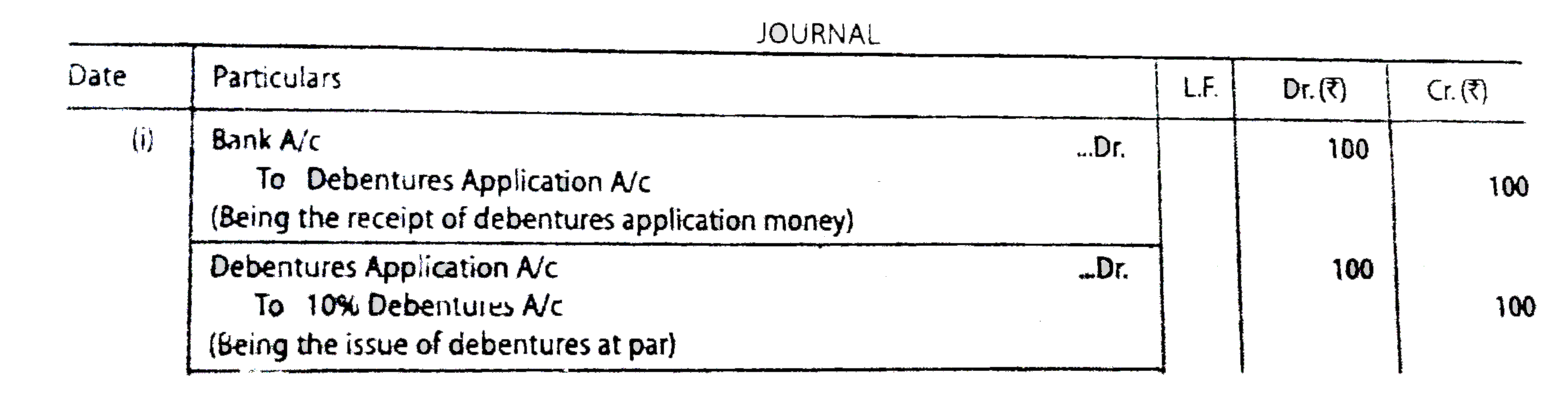

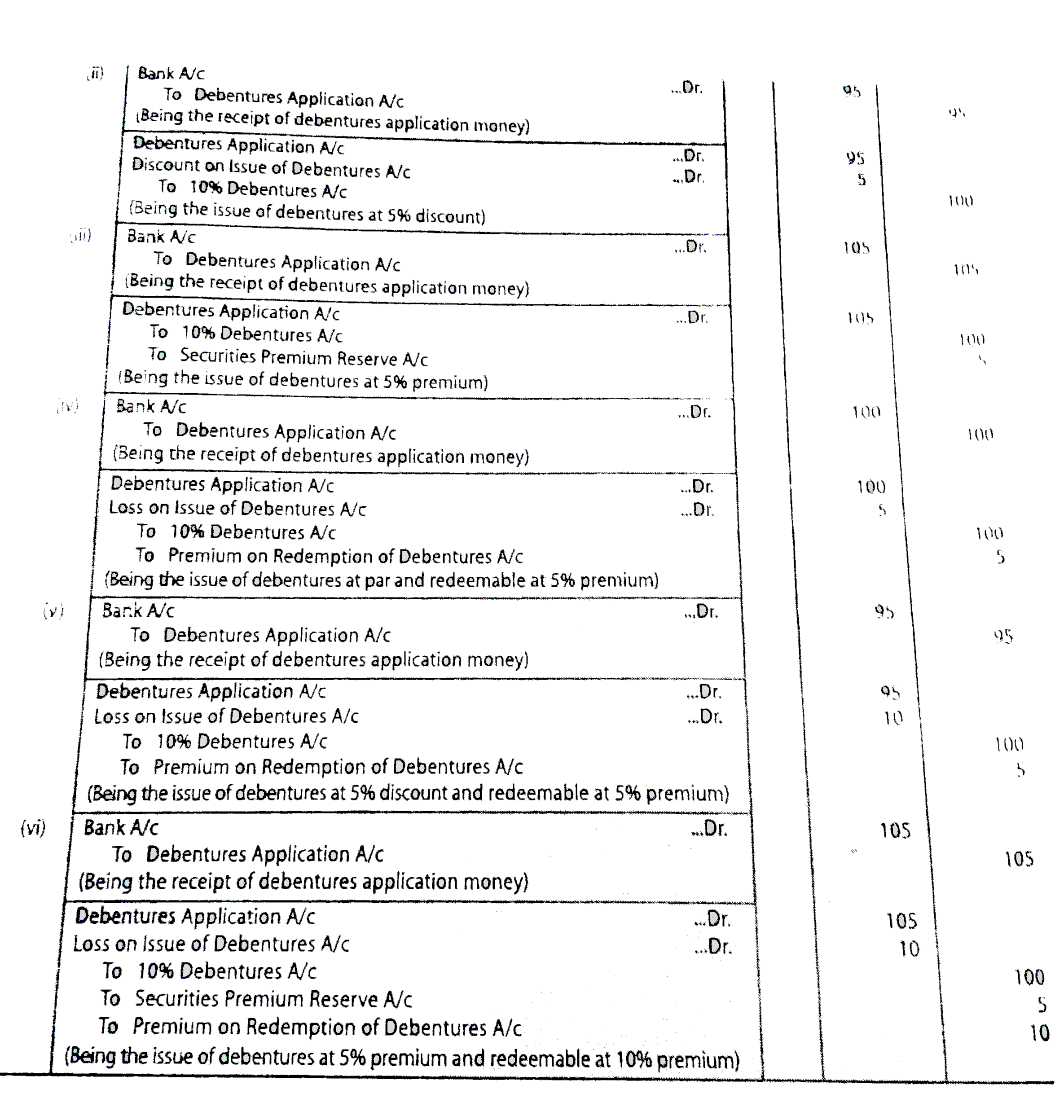

Pass Journal entries for issue of debentures in each of the following alternative cases:

(i) 10% Debentures of ₹ 100 each issued at ₹ 100, rapayable at ₹ 100.

(ii) 10% Debentures of ₹ 100 each issued at ₹ 95, rapayable at ₹ 100.

(iii) 10% Debentures of ₹ 100 each issued at ₹ 105, rapayable at ₹ 100.

(iv) 10% Debentures of ₹ 100 each issued at ₹ 100, rapayable at ₹ 105.

(v) 10% Debentures of ₹ 100 each issued at ₹ 95, rapayable at ₹ 105.

(vi) 10% Debentures of ₹ 100 each issued at ₹ 105, rapayable at ₹ 110.

Similar Questions

Journalise the following:

(a) A debentures issued at ₹ 95, rapable at ₹ 100.

(b) A debentures issued at ₹ 95, repayable at ₹ 105.

(c) A debentures issued at ₹ 100, rapayable at ₹ 105.

The face value of debentures is ₹ 100 in each of the above cases.

View SolutionPass necessary Journal entries for the issue of debentures in the following cases:

(a) ₹ 40,000, 12% Debentures of ₹ 100 each issued at a premiuma of 5% redeemable at par.

(b) ₹ 70,000, 12% Debentures of ₹ 100 each issued at a premium of 5% redeemable at ₹ 110.

View SolutionPass necessary Journal entries for the issue and redemption of Debentures in the following cases:

(i) 15,000 , 10% Debentures of Rs. 100 each issued at 10% premium, repayable at par.

(ii) 60,000, 12% Debentures of Rs. 100 each issued at 5% premium, repayable at 10% premium.

View SolutionPass necessary Journal entries for the issue and redemption of Debentures in the following cases :

(i) 15,000, 10% Debentures of Rs.100 each issued at 10% premium, repayable at par.

(ii) 6,00,000, 12% Debentures of Rs.500 each issued at 5% premium, repayable at 10% premium.

View SolutionPass necessary Journal entries for the issue of debentures in the following cases:

(a) ₹ 40,000, 12% Debentures of ₹ 100 each issued at a discount of 10% redeemable at par.

(b) ₹ 80,000, 15% Debentures of ₹ 100 each issued at a premium of 10% redeemable at a premium of 10%.

View SolutionPass necessary Journal entries relating to the issue of debentures for the following:

(a) Issued ₹ 28,000, 10% Debentures of ₹ 100 each at a premium of 15% redeemable at par.

(b) Issued ₹ 30,000, 10% Debentures of ₹ 100 each at premium of 10% and redeemable at premium of 15%.

(c) Issued ₹ 80,000, 10% Debentures of ₹ 100 each at par rapayable at a premium of 10%.

View SolutionPass necessary Journal entries relating to the issue of debentures for the following:

(a) Issued ₹ 4,00,000, 9% Debentures of ₹ 100 each at a premium of 8% redeemable at 10% premium.

(b) Issued ₹ 6,00,000, 9% Debentures of ₹ 100 each at par, repayable at a premium of 10%.

(c) Issued ₹ 10,00,000, 9% Debentures of ₹ 100 each at a premium of 5%, redeemable at par.

View SolutionPass Journal enteries for issue of debentures in each of the following transactions:

(i) Star Ltd. Issue 30,000, 10% Debentures of 100 each at a discount of 5% to be rapaid at par at the and of 5 yea₹.

(ii) Green Ltd. Issue 10% Debentures of ₹ 100 each for the total nominal (face) value of ₹ 40,00,0000 at a premium of 5% to be redeemed at the end of 5 yea₹.

(iii) Moon Ltd. issue ₹ 50,00,000, 10% Debentures of ₹ 100 each at par but redeemable at the end of 10 yea₹ at 105%.

(iv) Strong Ltd. issue ₹ 60,00,000, 10% Debentures of ₹ 100 each at a discount of 5% repayable at a premium of 10% at the end of 5 yea₹.

(v) Smart Ltd issues ₹ 70,00,000, 19% Debentures of ₹ 100 each at a premium of 5% receemable at 110% at the end of 10 yea₹.

View SolutionJournalise the following transactin at the time of issue of 12% Debentures:

Nanden Ltd. issued ₹ 90,000, 12% Debentures of ₹ 100 each at a discount of 5% redeemable at 110%.

View SolutionF Ltd, issue ₹ 7,00,000, 10% Debentures of ₹ 100 each at a premium of 5% redeemable at 110% after 5 yea₹. Journalise.

View Solution