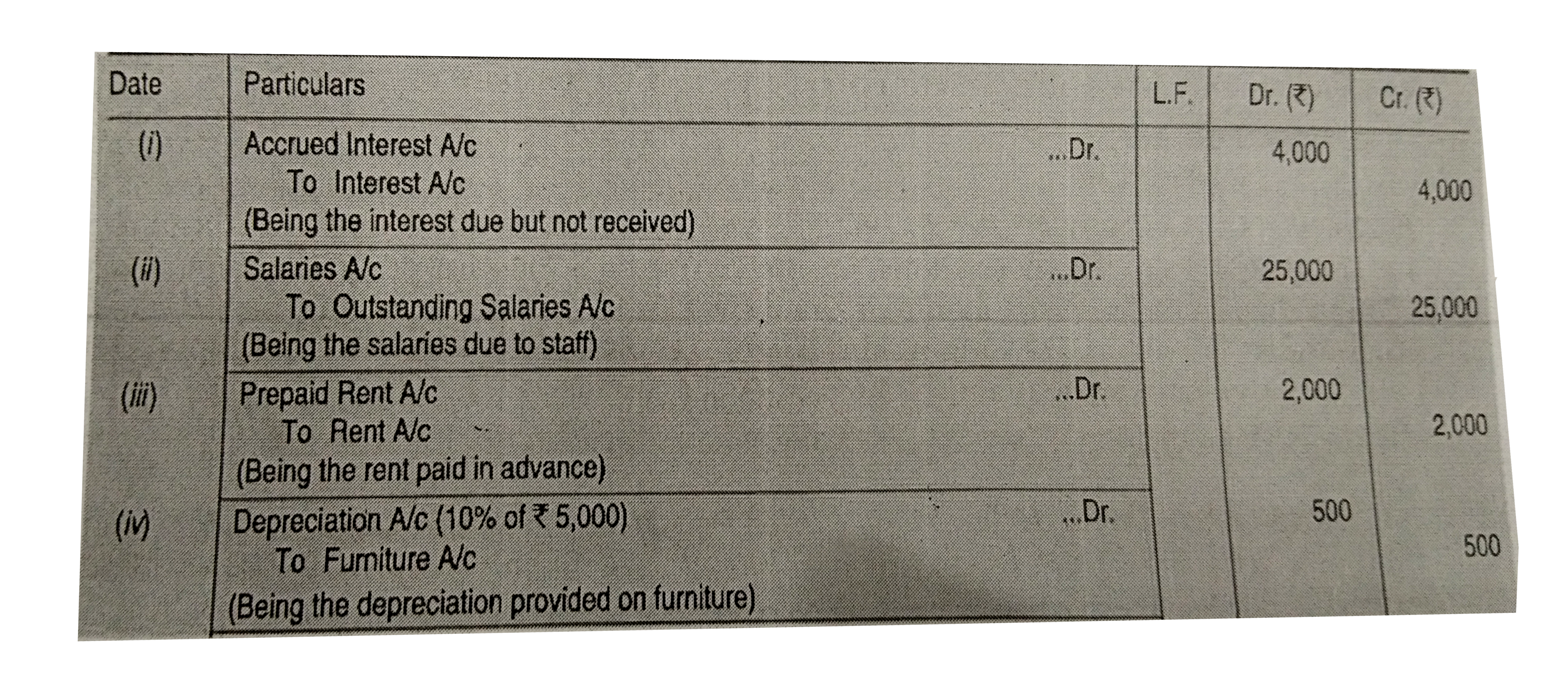

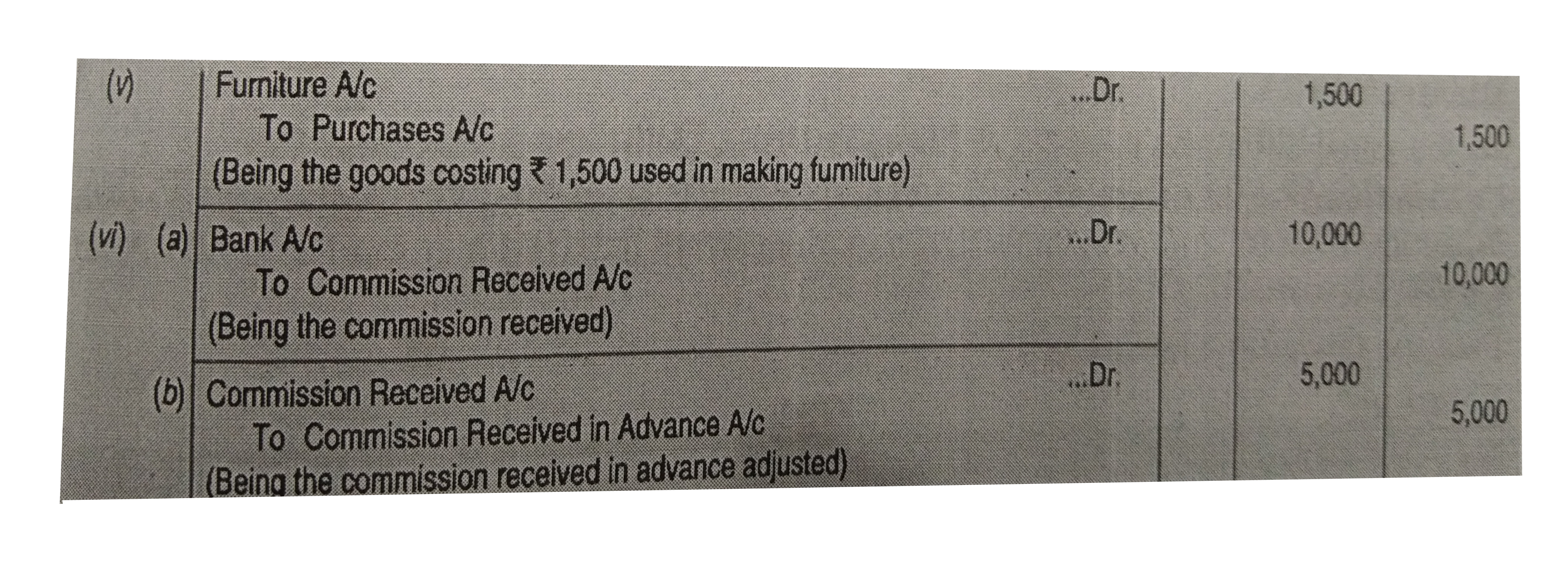

Pass Journal entries for the followings:

(i) Interest due but not recevied Rs. 4,000.

(ii) Salaries due to staff Rs. 25,000.

(iii) Out of the rent paid this year, Rs. 2,000 relates to the next year.

(iv) Provide 10% depreciation on furniture costing Rs. 5,000.

(v) Goods used in making Furniture (Sale Price Rs. 2,000, Cost Rs. 1,500).

(vi) Received commission of Rs. 10,000 by cheque, half of which is in advance.

Topper's Solved these Questions

Similar Questions

Journalise the following transactions in the books of Mohan, Delhi:

(i) Raj of Alwar, Rajasthan who owed Mohan Rs. 25,000 became insolvent and received 60 paise in a ruee as full and final settlement.

(ii) Mohan owes to his landlord Rs. 10,000 as rent.

(iii) Charge depreciation of 10% on furniture costing Rs. 50,000.

(iv) Salaries due to employees Rs. 20,000.

(v) Sold to Sunil goods in cash of Rs. 10,000 less 10% trade discount plus CGST and SGST @ 6% each and received a net of Rs. 8,500.

(vi) Provided interest on capital of Rs. 1,00,000 @ 10% per annum.

(vii) Goods lost in theft Rs. 5,000, which were purchased paying IGST @ 12% from Alwar, Rajasthan.

View SolutionGive rectifying Journal entries for the following errors:

(i) Goods returned by Mohan of Rs. 1,500 not recorded in books.

(ii) Goods distributed as free samples for Rs. 5,000 not recorded.

(iii) Depreciation of machinery of Rs. 10,000 not charged.

(iv) Goods costing Rs. 780, selling price Rs. 1,000 given as charity not recorded.

View Solution

Knowledge Check

At a deposit of Rs. 2,000 a bank returns Rs. 3,000 after 5 years. What is the percentage rate of interest?

A20%B15%C10%D5%

What will be the effect of the following on the Accounting Equation ?

(i) Harish started business with cash Rs. 1,80,000.

(ii) Purchased goods for cash Rs. 60,000 and on credit Rs. 30,000.

(iii) Sold goods for cash Rs. 40,000 , costing Rs. 24,000.

(iv) Rent paid Rs. 5,000, and rent outstanding Rs. 2,000.

(v) Sold good on credit Rs. 50,000 (costing Rs. 38,000).

(vi) Salary paid in advance Rs. 3,000.

View SolutionPass the Journal entries rectifying the following errors:

(i) Purchases of Rs. 10,000 was omitted to be recorded.

(ii) Purchases of office furniture of Rs. 10,000 was recorded in Purchases Book.

(iii) Office Rent of Rs. 15,000 was debited to the Personal Account of the landlord.

(iv) Old machine sold for Rs. 5,000 was credited to Sales Account.

(v) Bill for Rs. 800 received from Mukesh for repair of machinery was entered in the Purchases Book as Rs. 700.

View SolutionPass necessary adjustment entries for the following in the books of Shri R. Banerjee at the end of accounting year on 31st March , 2019:

(i) Salary of Rs. 1,000 for March, 2019 is outstanding,

(ii) Interest accrued on investment Rs. 200,

(iii) Rent received in advance Rs. 400,

(iv) Insurance prepaid Rs. 300,

(v) Closing stock Rs. 10,000, and

(vi) Depreciate furniture by Rs. 800.

View SolutionPass Journal entries in the books of Puneet, Delhi for the following:

(i) Received an order from Karan & Co. for supply of goods of Rs. 50,000.

(ii) Received an order from AK & Co. for goods of Rs. 1,00,000 along with a cheque for Rs. 25,000 as advance.

(iii) Paid to staff Rs. 40,000 against outstanding salary of Rs. 60,000.

(iv) Sold goods to Bharat, Kaithal (Haryana) of Rs. 10,000 plus IGST @ 12% out of which 1/5th were returened being defective.

(v) Chaque of Rs. 20,000 issued by Feroz was dishonoured.

(vi) Received 40 paise in a reupee form Feroz against the above dues.

(vii) Received a cheque of Rs. 25,000 from Mohan after banking hours.

(viii) Purchased goods form Barun of Chandigarh of Rs. 10,000 plus IGST @ 12% and sold them to Arun of Shimla (HP) at Rs. 22,400, including IGST @ 12%.

(ix) Arun returned goods of Rs. 6,720, including IGST which were returned to Barun.

(x) ABC & Co. purchased 10TV sets @ Rs. 20,000 per set and paid IGST @ 12% It sold all the sets @ Rs. 25,000 per set plus CGST and SGST @ 6% each.

(xi) Paid insurance of Rs. 12,000 plus CGST and SGST @ 6% each for a period of one year.

(xii) Sold personal car for Rs. 1,00,000 and invested the amount in the firm.

(xiii) Goods costing Rs. 1,00,000 were destroyed in fire. Insurance company admitted the claim for Rs. 75,000. These goods were purchased within Delhi.

(xiv) Purchased machinery for Rs. 56,000 including IGST of Rs. 6,000 and paid cartage thereon Rs. 5,000 and installation charges Rs. 10,000.

(xv) Goods costing Rs. 40,000 sold to Mr. X at a profit of 20% on sales less 10% Trade Discount plus CGST and SGST @ 6% each and received a cheque under 2% cash discount.

(xvi) Purchased machinery from New Machinery House for Rs. 50,000 and paid it by means of a bank draft purchased from bank. Paid bank charges Rs. 500.

View SolutionYou are required to give (a) Journal Entries, (b) Nature of Account (whether Asset, Liability, Capital, Expense or Revenue), (c) Direction of change (Increase of Decrease), and (d) Appropriate rule for recording the change for the following transactions:

Nitin invested Rs. 50,000 cash and Rs. 5,00,000 by cheque to start a business.

2. He deposited Rs. 5,000 out of cash in the bank.

3. Purchased goods for Rs. 5,000 against cash.

4. Pruchased a building and paid Rs. 2,50,000 by cheque.

5. Purchased goods from M/s. Hari & Co. for Rs. 1,00,000

6. Sold goods for cash Rs. 50,000.

7. Sold goods on credit to M/s Ramesh & Co, Rs. 25,000.

8. M/s. Ramesh & Co. returned goods of Rs. 5,000, being defective.

9. Goods returned to M/s. Hari & Co. at cost price, i.e., Rs. 4,000.

10. Paid salary to staff by cheque Rs. 15,000.

11. Paid rent for the residence of Nitin Rs. 10,000 by cheque.

12. Paid electricity charges for the month Rs. 1,000 in cash.

13. Paid telephone charges Rs. 500 in cash.

14. Bought office furniture for Rs. 25,000 against cheque.

15. Paid M/s. Hari & Co. on account Rs. 50,000 by cheque.

16. Received from M/s. Ramesh & Co. Rs. 15,000 by cheque.

17. Paid advance Rs. 20,000 by cheque to M/s. Abhi & Sons.

18. Received advance of Rs. 30,000 by cheque from M/s Ajay & Co.

19. Paid Rs. 1,000 for stationery.

20. Nitin withdrew Rs. 10,000 for household expenses out of cash.

View SolutionPrepare Accounting Equation from the following :

(a) Started business with Cash Rs. 2,00,000.

(b) Purchased goods for Cash Rs. 60,000 and on Credit Rs. 1,50,000.

(c ) Sold goods for Cash costing Rs. 40,000 at a profit of 20% and on Credit costing Rs. 72,000 at a profit of 25%.

(d) Paid for Rent Rs. 5,000.

View SolutionPrepare 'Accounting Equation' from the following :

(a) Started business with cash Rs.1,00,000.

(b) Purchased goods for cash Rs.20,000 and on credit Rs.30,000.

(c ) Sold goods for cash costing Rs. 10,000 and on credit costing Rs. 15,000 both at a prodit of 20%.

View Solution