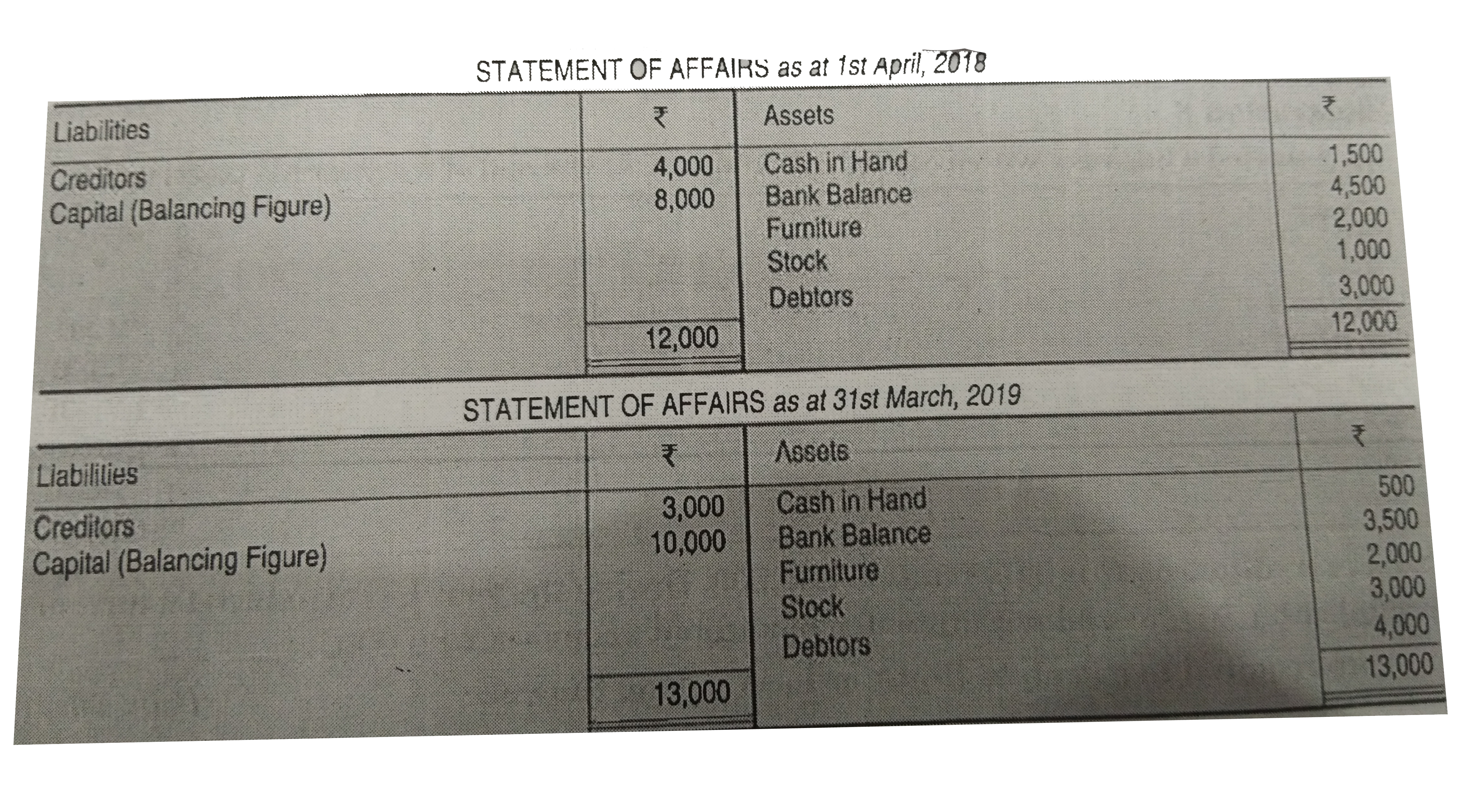

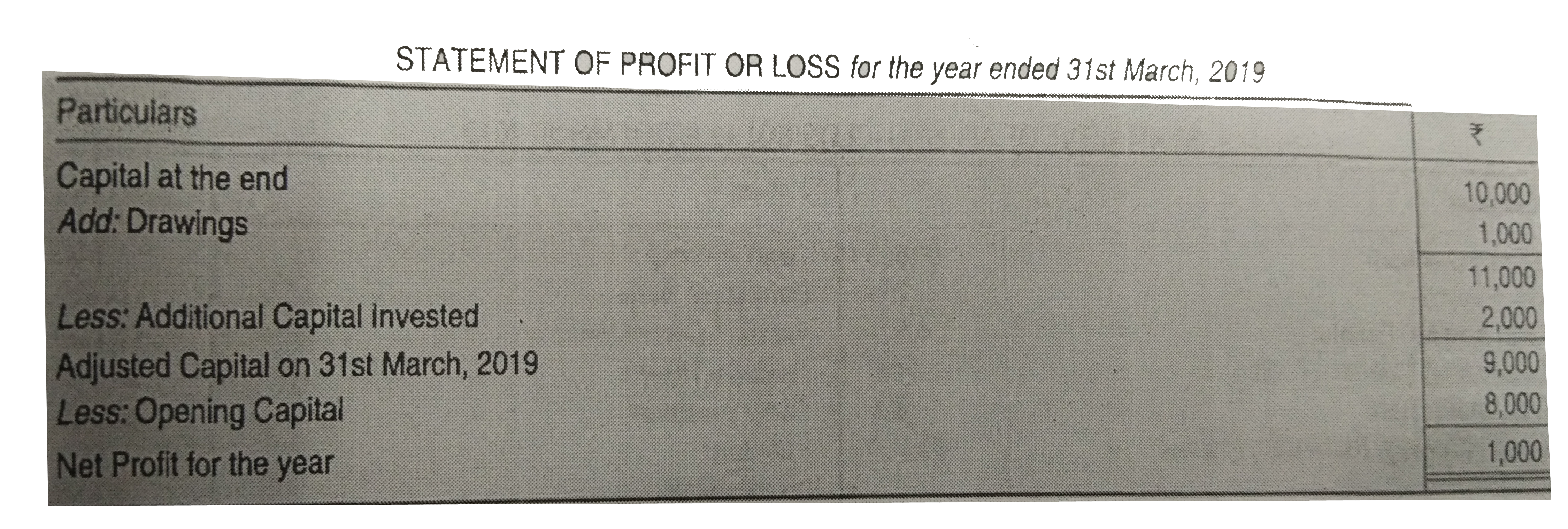

Gopi Chand maintains his books of account on Single Entry System. Calculate his profit on 31st March, 2019 from the following information:

Liabilities and Assets1st April, 2018 (Rs.)31st March, 2019 (Rs.)Cash in Hand1,500500Bank Balance4,5003,500Fumiture2,0002,000Stock1,0003,000Creditors4,0003,000Debtors3,0004,000

During the year his drawings were Rs. 1,000 and additional capital invested Rs. 2,000.

Similar Questions

Kumaran, a trader, does not keep proper boods of account. However, he furnishes you the following particulars:

31st March, 2018 (Rs.) 31st March, 2019 (Rs.)Cash at Bank 4,500 3,000Cash in Hand 300 4,000Stock-in-Trade 40,000 45,000Debtors 12,000 20,000Office Equipment 5,000 5,000Sundry Creditors 30,000 20,000Furniture 4,000 4,000

During the year Kumaran introduced Rs. 6,000 as further capital and withdrew Rs. 4,000 as drawings. Write off Depreciation on furniture at 10% andon office equipment at 5%. Prepare a statement showing the Profit or Loss made by him for the year ended 31st March, 2019.

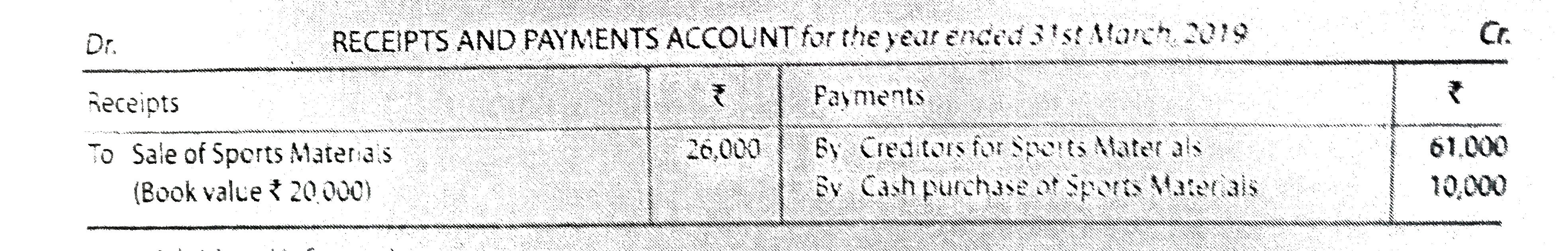

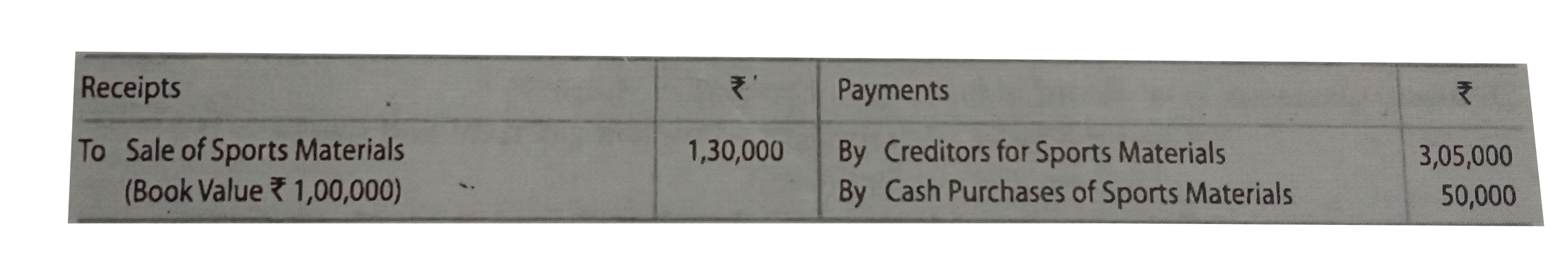

View SolutionHow are the following dealt with while preparing the final accounts for the year ended 31st March 2019?

Additional Information

As at 31st March , 2018(Rs)As at 31st March 2019(Rs)Sporst Materials20,00025,000Creditors for Sports Materials7,00015,000

View SolutionHor are the following dealt with while preparing the final accounts of a sports club for the year ended 31st March 2019 ?

Additional Information:

As at 31st March , 2018(Rs)As at 31st March 2019(Rs)Sporst Materials20,00025,000Creditors for Sports Materials7,00015,000

View SolutionPrepare Trading Account for the year ended 31st March, 2019 from the following balances:

RsRsStock(1st April, 2018)1,00,000Purchases10,00,000Wages50,000Carriage Inwards10,000Sales15,50,000Returns Inward50,000Returns Outward80,000Freight Inwards5,000

Closing Stock as on 31st March, 2019 was valued at Rs 2,00,000.

Also, pass the Closing Entries.

View SolutionPrepare Trading Account for the year ended 31st March, 2019 from the following balances:

RsRsStock(1st April, 2018)1,00,000Purchases10,00,000Wages50,000Carriage Inwards10,000Sales15,50,000Returns Inward50,000Returns Outward80,000Freight Inwards5,000

Closing Stock as on 31st March, 2019 was valued at Rs 2,00,000.

Also, pass the Closing Entries.

View SolutionHow are following cases dealt with while preparing final accounts of National Club for the year ended 31st March 2019?

Additional Information

As at 1st April 2018 (Rs)As at 31st March 2019 (Rs)Stock of sports Material1.00.0001.25.000Creditors for Sports Material35.00075.000

View SolutionKuldeep, a general merchant, keeps his accounts on Single Entry System. He wants to know the results of his business on 31st March, 2019 and for that following information is available:

∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣1st April, 2018 (Rs.)31st March, 2019 (Rs.)Cash in Hand.......................................................1,50,0001,75,000Bank Balance.......................................................7,50,0008,00,000Furniture.......................................................1,00,0001,00,000Stock.......................................................5,00,0006,50,000Creditors.......................................................3,50,0004,00,000Debtors.......................................................2,50,0003,00,000∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣

During the year, he had withdrawn Rs. 5,00,000 for his personal use and invested Rs. 2,50,000 as additional capital. Calculate his profits on 31st March, 2019 and prepare the Statement of Affairs as on that date.

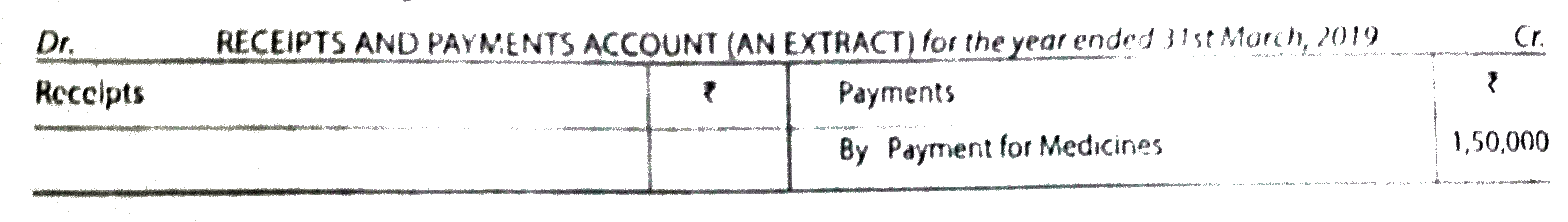

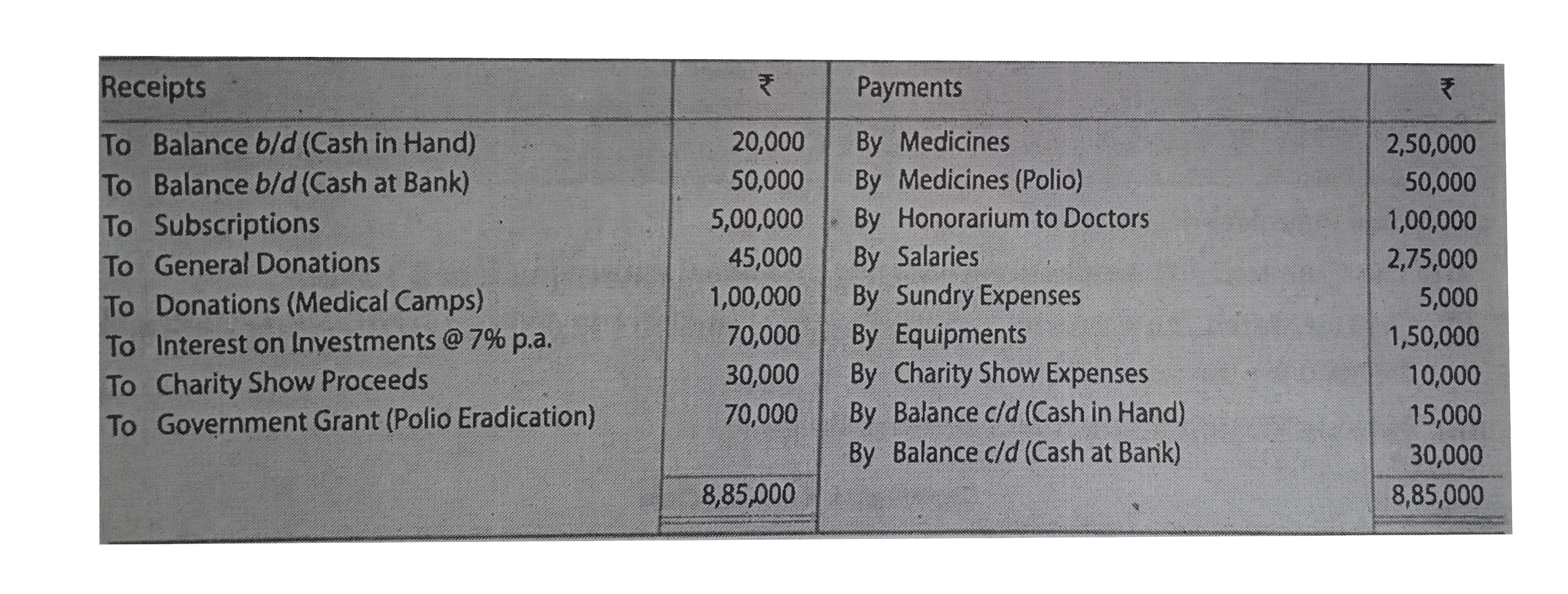

View SolutionReceipts and payments Account of Medical aid Society for the year ended 31st March 2019 is given below :

Additional Information

1st April31st March1st April31st March2018(Rs)2019(Rs)2018(Rs)2019(Rs)Subscriptions Due5,00010,000Amount Due to medicine Supplier80,0001,20,000Subscriptions Received in Advance10,0005,000Equipments2,10,0003,00,000Stock of Medicines1,00,0001,50,000Building4,00,0003,80,000

Prepare Income and Expenditure Account for the year ended 31st March 2019 and Balance Sheet as at that date.

View SolutionSrinvas did not maintain the Books of Accounts properly. From the following data, prepare final accounts for the year ended 31st March, 2019:

∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣Rs.Opening Stock1,00,000Creditors on April, 2018 40,000Cash in Hand on 31st March, 2018 60,000Furniture on 1st April, 2018 20,000Salaries 68,000Rent 24,000Other expenses 48,000Cash Sales 80,000Credit sales8,00,000∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣Rs.Cash received from debtors6,40,000Cash paid to creditors3,60,000Cash purchases 40,000Credit purchases6,00,000Closing stock 80,000Debtors on 31st March, 20192,40,000Debtos on 1st April, 20181,00,000Drawings1,00,000Discount allowed to debtors 20,000∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣

View SolutionHari maintains his books of account on Single Entry System. His books provide the following information:

∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣1st April, 2018 (Rs.)31 March, 2019 (Rs.)Furniture.......................................................2,0002,000Stock.......................................................28,00030,500Sundry Debtors.......................................................21,00034,000Cash.......................................................1,5002,00Sundry creditors.......................................................17,50019000Bills Receivable..........................................................5,000Loan..........................................................5,000Investments..........................................................10,000∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣

His drawing during the year were Rs. 5,000. Depreciate furniture by 10% and provide a reserve for Bad and Doubtful Debts at 10% on Sundry Debtors.

Prepare the statement showing the profits for the year.

View Solution