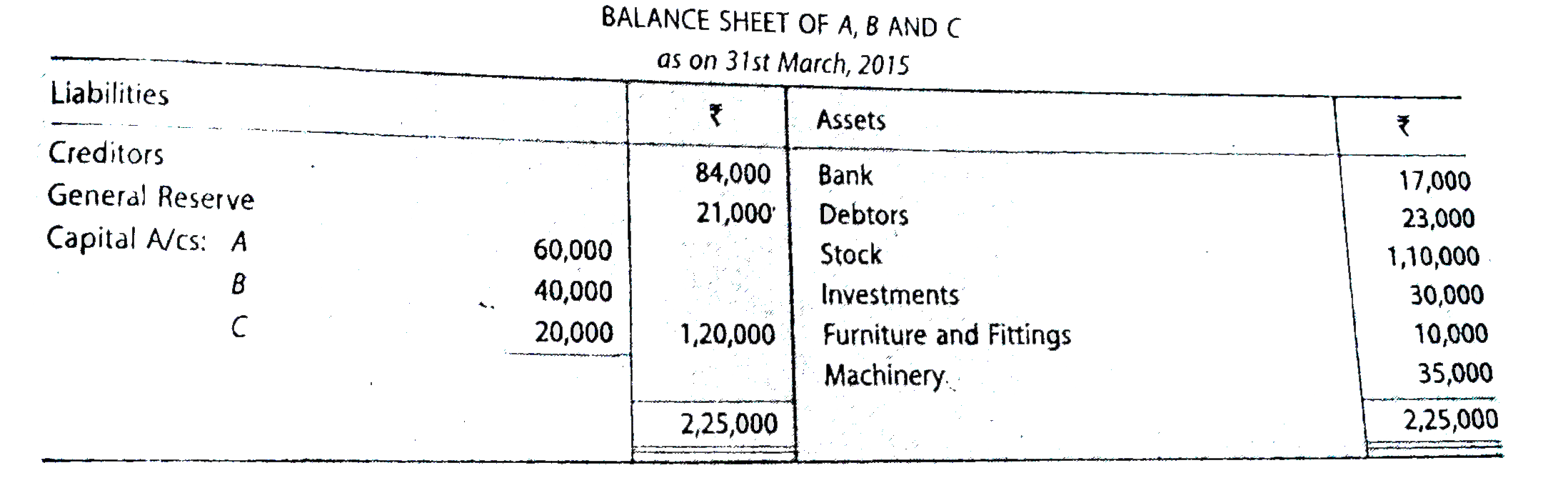

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 31st March, 2015, their Balance Sheet was as follows:

On the above date, D was admitted as a new partner and it was decided that :

(i) The new profit-sharing ratio between A, B, C and D will be 2 : 2 : 1 :1.

(ii) Goodwill of the firm was valued at RS.90,000 and D brought his share of goodwill premium in cash.

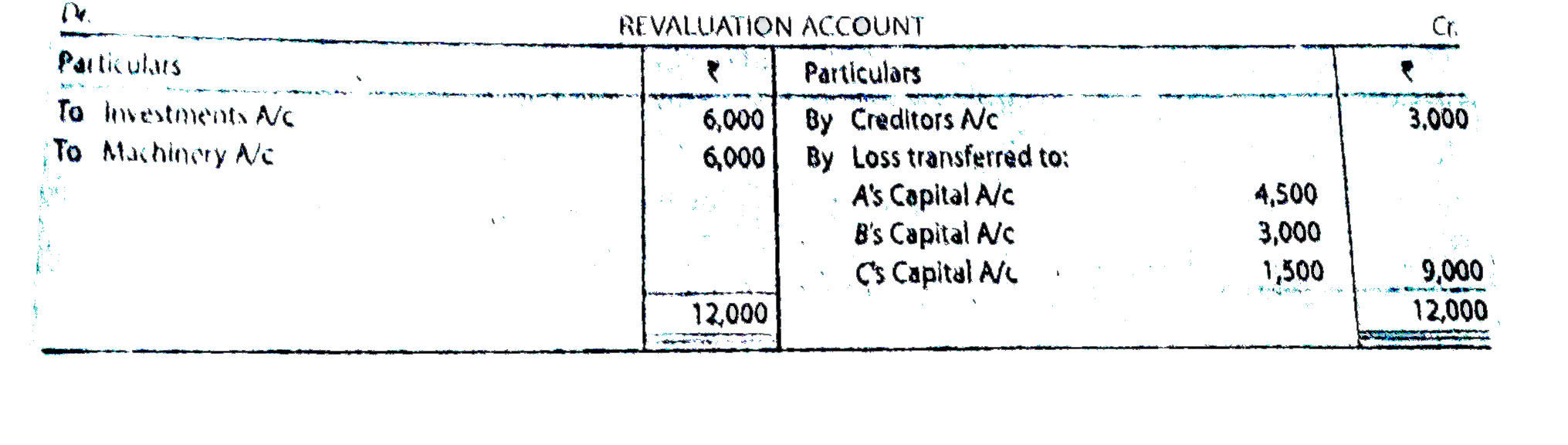

(iii) The market value of investments was RS.24,000.

(iv) Machinery will be reduced to RS.20,000.

(v) A credior of RS.3,000 was not likely RS.29,000.

(vi) D will bring proportionate capital so as to give him 1/6th share in the profits of the firm.

Prepare Revaluation Account, Partner's Capital Accounts and the Balance Sheet of the reconstituted firm.

Working Notes:

Calculation of Sacrifice//(Gain) of each partner A B C DI.Old Share 3/6 2/6 1/6 ...II.New Share 2/6 2/6 1/6 1/6––––––––––––––––––––––––––––––III.Sacrifice//(Gain)(I-II) 1/6(Sacrifice) ... ... −1/6(Gain)––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

2. Goodwill Premium to be brought in by D=1/6 of RS.90,000 =RS.15,000.

3. Calculation of Proportionate Capital of D: Adjusted combined capital of old partners =RS.81,000+RS.44,000+RS.22,000=RS.1,47,000

Total capital of new firm =Adjusted combined capital of the old partnersCombined share of profit of the old partners

=RS.1,47,000×65=RS.1,76,400

D's Capital =16×RS.1,76,400=RS.29,400

Similar Questions

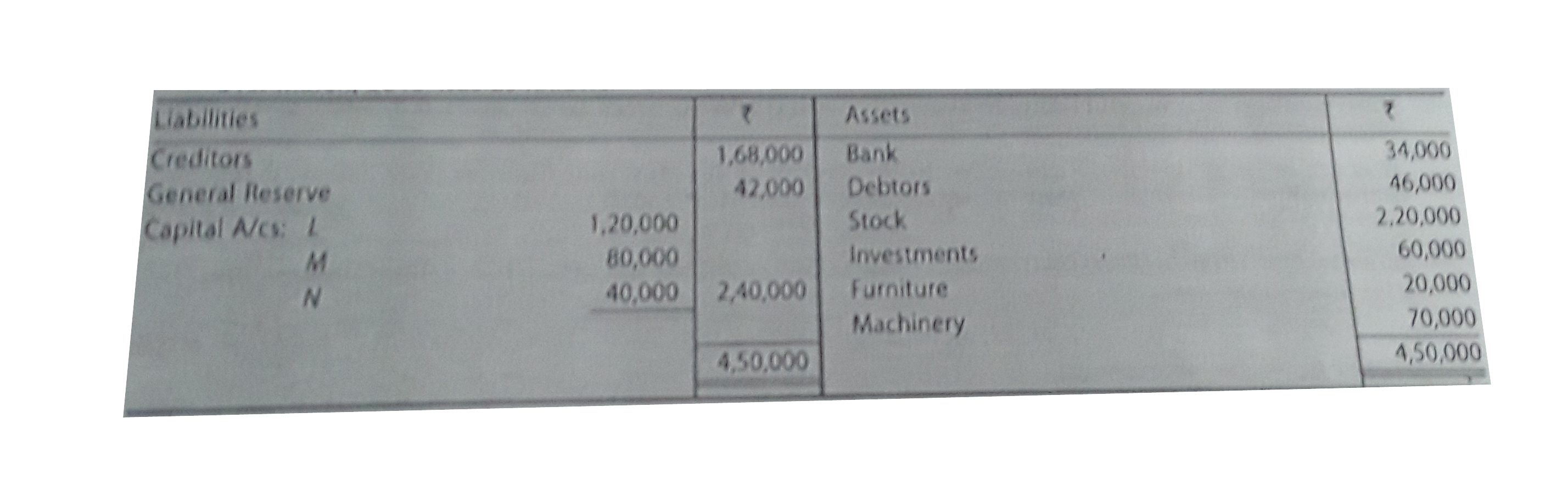

L, M and N were partners in a firm sharing profits in the ratio of 3:2:1. Their Balance Sheet on 31st March, 2015 was as follows:

On the above date, O was admitted as a new partner and it was decided that:

(i) The new profit-sharing ratio between L, M, N and O will be 2:2:1:1.

(ii) Goodwill of the firm was valued atRs 1,80,000 and O brought his share of goodwill premium in cash.

(iii) The market value of investments wasRs 36,000.

(iv) Machinery will be reduced toRs 58,000.

(v) A creditor ofRs 6,000 was not likely to claim the amount and hence was to be written off.

(vi) O will bring proportionate capital so as to give him 1/6th share in the profits of the firm.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the new firm.

View SolutionA, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. They admited D as a new partner for 1/8th share in the profits, which he acquired 1/16th from B and 1/16th from C. Calculate the new profit-sharing ratio of A, B, C and D.

View Solution

Knowledge Check

A, B and C are partners sharing profits in the ratio of 1/2:1/4:1/4. New ratio on the retirement of B will be:

A2:4B1:2C2:1D1/4:1/2A, B and C are the partner sharing profits in the ratio 3:2:1 , C retires . What will be the new profit - sharing ratio?

A1:3B3:2C1:1DNone of these.A, B and C are partners sharing profits in the ratio of 1/4:3/10:9/20. The New ratio on the retirement of C will be:

A6:5B5:6C4:3D4:10

A, B and C were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. The partners decide to share future profits and losses in the ratio of 2 : 2 : 1. Indicate each partner's gain or sacrifice due to change in ratio.

View SolutionA and B are partners in a firm sharing profits in the ratio of 3 : 2 . They decided to share profits in the ratio of 3 : 4 w.e.f., April 1, 2016. On that date there was journal entry assuming that partners decide to distribute the profits.

View SolutionA, B and C are partners sharing profits in the ratio of 4 : 3 : 2. D is admitted for 1/3rd share in future profis. What is the sacrificing ratio?

View SolutionA and B were partners in a firm sharing profits and losses in the ratio of 3:2. They admit C into the partnership with 1/6 share in the profits. Calculate the new profit sharing ratio?

View SolutionA,B and C are the partners sharing profits in the ratio 3:2:1, C retires , the new profit - sharing ratio is 3:2. What will be the gaining ratio?

View Solution