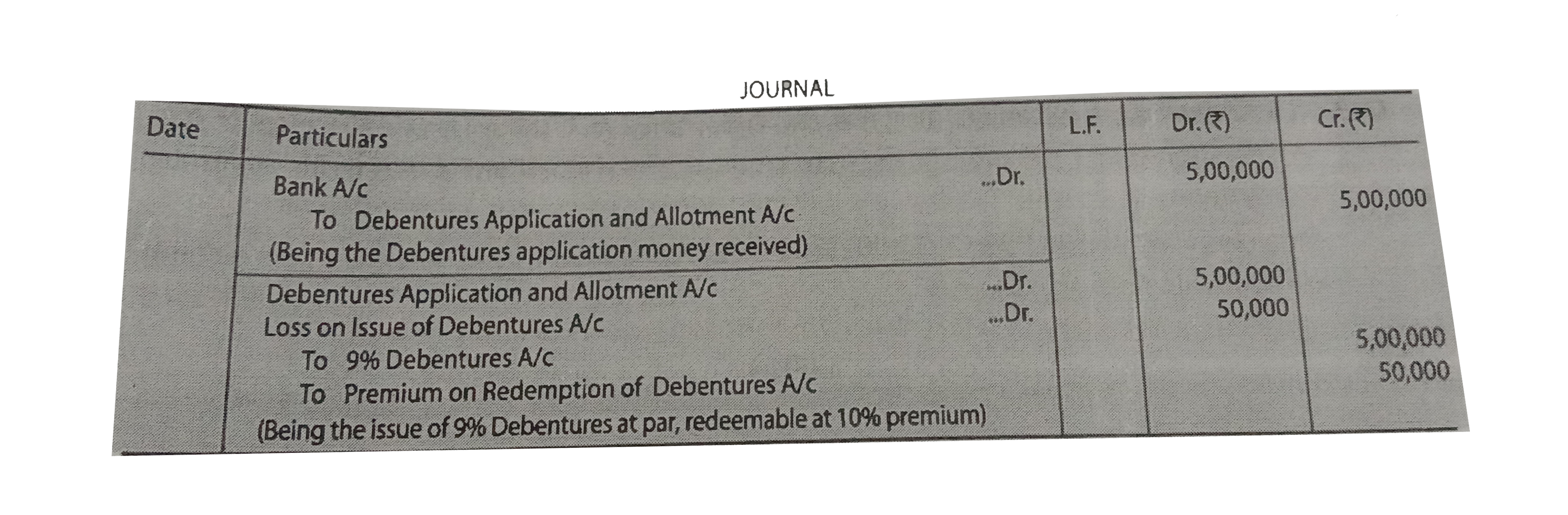

Sunrise Company Ltd. has an equity share capital of Rs. 10,00,000. The company earns a return on investment of 15% on its capital. The company needed funds for diversification. The finance manager had the following options: (i) Borrw Rs. 5,00,000 @ 15% p.a. from a bank payable in four equal quarterly instalments starting from the fifith year, or (ii) Issue Rs. 5,00,000, 9% Debentures of Rs. 100 each redeemable at a premium of 10% after five year. To increase the return to the shareholders, the company opted for option (ii).

Pass necessary Journal entries for issue of debentures.

Similar Questions

Arushi Ltd. issued 5,000, 10% debentures of Rs. 100 each at par but redeemable at a premium of 5% after 5 years. Give journal entries and also prepare the balance sheet of the company.

View SolutionFena Ltd. issued Rs. 7,00,000, 12% Debentures of Rs. 100 each at a premium of 5% redeemable at a premium of 20%.

Pass necessary Journal entries at the time of issue of debentures.

View Solution

Knowledge Check

A company has issued 5,000, 8% Debentures of Rs.100 each at a premium of Rs.10. the prefix 8% is

Athe rate of interest payable on the debentures.Bto distinguish from other debentures issued by the company.CBoth (a) and (b)DNone of these.A company has issued 5,000 8% Debentures of Rs 100 each at a premium of Rs 10. The prefix '8%' is

Athe rate of interest payable on the debenturesBto distinguish from other debentures issued by the companyCBoth (a) and (b)DNone of the aboveUTI Bank Ltd. has outstanding 50,000, 5% Debentures of Rs 100 each redeemable at a premium of Rs 10 each. These debentures are to be redeemed. Amount that should be invested in Debenture Redemption Reserve is

ARs 7,50,000BRs 5,00,000CRs 50,000DNil

X Ltd. has Rs. 8,00,000, 9% Debentures due to be redeemed out of profits on 1st October, 2015 at a premium of 5%. The company had a Debenture Redemption Reserve of Rs. 4,14,000.

Pass necessary Journal entries at the time of redemption.

View SolutionAnupama Ltd. Had issued 20,000, 9% Debentures of Rs.100 each which is due for redemption on 31st March 2018. The company has in its Debenture Redemption Reserve Account a balance of Rs.4,00,000. Record the necessary journal entries for the Redemption of Debentures.

View SolutionAFCONs India Ltd. (an infrastructure company) issued 5,00,000, 9% Debentures of Rs.20 each on April 1, 2005 redeemable on March 31, 2015. Investment as required by law was made in fixed deposit of the bank on 30th April. Record journal entries for issue and redemption of debentures.

View SolutionOn 31 st March, 2003, G Ltd. Had Rs. 8,00,000 9% Debentures due for redemption. The company had a balance of Rs. 1,40,000 in its Debentures Redemption Reserve. Pass necessary Journal entries entries for redemption of debentures.

View SolutionUTI Bank Ltd. Has outstanding 50,000, 5% Debentures of Rs. 100 each redeemable at a premium of Rs.10 each . These debentures are to be redeemed . Amount that should be invested in Debenture Redemption Reserve is

View Solution