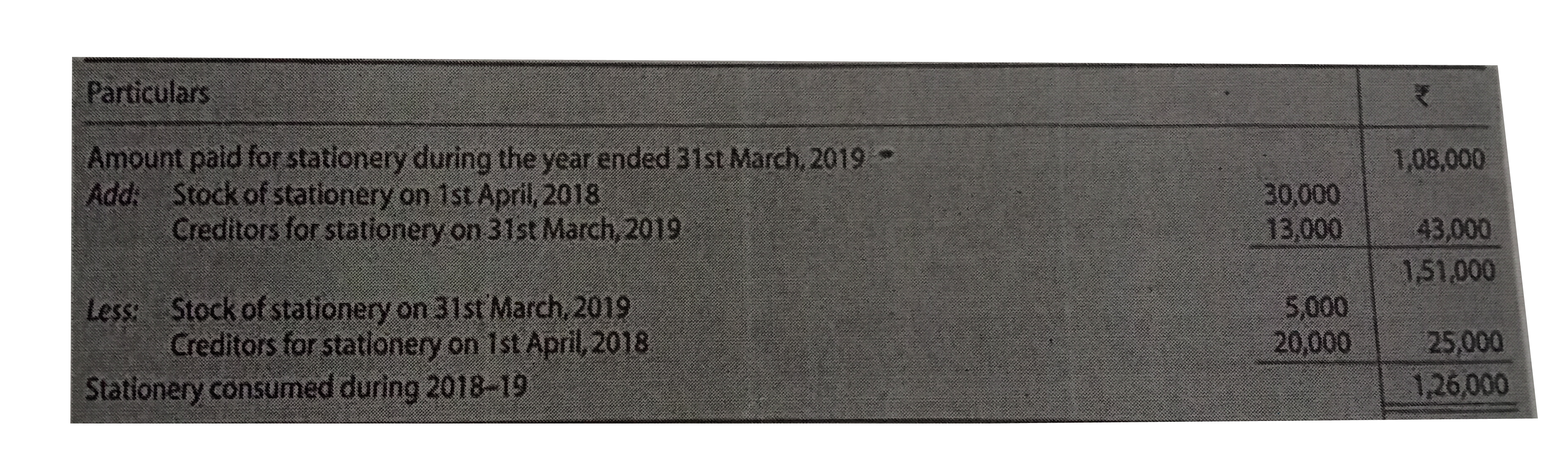

From the following information determine the amount to be debited to Stationery Account in Income and Expenditure Account for the year ended 31st March 2019 :

RsStock stationery on 1st April 201830,000Creditors for stationery on 1st April 201820,000Amount paid for stationery during the year ended 31st March 20191,08,000Stock of stationery on 31st March 20195,000Creditors for stationery on 31st March 201913,000

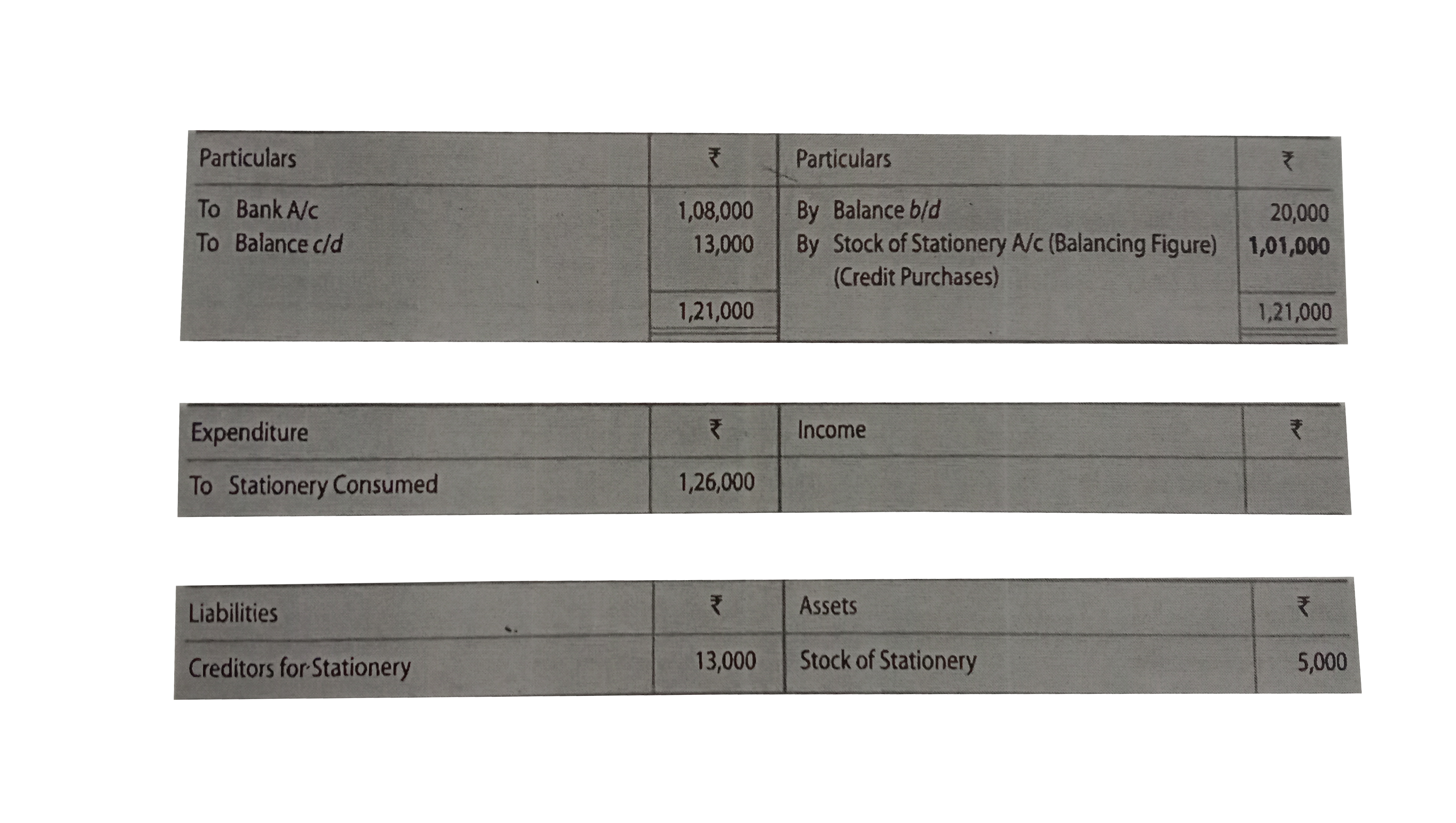

Also show the above items in the Income and Expenditure Account for the year ended 31st March 2019 and in the Balance Sheet as at that date.

The correct Answer is:N/a

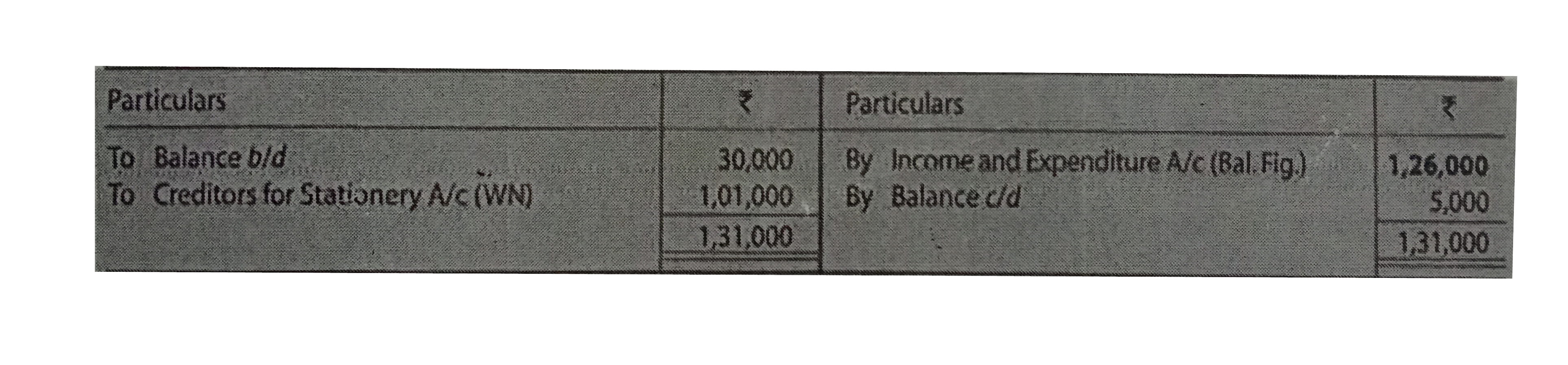

Alternative : Amount of stationery consumed to be debited to Income and Expenditure Account can be also be computed by preparing Stock of Stationery Account as follows :

Similar Questions

On the basis of the following information calculate amount that will appear against the item Stationery Used,

in the Income and Expenditure Account for the year ended 31st March 2019,RsStock of Stationery as at 1st April 201812,000Creditors for Stationery as at 1st April 201825,600Amount paid of Stationery during the year ended 31st March 20191,40,00Stock of Stationery as at 31st March 201923,200Creditors for Stationery as at 31st March 201924,000

View SolutionCalculate the amount that will be posted to the income and Expenditure Account for the year ended 31st March 2019:

RsStock of Stationery on 1st April 201830,000Creditors for Stationery on 1st April 201820,000Advance paid for Stationery carried forward from the year ended 31st March 20182,000Amount paid for Stationery during the year ended 31st March 20191,08,000Stock of Stationery on 31st March 20195,000Creditors for Stationery on 31st March 201913,000Advance paid for Stationery on 31st March 20193,000

View SolutionCalculate the amount of stationery that will be debited to Income and Expenditure Account for the year ended 31st March 2019:

(a) Amount paid for stationery during the year ended 31st March 2019 54,000

Stock of stationery in hand on 31st March 2019 2,500

(b) Stock of stationery on 1st April 2018 15,000

Payment made for stationery during the year ended 31st March 2019 54,000

Stock of stationery in hand on 31st March 2019 2,500

View SolutionFrom the following information, calculate the amount of medicines to be debited to the Income and Expenditure Account of National Hospital for the year ended 31st March, 2018:

Rs.Stock of medicines on 1st April, 20173,69,00Stock of medicines on 31st March, 20183,69,000Creditors for medicines on 1st April, 201717,85,000Creditors for medicines on 31st March, 201819,37,000Paid to creditors for medicines during the year ended 31st year ended 31st March,201820,00,000

View SolutionFrom the following information, calculate the amount of sports meterial to be debited to the Income and Expenditure Account of a Sport Club for the year ended 31st March, 2018

Rs.Balance of Sport Material as on 1st April,201720,000Balance of Sport Material on 31st March,201815,000Creditors for Sports Material as on 1st April, 201740,000Creditors for Sports Material as on 31st March, 201845,000Payment made for Sports material Creditors during the year ended31st March,20182,00,000

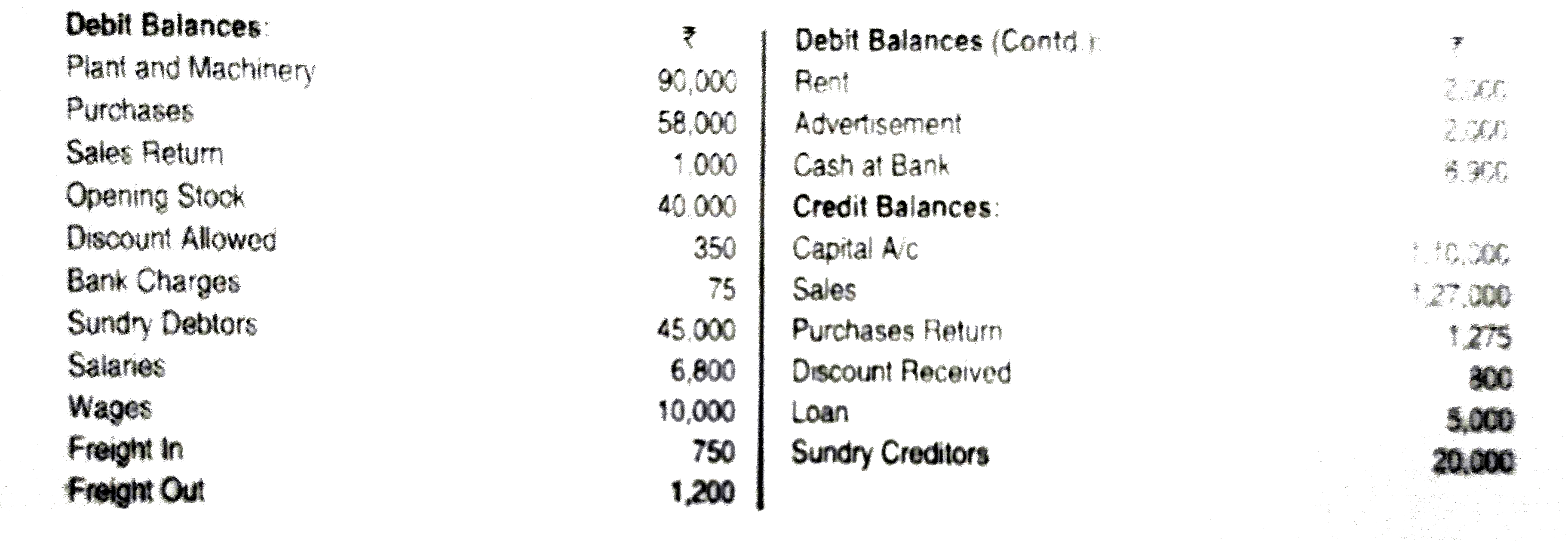

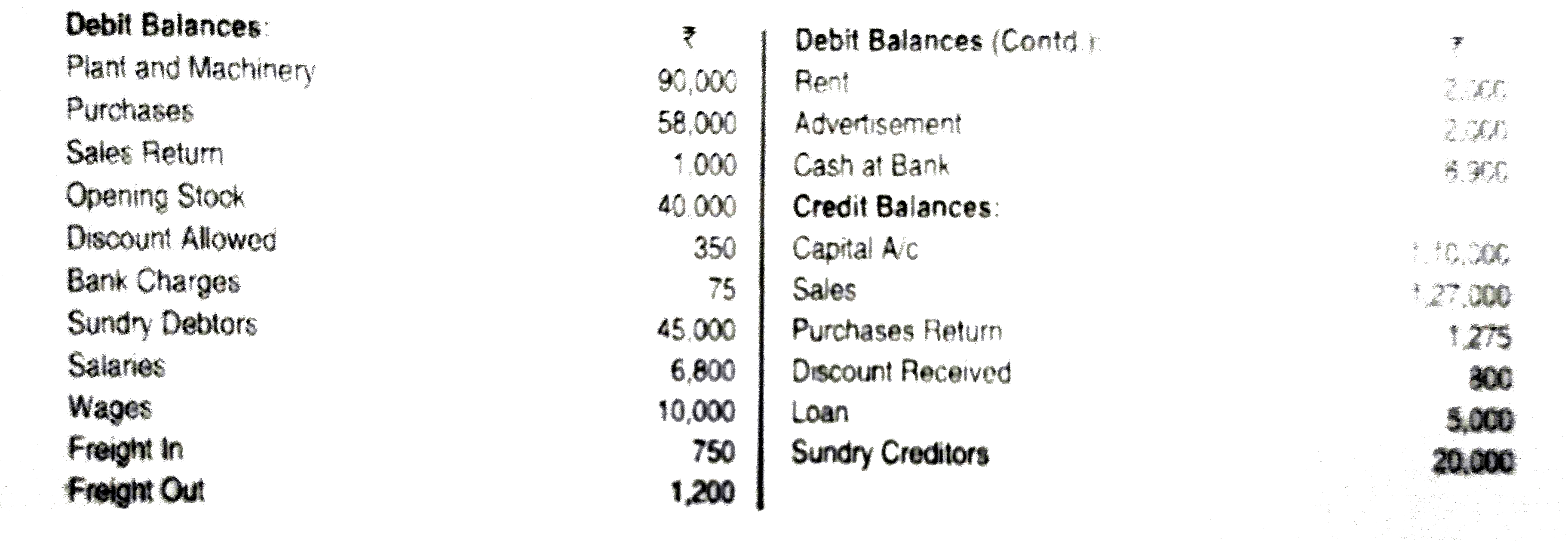

View SolutionTrial Balance of Chatter Sen on 31st March, 2019 revealed the following balances:

Stock on 31st March, 2019 was valued at Rs 35,000.

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date

View SolutionTrial Balance of Chatter Sen on 31st March, 2019 revealed the following balances:

Stock on 31st March, 2019 was valued at Rs 35,000.

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date

View SolutionIn the year ended 31st march 2019 Salaries paid amounted to Rs. 2.04,000. Ascertain the amount chargeable to the income and Expenditure Account for the year ended 31st March 2019 from the following additional information:

RsPrepaid Salaries on 31st March 201824,000Prepaid Salaries on 31st march 201912,000Outstanding Salaries on 31st March 201818,000Outstanding Salaries on 31st March 201915,000

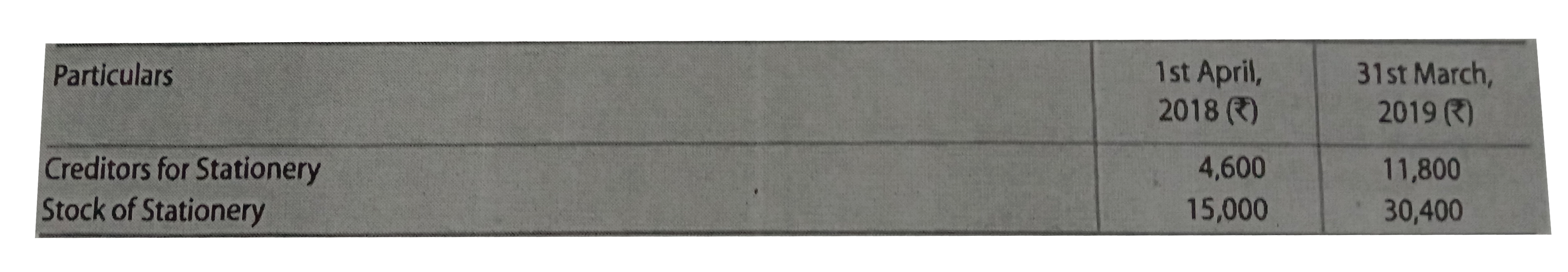

View Solutionfrom the following information calculate the amount that will be shown against Stationery Account in Income and expenditure Account for the year ended 31st March 2019 :

During the year ended 31st March 2019 payment made to creditors amounted to Rs. 56,800. Stationery purchased in cash during the year was 20% of the total purchase of stationery .

View SolutionFrom the following information, calculate the amount of subscriptions to be credited to the Income and Expenditure Account for the year 2017-18:

RsSubscriptions received during the year60,000Subscriptions outstanding on 31st March, 201716,000Subscriptions outstanding on 31st March, 20189,000Subscriptions received in advance on 31st March, 201712,000Subscriptions received in advance on 31st March, 20187,000Subscriptions of Rs6,000 are still in arrears for the year2016−17

View Solution