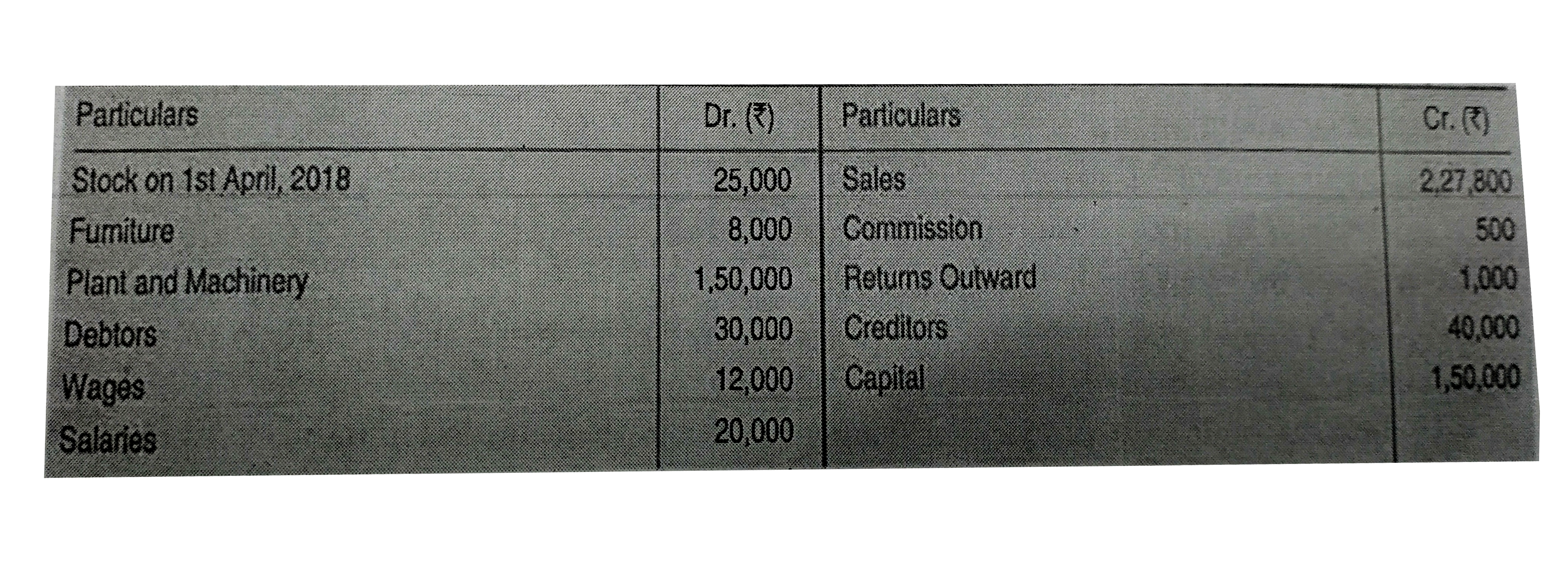

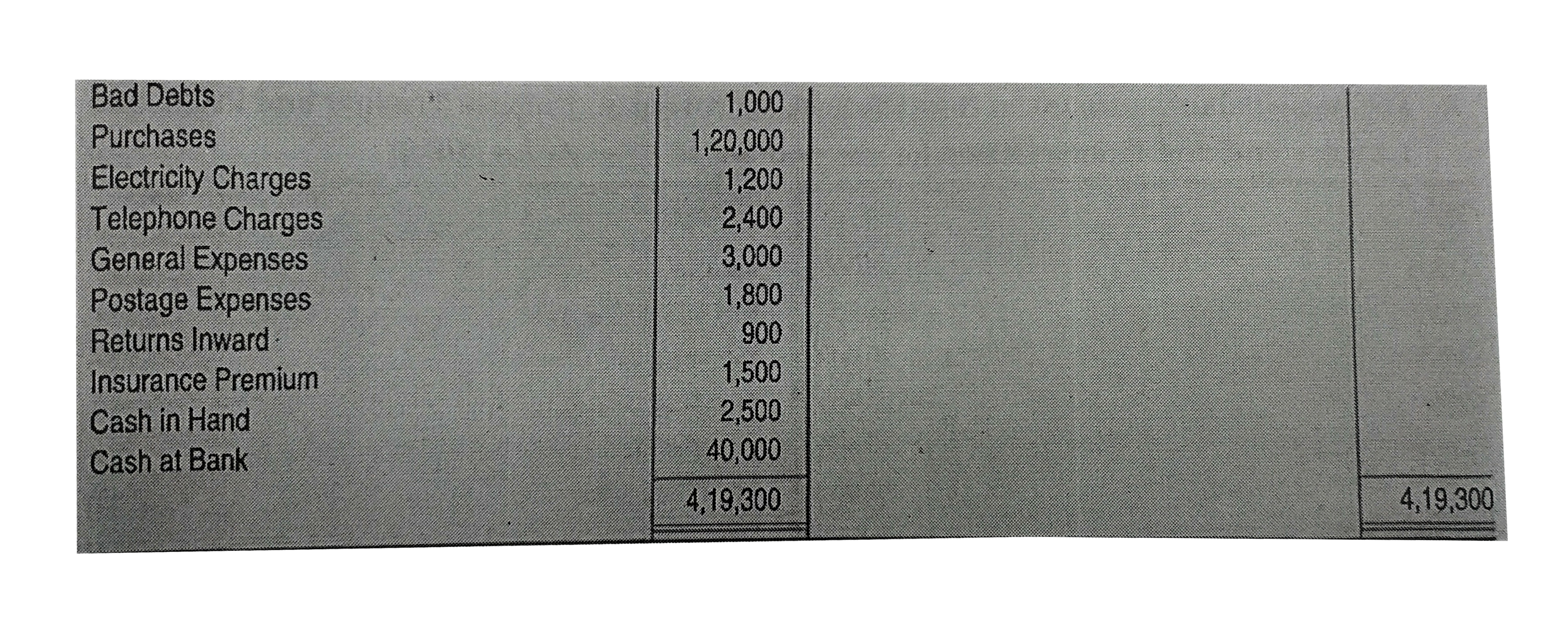

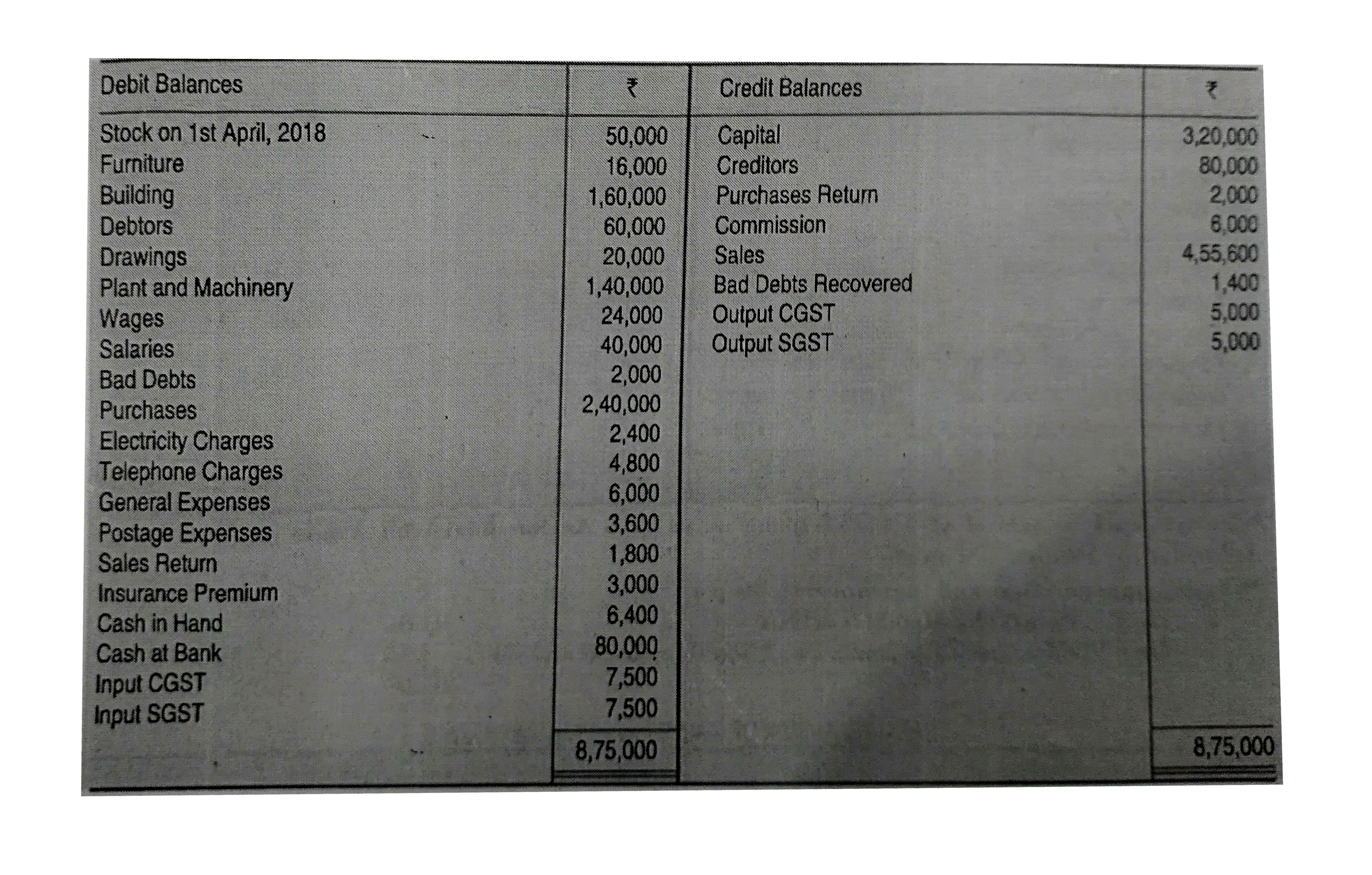

Trial balance of a business as at 31st March, 2019 is given below:

Prepare Trading and Profit and Loss Account for the year ened 31st March, 2019 and Balance Sheet as at that date after taking into account the following adjustments:

(i) Closing Stock was valued at Rs 7,000.

(ii) Outstanding liabilites for wages were Rs 600 and salaries Rs 1,400.

(iii) Depreciation is to be provided @ 5% p.a. on fixed assets.

(iv) Plant and Machinery includes a machine purchased for Rs 10,000 on 1st October, 2018.

(v) Insurance premium paid in advance Rs 200.

The correct Answer is:Gross Profit -Rs 77,300; Net Profit -Rs 38,050; Balance Sheet Total - Rs 2,30,050.

NA

Similar Questions

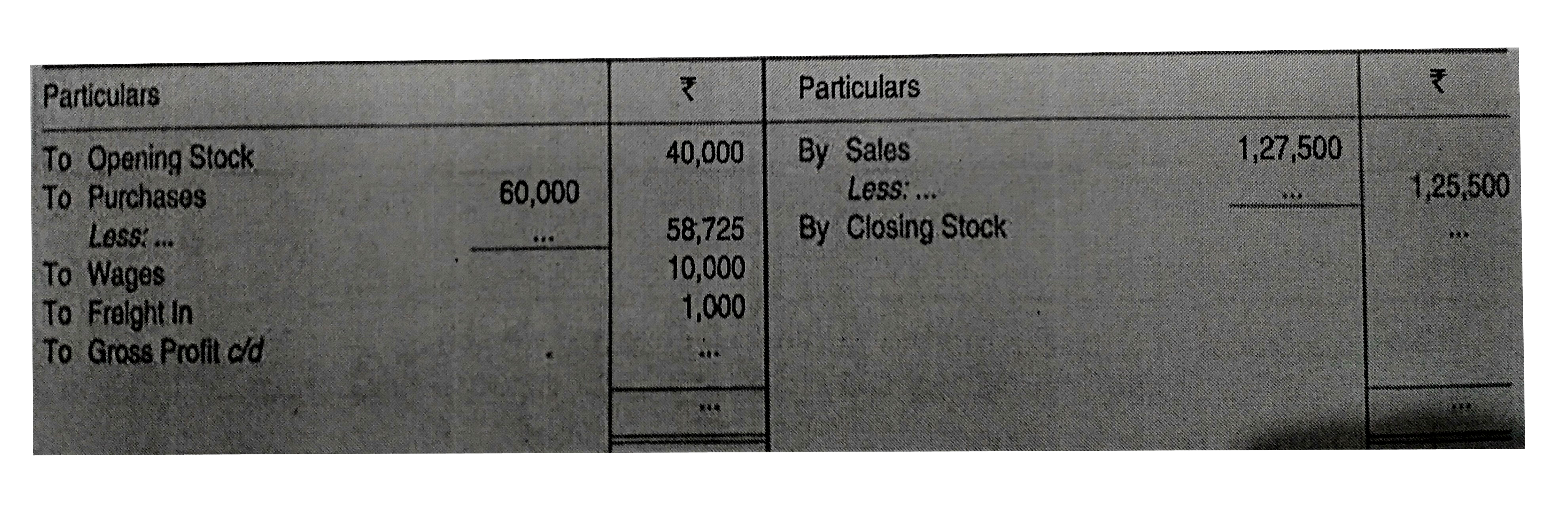

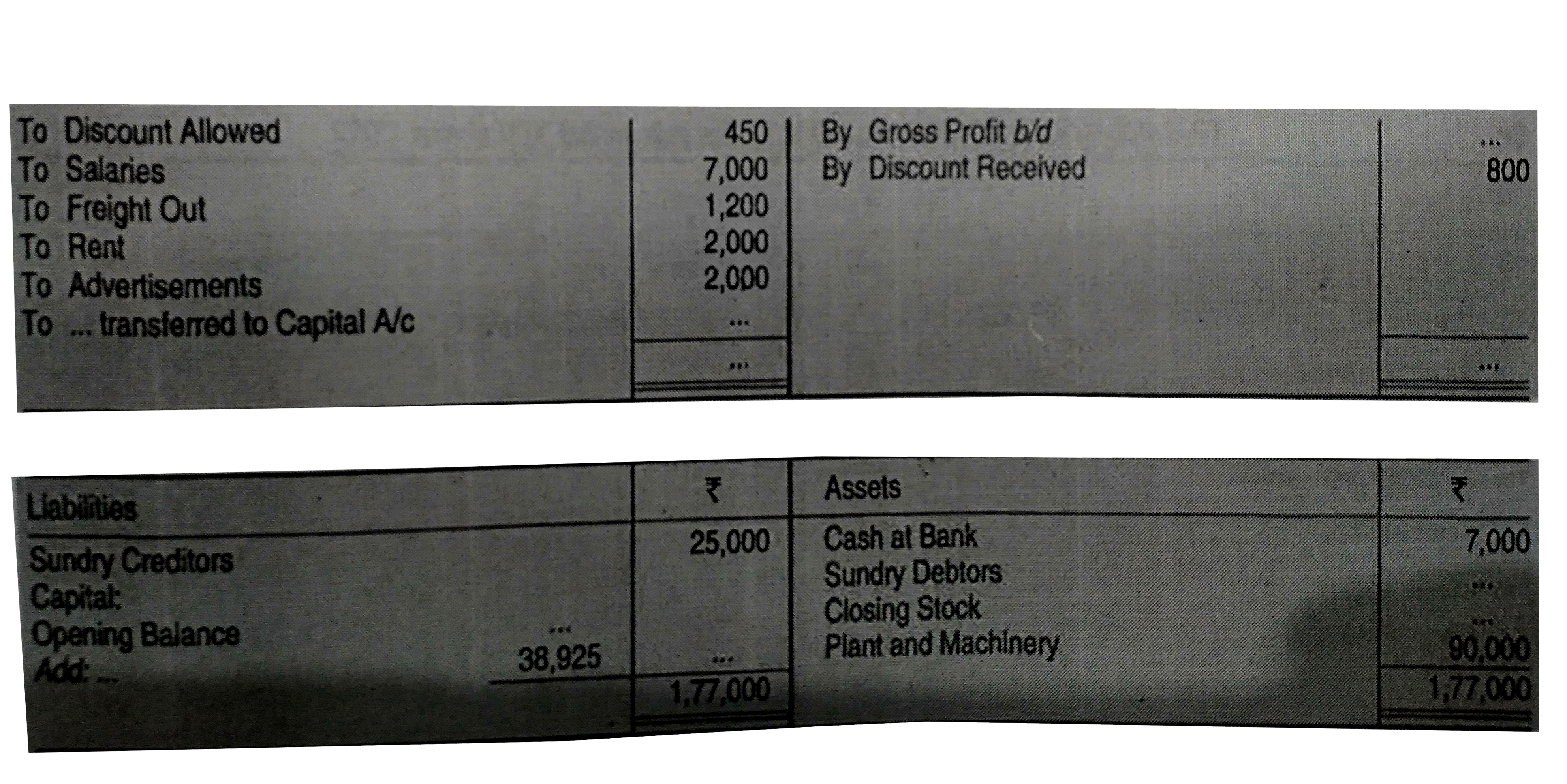

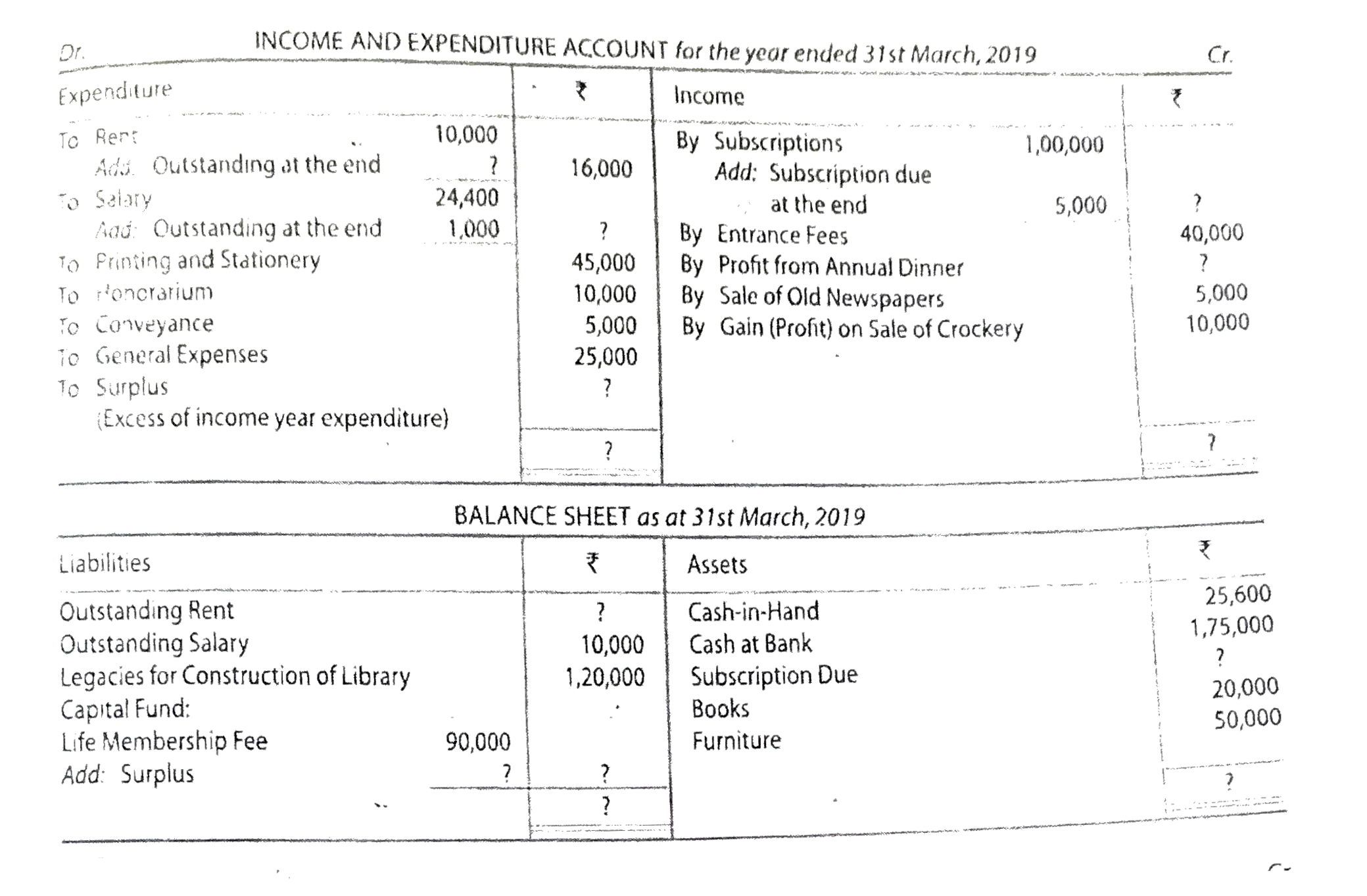

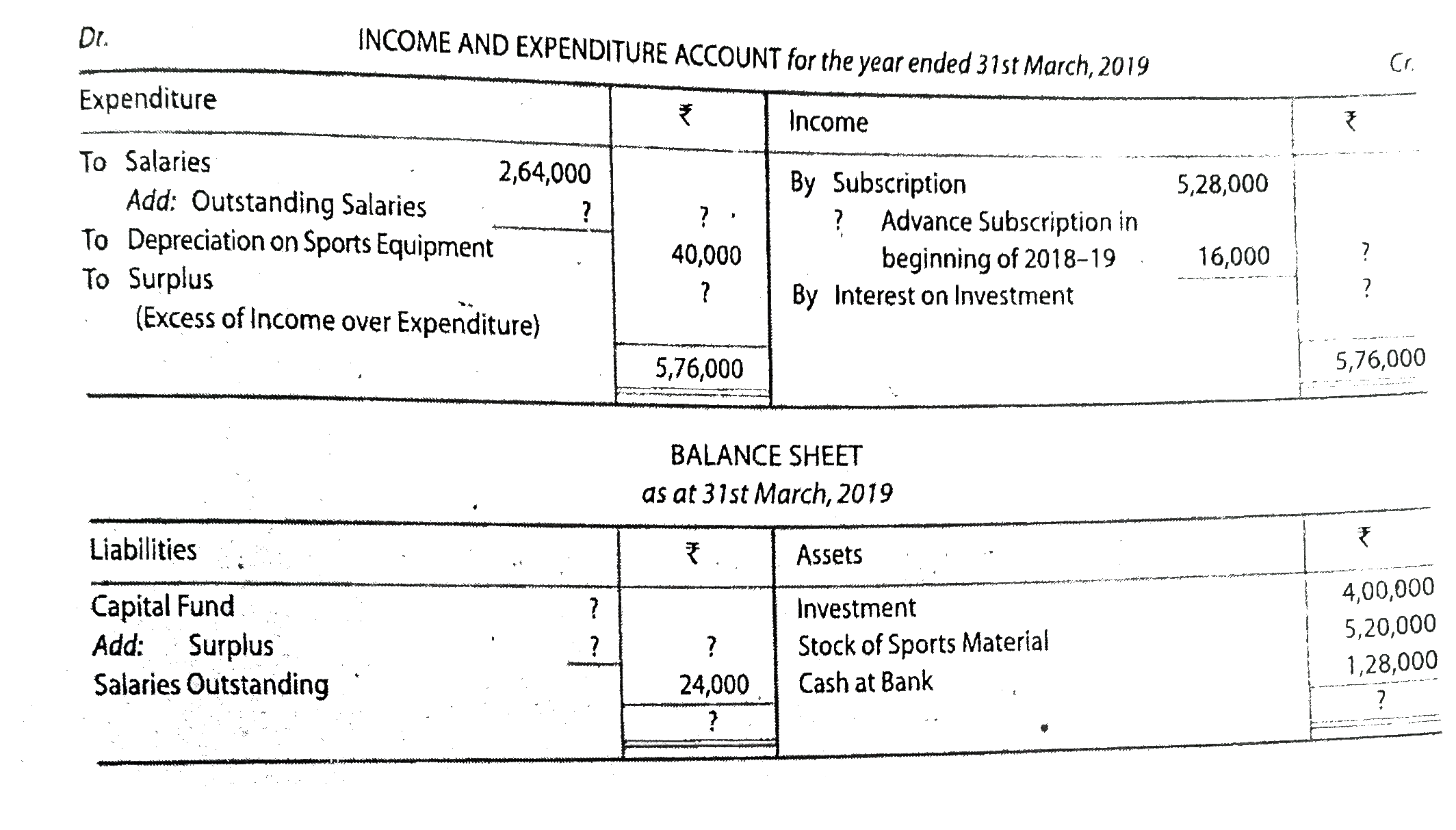

In the following Trading and Profit and Loss Account for the year ended 31st March, 2019, and Balance Sheet as on that date, determine the missing information:

View SolutionIn the following Trading and Profit and Loss Account for the year ended 31st March, 2019, and Balance Sheet as on that date, determine the missing information:

View SolutionFrom the following Trial Balance, Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

On 31st March, 2019 the stock was valued at Rs 1,00,000

View SolutionFrom the following Trial Balance, Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

On 31st March, 2019 the stock was valued at Rs 1,00,000

View SolutionFrom the following balances taken from the books of Hari & Co., prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at the date:

Closing Stock was value at Rs 1,82,100

View SolutionFrom the following balances taken from the books of Hari & Co., prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at the date:

Closing Stock was value at Rs 1,82,100

View SolutionIn the following income and Expenditure Account for the year ended 31st March 2019 and Balance Sheet as on that date , determine the missing information :

View SolutionIn the following income and Expenditure Account for the year ended 31st March 2019 and Balance Sheet as on that date , determine the missing information :

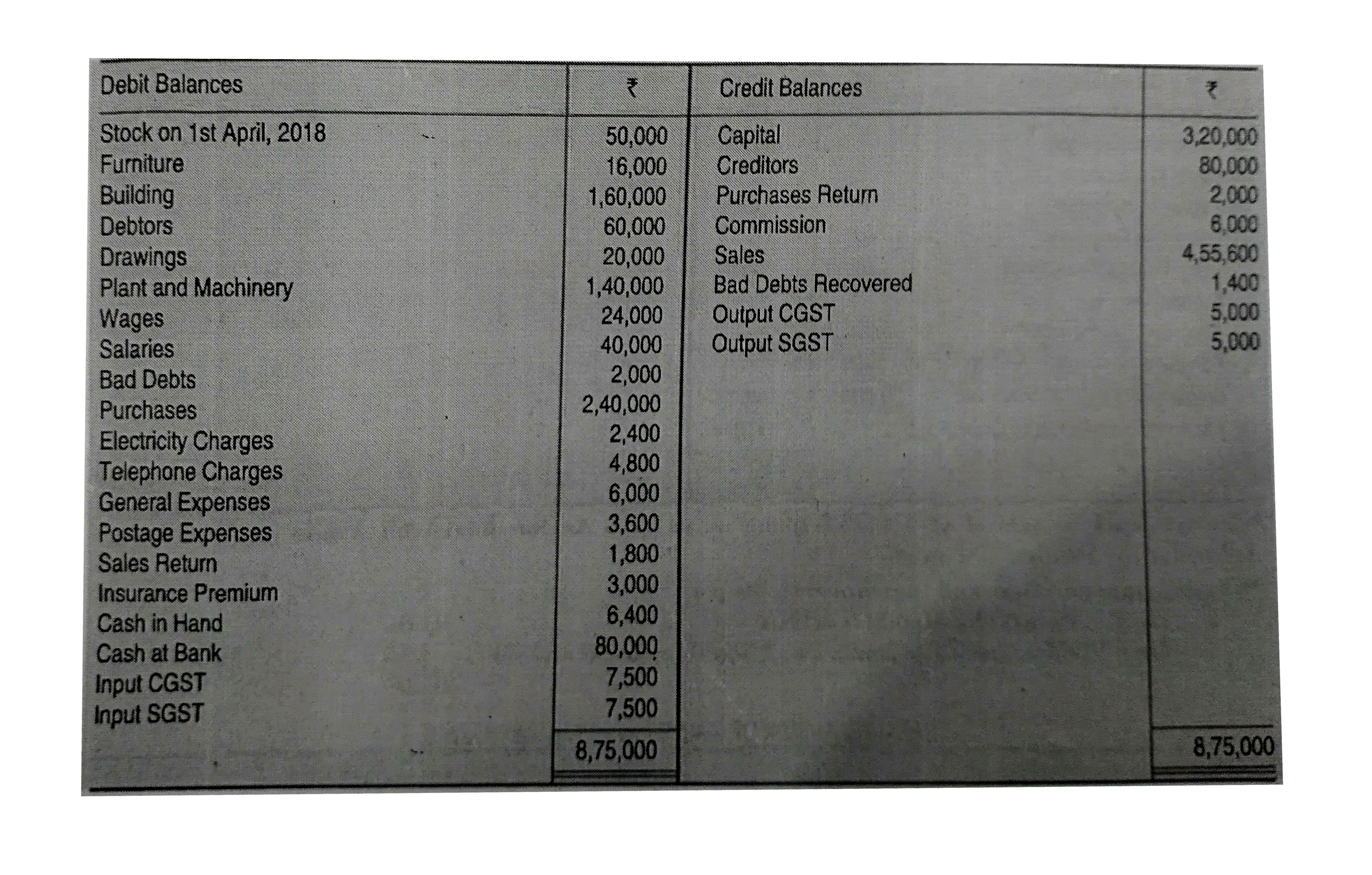

View SolutionFollowing Trial Balance is extracted from the books of Nikesh as at 31st March, 2019:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and balance sheet as at that date after taking into account the following adjustments :

(i)Stock on 31st March, 2019 was valued at cost at rs 14,000. Its Net Realisable value (Market Value) was 15,000.

(ii) Plant and Machinery includes a machine purchased for 20,000 on 1st October, 2018.

(iii) Outstanding liabilities for Wages rs 1,200 and Salaries rs 2,800. These are not subject to GST.

(iv) Depreciation ∘5% p.a. on Written Down value is to be provided on fixed assests.

(v) Write off bad debts rs 1,500.

(vi) Insurance premium paid in advance rs 400.

(vii) Accrued commission rs 500. CGST and SGST is levied ∘6% each.

View SolutionFollowing Trial Balance is extracted from the books of Nikesh as at 31st March, 2019:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and balance sheet as at that date after taking into account the following adjustments :

(i)Stock on 31st March, 2019 was valued at cost at rs 14,000. Its Net Realisable value (Market Value) was 15,000.

(ii) Plant and Machinery includes a machine purchased for 20,000 on 1st October, 2018.

(iii) Outstanding liabilities for Wages rs 1,200 and Salaries rs 2,800. These are not subject to GST.

(iv) Depreciation ∘5% p.a. on Written Down value is to be provided on fixed assests.

(v) Write off bad debts rs 1,500.

(vi) Insurance premium paid in advance rs 400.

(vii) Accrued commission rs 500. CGST and SGST is levied ∘6% each.

View Solution