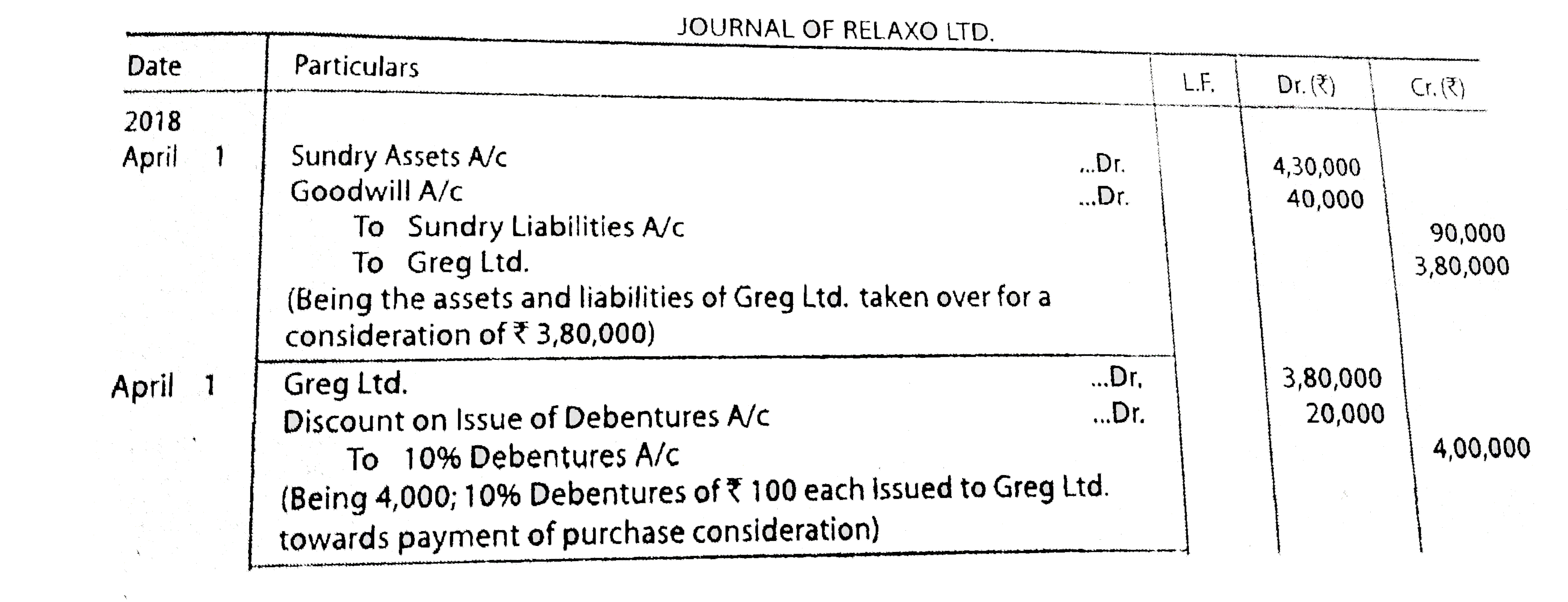

On 1st Apirl, 2018, Relaxo Ltd. Purchased assets of ₹ 4, 30,000 and took over liabilities of ₹ 90,000 of Greg Ltd. At an agreed value of ₹ 3, 80,000. It issue to the venor, 10% Debentures of ₹ 100 each 100 each at 5% discout, redeemable at par after 5 yea₹, in full satisfaction of the purchase price. ltbRgt On the same date, the company issued 500, 11% Debentures of ₹ 100 each as a collateral security to a bank who had advenced a loan of ₹ 45,000 to it for a period of 3 yea₹ and also issued 5,000 12% Debentures of ₹ 100 each at par, redeemable after 3 yea₹ at 5% premium.

Additional Information:

The interest on debentures is paid half yearly on 30th September and 31st March each year. Tex deducted at source @ 20% .The Company had ₹ 1,20,000 in its Securities Premium Reserve Account at the end of the year (Ignore interest on bank loan).

you are required to pass Journal entries in the books of Relaxo Ltd. for the year ended 31st March, 2019.

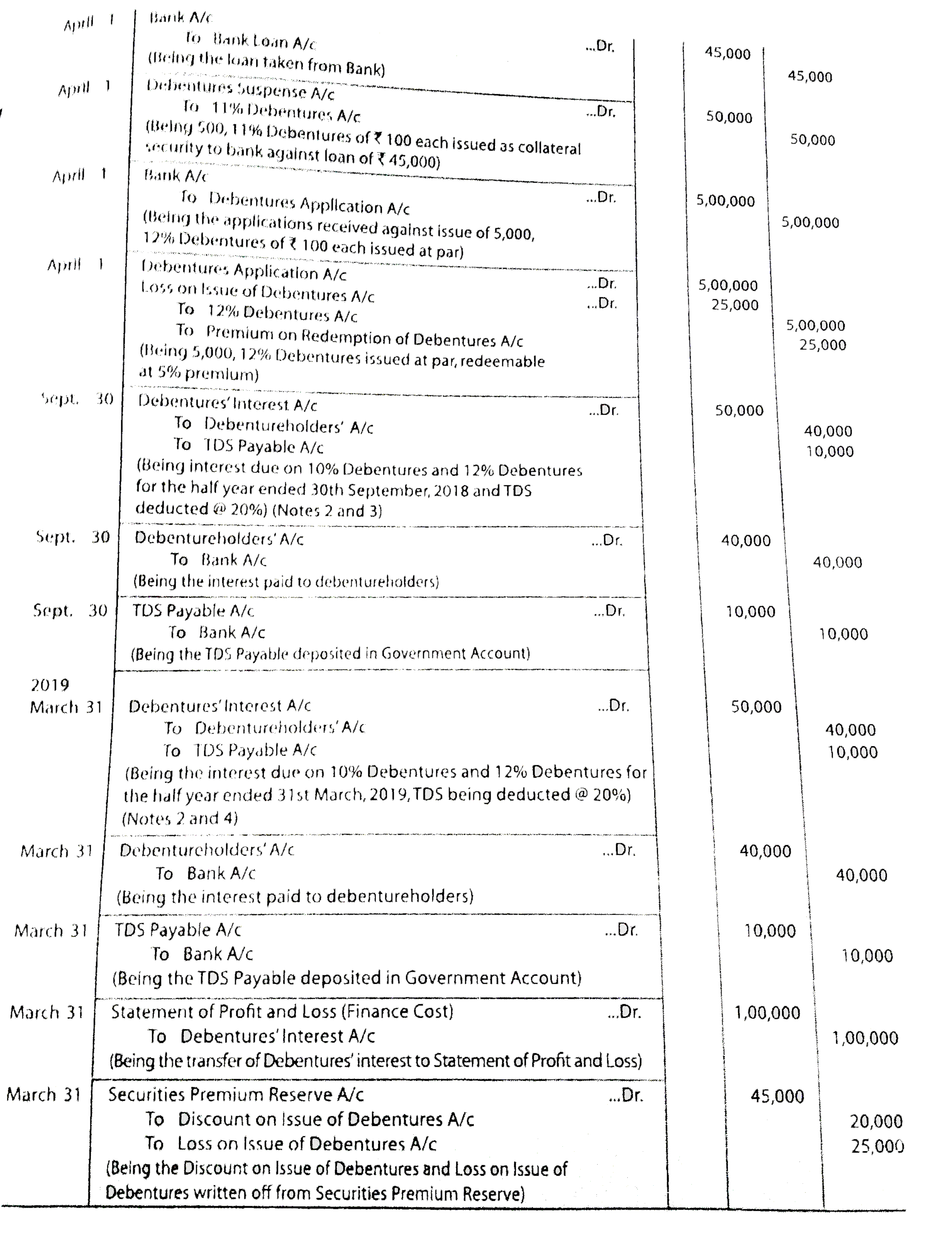

Notes: 1. Interest on Debentures issued as Collateral Security is not paid Therefore, interest on 500, 11% Debentures of ₹ 100 each is not accounted.

2. Calculation of Half Yearly Interest Payable:

{:("4,000, 10% Debenture of Rs 100 each"," "₹),("yearly Interest = Rs 40, 00,000xx10//100 = Rs 40,000", " . "),("Interest for Half Year ", " 20.00"),("5,000m12% Debentures of ₹ 100 rach" ,. ),("Yearly Interest = ₹ 5,00,000 xx12//10 = ₹ 60,000",.),("Intereat for Half Year "," 30,000"),("Total Intereat for Half Year" ," 50,000"),("TDS Payable @ 20% of ₹ 50,000"," 10,000"):}

3. Interest on Debentures is accounted as paid to Debentureholders net of TDS Payable . Therefore, net amount of interest (amount less TDS Payable ) is paid to Debentureholders and amount of TDS Payable is deposited in Government Account.

4. Debentures interest for the half year ended 30th September, 2018 and TDS Payable is paid within the year ended 31st March, 2019. It is assumed that, debenture interest for the half year ended 31st March, 2019 and TDS payable are paid on 31st March, 2019.

Similar Questions

F Ltd, issue ₹ 7,00,000, 10% Debentures of ₹ 100 each at a premium of 5% redeemable at 110% after 5 yea₹. Journalise.

View SolutionGreen Ltd. Purchased the assets of Strong Ltd. For ₹ 40,00,000 and took over liabilities of ₹ 7,00,000 at an agreed value of ₹ 32,40,000. Payment was made by issuing 10% Debentures of ₹ 100 each at a discount of 10%. Pass the necessary Journal entries in the books of Green Ltd.

View SolutionExe Ltd. Purchased assets of ₹ 8,40,000 and took over liabilities of ₹ 80,000 of Whe Ltd. at a value of ₹ 7,20,000. Exe Ltd. Issued 10% Debentures of ₹ 100 each at 10 % Discount in full satisfaction of the price. The company decided to weite off discount on Issue of Debentures from Securities Premium Reserve of ₹ 1,00,000. Pass Journal entries in the books of Exe Ltd.

View SolutionChrome Ltd. Took over assets of ₹ 6,00,000 and liabilities of ₹ 40,000 of Polymar Ltd. At an agreed value of ₹ 6,30,000. Chrme Ltd. Issued 10% Debentures of ₹ 100 each at a discount of 10% to Polymar Ltd. In full satisfaction of the price .

Pass the necessary Journal entries to record to above transaction in the books of Chrme Ltd.

View SolutionBule Ltd. Issued ₹ 8,00,000, 9% Debentures of ₹ 100 each at per and redeemable at 10% premium at the end of sixth year. Pass Journal entries for issue of debentures.

View SolutionExe Ltd. Purchased assets of the books value ₹ 4,00,000 and took over the liabilities of ₹ 50,000 from Mohan Bros. It was agreed thet the purchaase consideration, settled at ₹ 3,80,000, be paid by issuing debentures of ₹ 100 each. It was agreed that any fraction of debentures be paid in cash.

View SolutionAnushree Ltd. Issued 10,000, 9% Debentures of ₹ 50 each at a discount of 8% redeemable at par after 7 yea₹. Pass necessary entries in the books of Anushree Ltd

View SolutionGreen Ltd. Issued ₹ 8,00,000, 9% Debentures of ₹ 100 each at a premium of 5 % redeemable at par. Give Journal entries.

View SolutionWellbeing Ltd. Took over assets of ₹ 9,80,000 and liabilities of ₹ 40,000 of HDR Ltd. At an agreed value of ₹ 9,00,000. Wellbeing Ltd. Paid to HDR Ltd. Bu issue of 9% Debentures of 100 each at a premium of 20% . Pass necessary Journal entries to record the above transaction in the books of Wellbeing Ltd.

View SolutionArushi Ltd. issued 5,000, 10% debentures of Rs. 100 each at par but redeemable at a premium of 5% after 5 years. Give journal entries and also prepare the balance sheet of the company.

View Solution