors detected during preparation of the Trial Balance:

Purchase Book is undercast by Rs. 1,000.

(ii) Wages paid for construction of office debited to Wages Account Rs. 20,000.

(iii) A credit sale of goods Rs. 1,200 to Ramesh has been wrongly passed through the Purchases Book.

(iv) Goods purchased for Rs. 5,000 were posted as Rs. 500 to the Purchases Account.

(v) An amount of Rs. 2,000 due from Muhesh Chand which had been written off as a bad debt in previous year was unexpectedly recovered has been posted to the personal account of Mahesh Chand.

(vi) A credit purchase of Rs. 1,040 from Ramesh was passed in the books as Rs. 1,400.

(vii) Goods (Cost Rs. 5,000, Sales Price Rs. 6,000) distributed as free samples among prospective customers were not recorded anywhere.

(viii) Goods worth Rs. 1,500 returned by Green & Co. have not recorded anywhere.

View Solution