One intra-state (i.e., within the state) pruchase of goods, which of the following GST is levied

CGST and IGST

CGST and SGST

SGST and IGST

None of these

The correct Answer is:B

CGST and SGST

Similar Questions

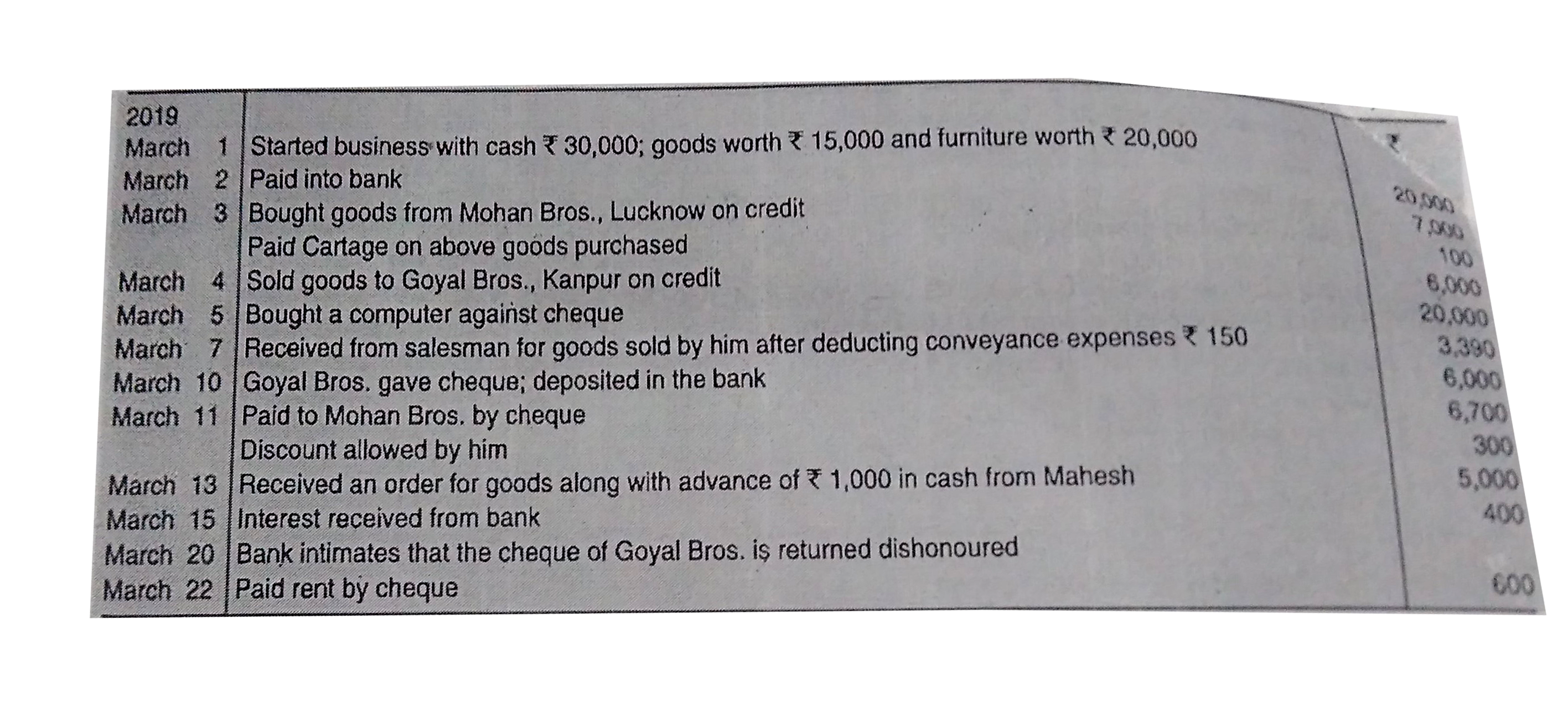

Journalise the following transactions in the books of Gupta Bros., Lucknow (UP):

CGST and SGST is levied @9% each on intra-state (within the state) sale and purchase and IGST is levied @ 18% on inter-state (Outside the state) sale and purchase.

View SolutionOn intra-state purchase of goods, which of the following accounts are debited:

View Solution

Knowledge Check

On intra-state(i.e., within the state) purchase of goods, which of the following GST is levied:

ACGST.BSGST.CCGST and SGST.DSGST and IGST.One intra-state (i.e., outside the state) pruchase of goods, which of the following GST is levied

AIGSTBIGST and CGSTCCGST and IGSTDNone of theseOn inter-state (i.e., outside the state) purchase of goods, which of the following GST is levied:

AIGST.BIGST and CGST.CCGST.DSGST .

On inter-state sale of goods, which of the following account is credited:

View SolutionIntra-state means:

View SolutionWhich one of the following is a state party?

View SolutionGST is NOT applicable on which of the following goods or services?

View SolutionA manufacturer buys raw material worth Rs. 12,000 for his articles @ 5% GST. He sell the finished product to a dealer at 50% profit. If the sale is intra-state and the rate of GST on the finished product is 18%, then answer the following:

The input tax paid by the manufacturer is:

View Solution