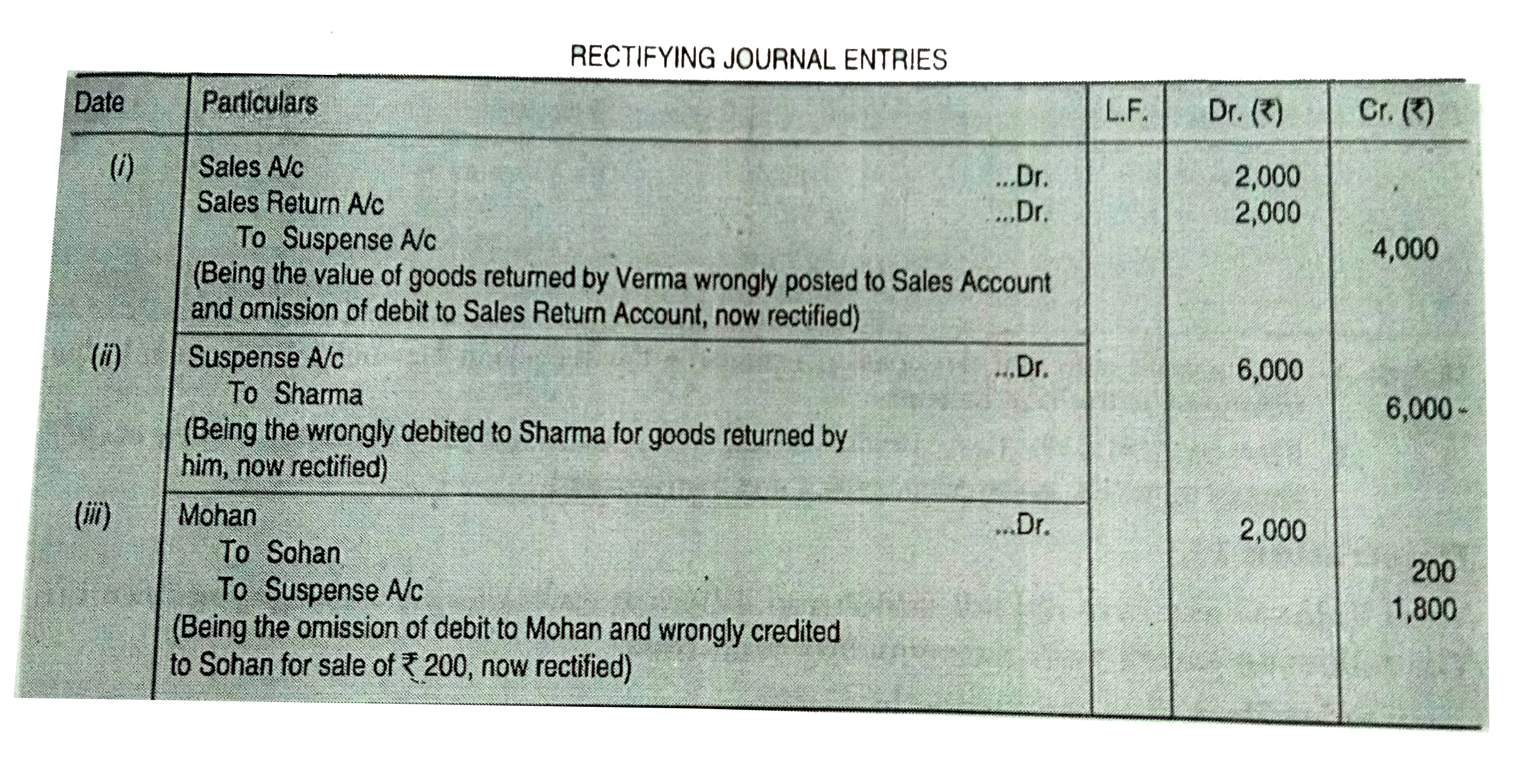

Pass the Journal entries to rectify the following errors, using Suspense Account:

(i) Goods of the value of Rs. 2,000 returned by Verma were entered in the Sales Book and posted therefrom to the credit of his account.

An amount of Rs. 3,000 entered in the Sales Return Book has been posted to the debit of Sharma, who returned the goods.

A sale of Rs. 2,000 made to Mohan was correctly entered in the Sales Book but wrongly posted to the debit of Sohan as Rs. 200.

Topper's Solved these Questions

Similar Questions

Give the Journal entries to rectify the following errors using Suspense Account, where necessary:

(i) Goods of the value of Rs. 2,000 returned by Mr. Gupta were entered in the Sales Book and posted therefrom to the credit of his account.

(ii) Goods worth Rs. 1,500 bought by the proprietor for his personal use without any payment being made as yet, was wrongly entered in the Purchases Book.

(iii) A cheque for Rs. 500 received from Ashok was dishonoured and has been posted to the debit of Sales Return Account.

(iv) The total of one page of the Sales Book was carried forward to the next page as Rs. 680 instead of Rs. 860.

(v) An item of Rs. 500 relating to Prepaid Insurance Account was omitted to be brought forward from the previous year's books.

View SolutionSales Return Book has a debit balance.

View Solution

Knowledge Check

Total of Sales Return Column in the Sales Return Book is posted to :

Option1 Sales A/c - Debit

Option2 Sales A/c - Credit

Option3 Sales Return A/c - Debit

Option4 Sales Return A/c - CreditASales A/c - DebitBSales A/c - CreditCSales Return A/c - DebitDSales Return A/c - CreditPeriodic total of Sales Return Journal is posted to the

ASales AccountBGoods AccountCSales Return Account.DAny of these

Total of Sales Book is posted to the _________ of Sales Account.

View SolutionRectify the following errors:

(i) The total of one page of Sales Book was carried forward as Rs. 371 instead of Rs. 317.

(ii) Rs. 540 received form Yatin was posted to the debit of his Account.

(iii) Purchases Returns Book was overcast by Rs. 300.

(iv) An item of Rs. 1,062 entered in Sales Return Book had been posted to the debit of customer who returned the goods.

(v) Rs. 1,500 paid for furniture purchased had been charged to ordinary Purchase Account.

View SolutionWhat will be the effect on Trial Balance if a purchase return of Rs. 5,000 has been wrongly posted to the debit of Sales Return Account but correctly entered in the Customer's Account ?

View SolutionRectify the following errors assuming that there is no Suspense Account:

(i) Salary of Rs. 5,000 paid to Rahul was not posted to Salaries Account.

(ii) Sales to Amrish of Rs. 1,430 posted to his account as Rs. 2,740.

(iv) Purchases from Pal of Rs. 1,430 posted to his account as Rs. 1,340.

View SolutionCorrect the following errors in Hari's Books:

(i) Credit sale of Rs. 132 to R. Krishan correctly entered in Sales Journal but posted to his account as Rs. 312.

(ii) The total of the credit side of Ramesh's Account was overcasted by Rs. 2,000.

(iii) Total of the Purchases Journal of Rs. 5,250 has been posted to Purchases Account as Rs. 5,205.

(iv) Printer purchased from R. Ltd. for Rs. 4,000 on credit was entered in the Purchases Book.

(v) An item of Rs. 2,000 entered in the Sales Return Book was posted to the debit of Pandey who had returned the goods.

View SolutionRectify the following errors assuming that a suspense account was opened. Ascertain the difference in trial balance.

(a) Credit sales to Mohan 7,000 were posted to the credit of his account.

(b) Credit purchases from Rohan 9,000 were posted to the debit of his account as 6,000.

(c) Goods returned to Rakesh 4,000 were posted to the credit of his account.

(d) Goods returned from Mahesh 1,000 were posted to the debit of his account as 2,000.

(e) Cash sales 2,000 were posted to the debit of sales account as 5,000.

View Solution