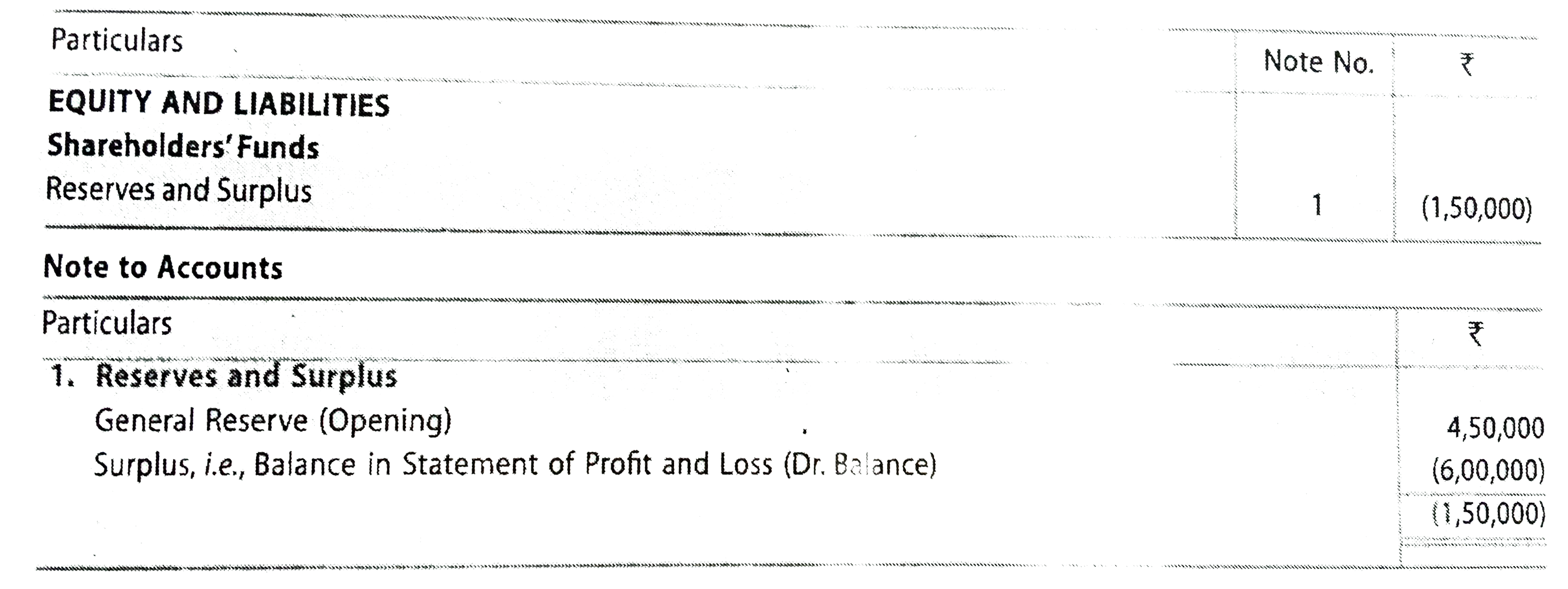

How are the following two items shown in a company's Balance Sheet as at 31st March, 2019 as per Schedule III of the Companies Act, 2013?

General Reserve (since 31st March, 2018) Rs 4,50,000, Surplus, i.e., Balance in Statement of Profit and Loss (Debit) as at 31st March, 2019 Rs 6,00,000.

The correct Answer is:N/a

Similar Questions

How are the following items shown in a company's Balance Sheet as at 31st March, 2019 as per Schedule III of the Companies Act, 2013?

General Reserve (since 31st March, 2018) Rs 3,00,000, Surplus, i.e., Balance in Statement of Profit and Loss (Debit) as at 31st March, 2019 Rs 2,00,000.

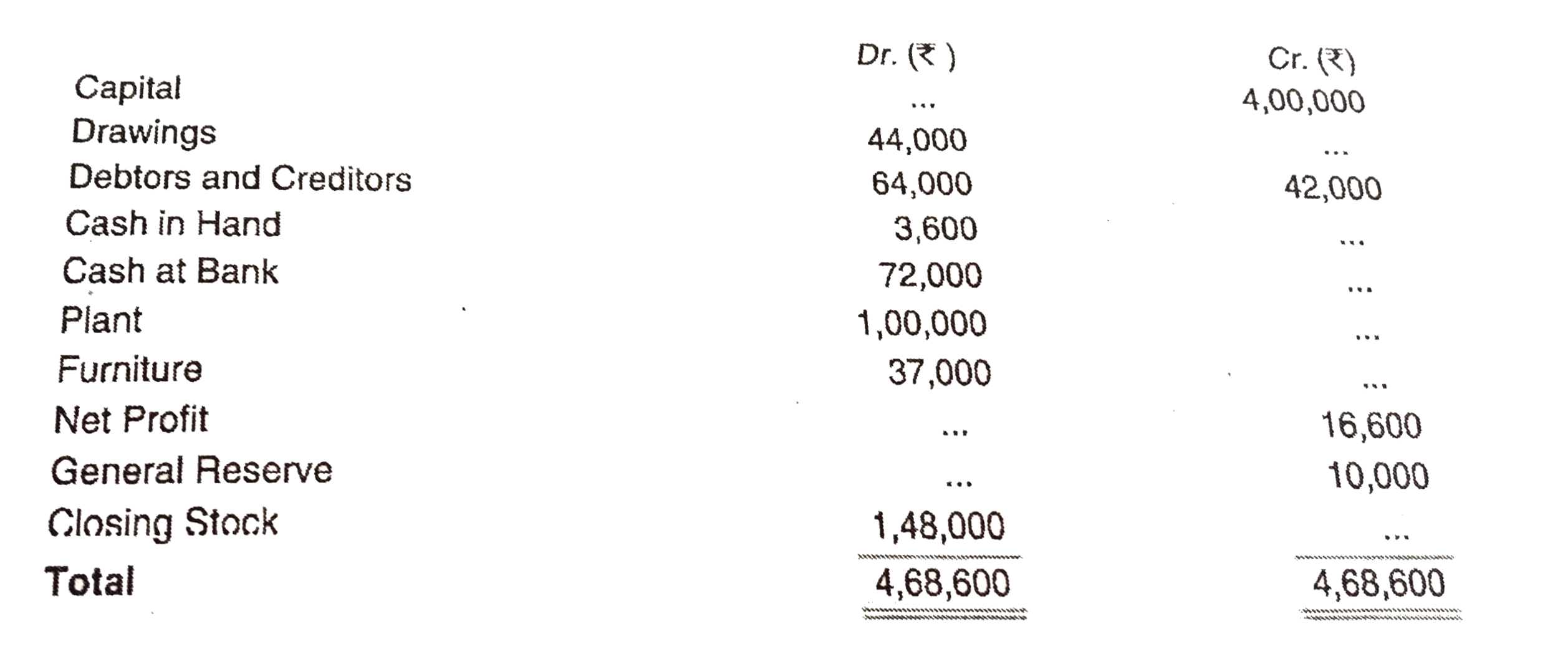

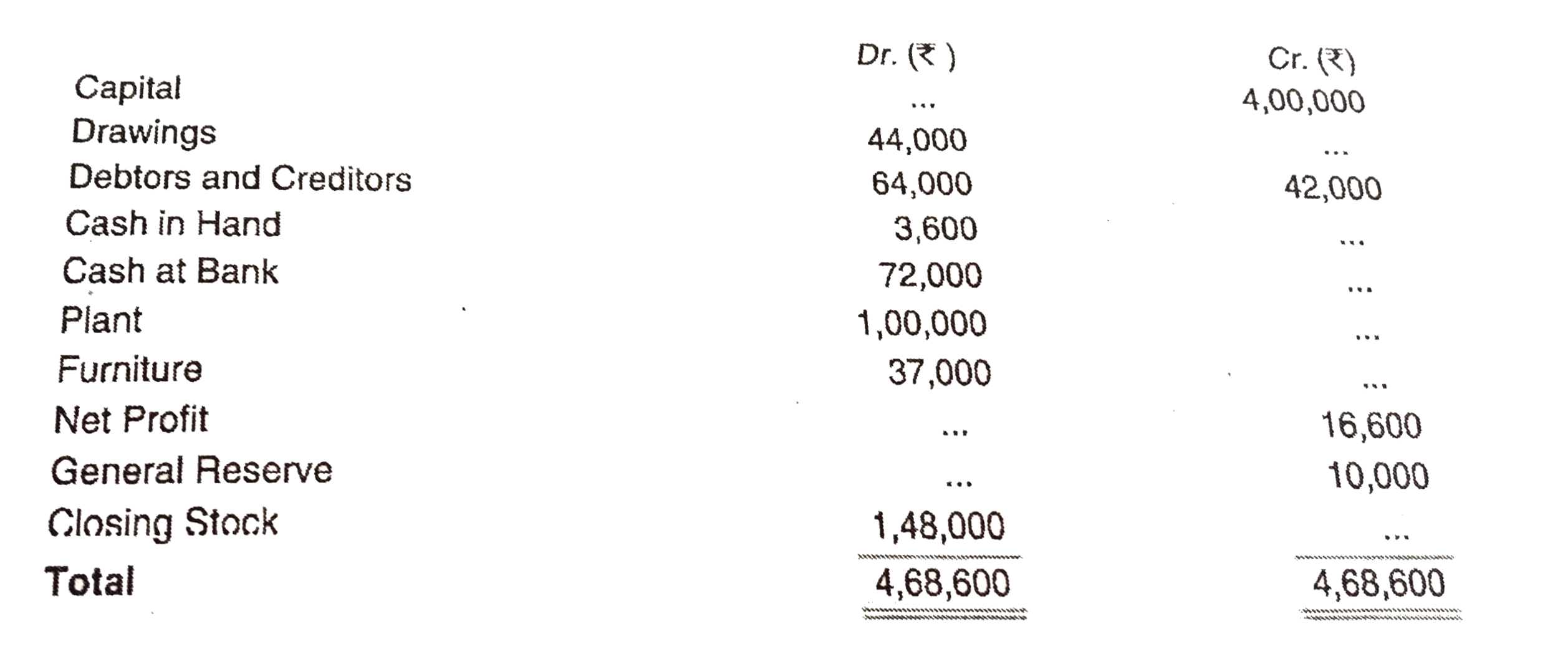

View SolutionFrom the following particulars, prepare Balance Sheet as at 31st March, 2019:

View SolutionFrom the following particulars, prepare Balance Sheet as at 31st March, 2019:

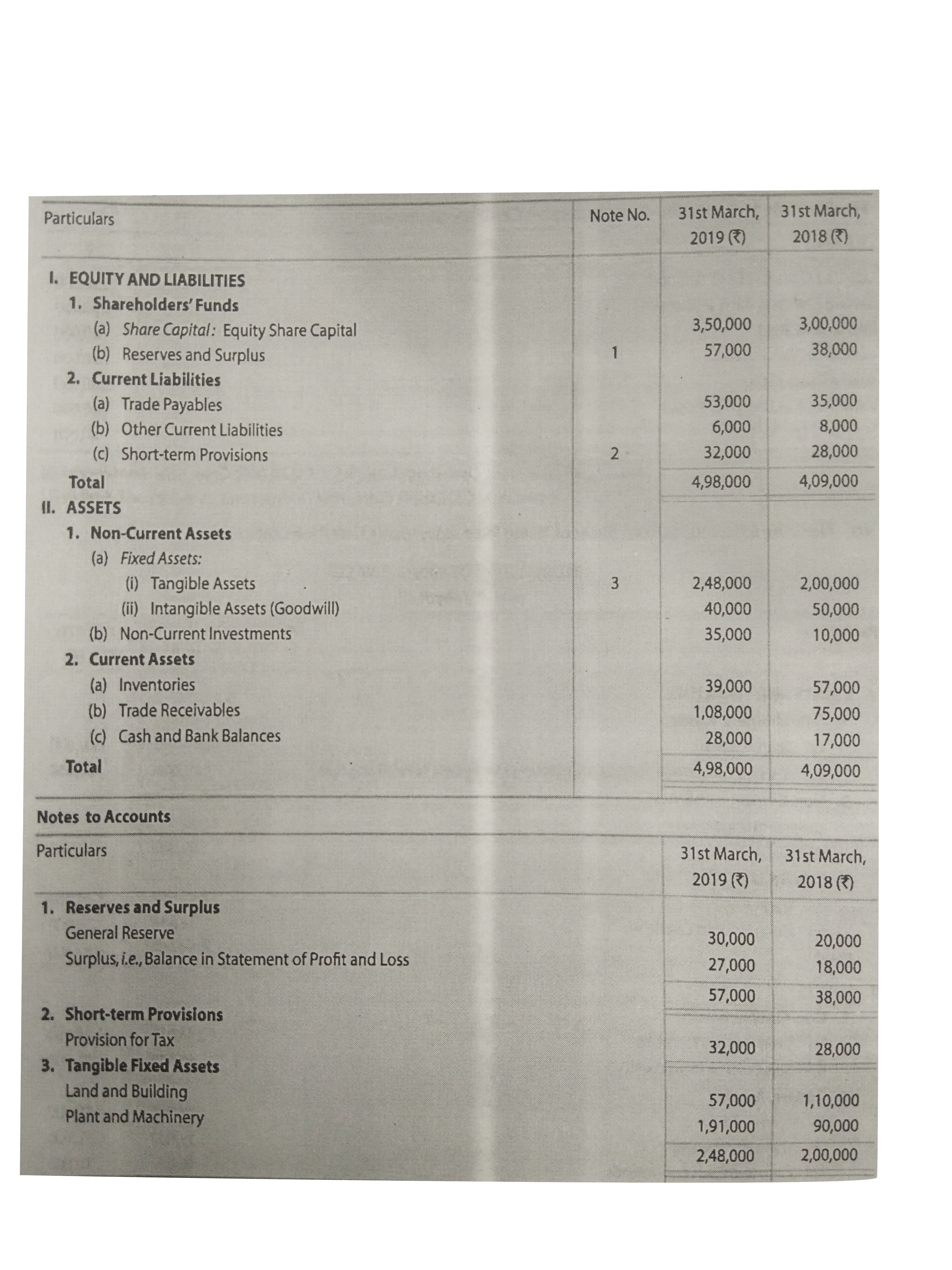

View SolutionFollowing is the Balance Sheet of Techno India Ltd as at 31st March, 2019.

View SolutionFollowimg is the Balance Sheet of Fine Products Ltd., as at 31st March , 2019:

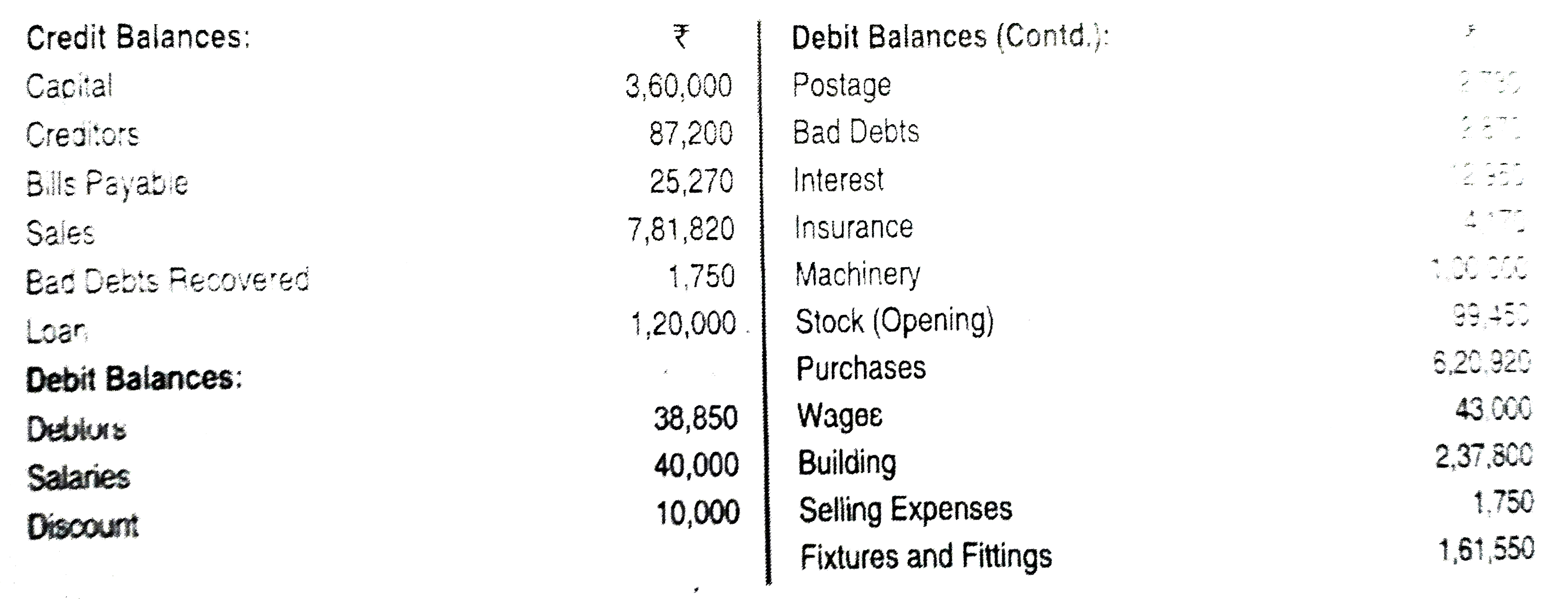

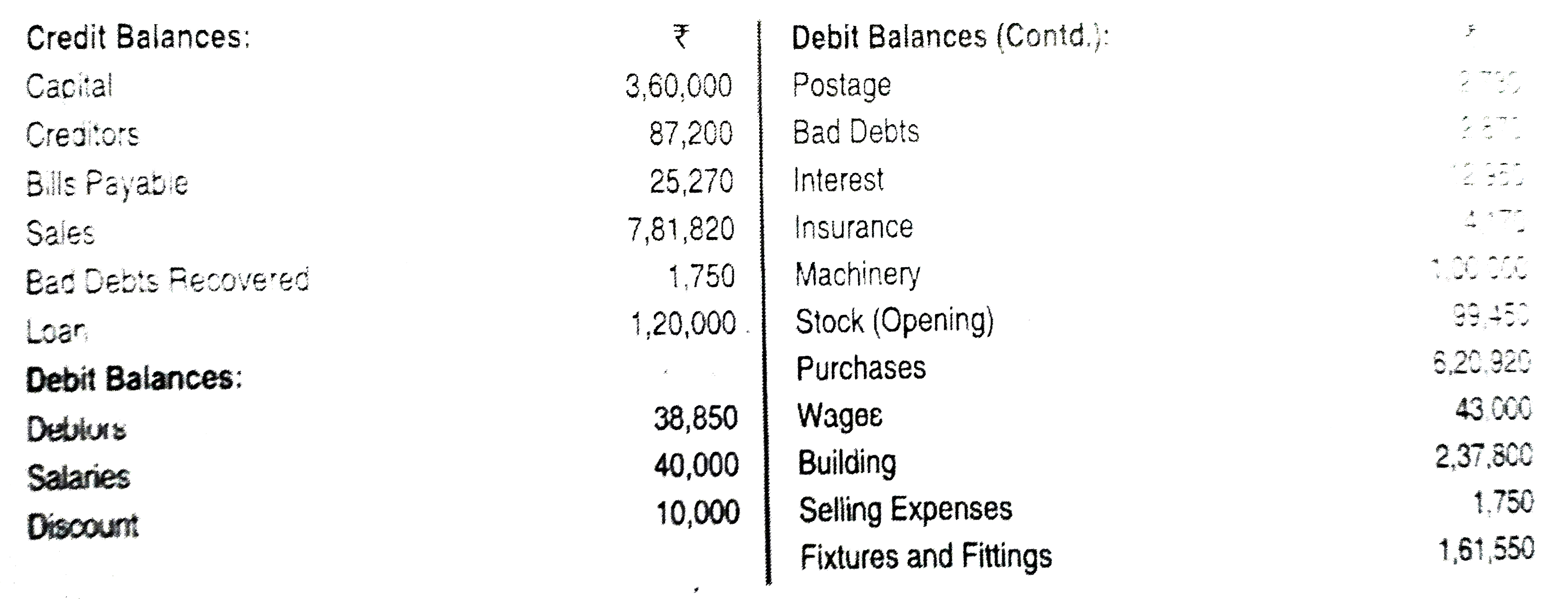

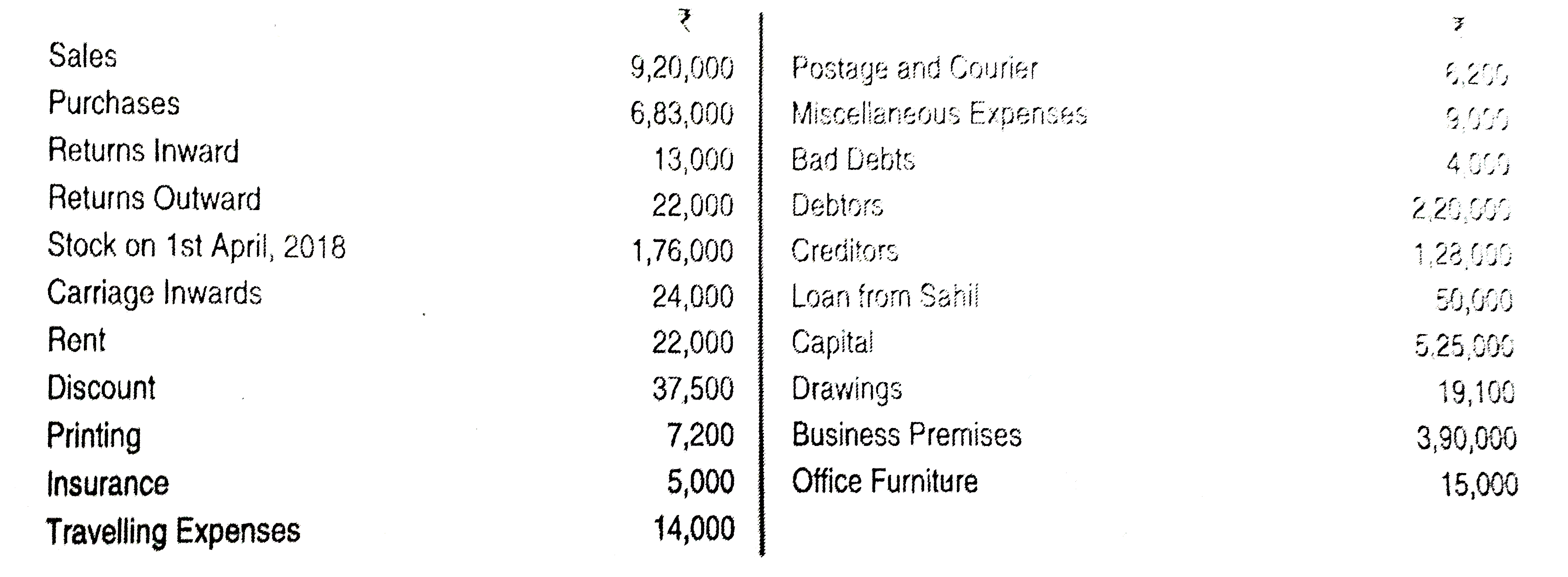

View SolutionFrom the following balances of Anand, prepare Trading Account, Profit and Loss Account, and Balance Sheet as at 31st March, 2019

Value of goods on hand (31st March, 2019) was Rs 1,43,000

View SolutionFrom the following balances of Anand, prepare Trading Account, Profit and Loss Account, and Balance Sheet as at 31st March, 2019

Value of goods on hand (31st March, 2019) was Rs 1,43,000

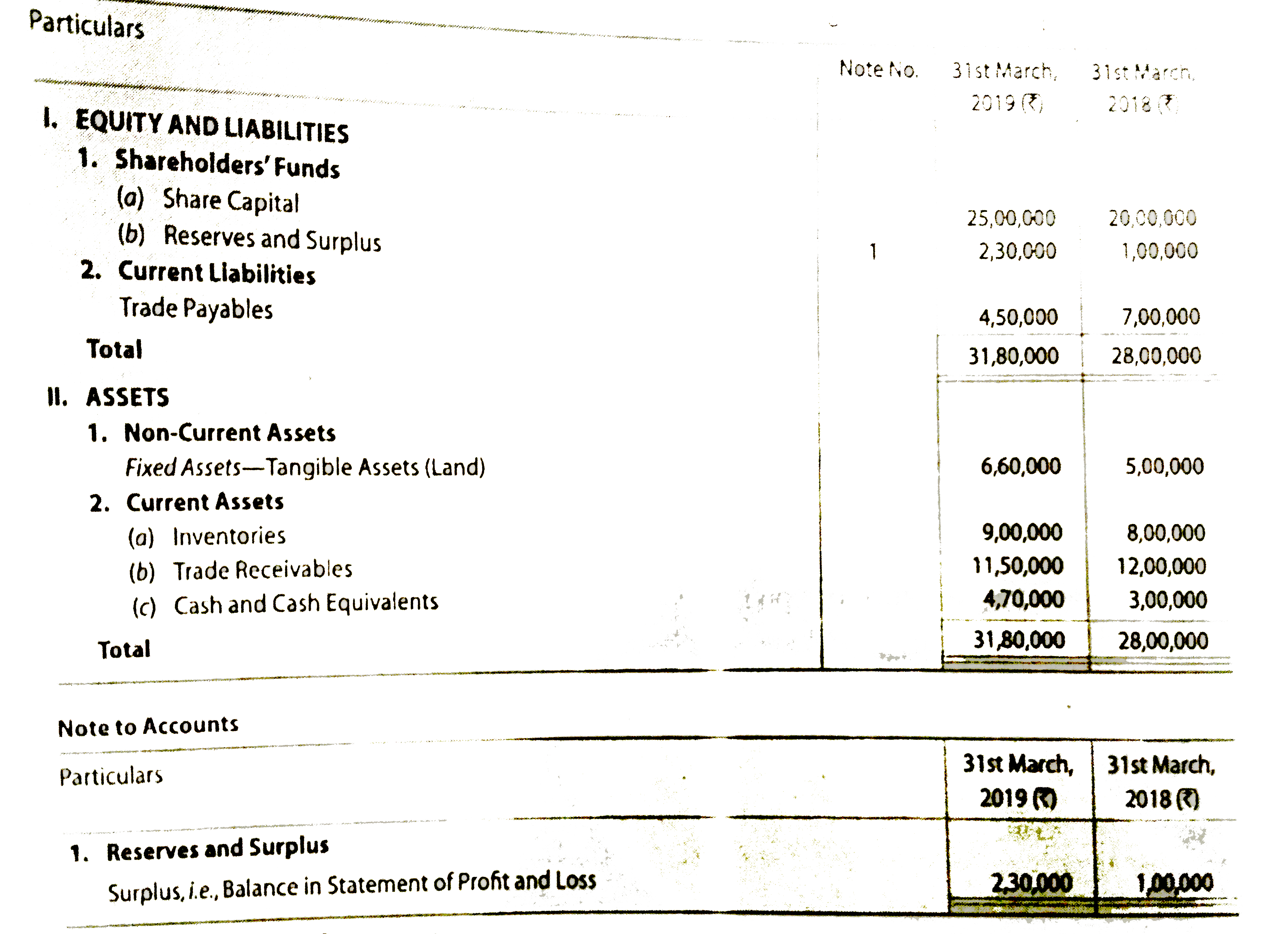

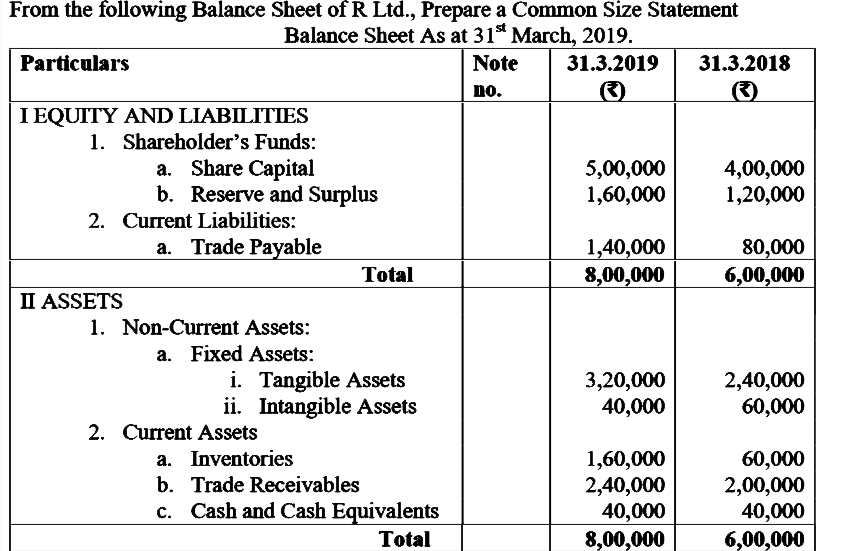

View SolutionFrom the following Balance Sheet of R Ltd., Prepare a Common Size Statement

Balance Sheet As at 31st March, 2019.

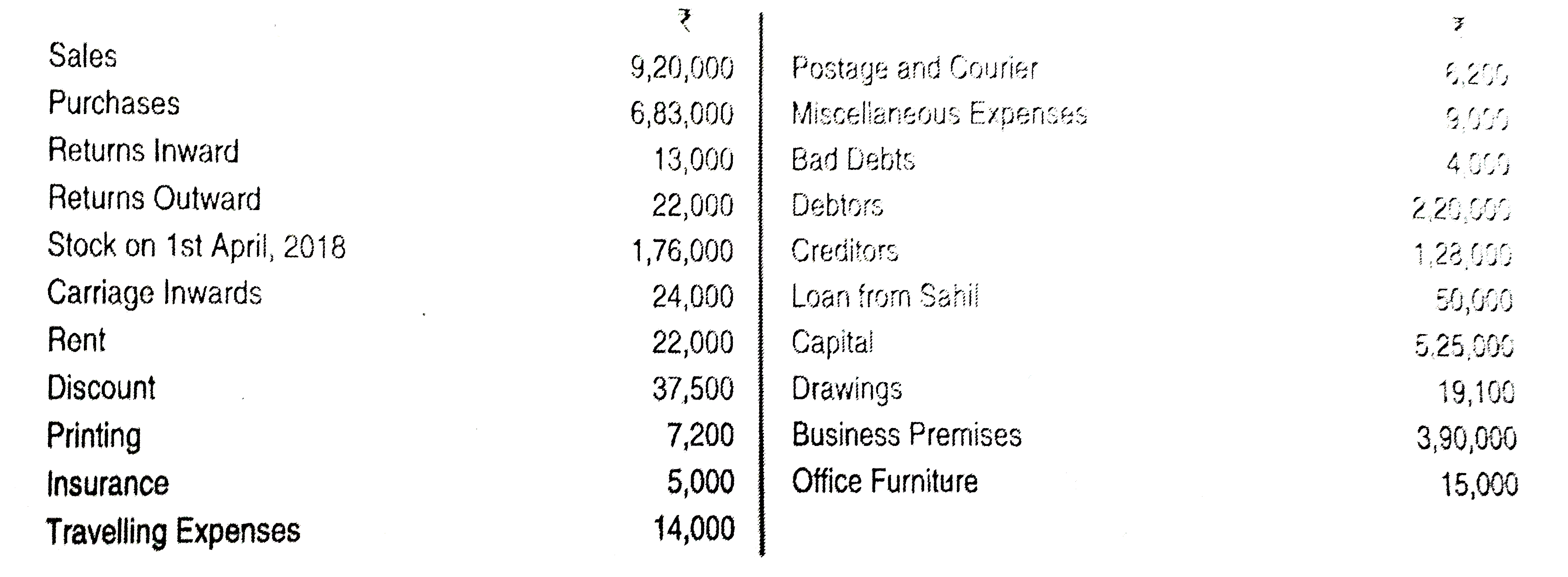

View SolutionThe following are the balances as on 31st March, 2019 extracted from the books of Dass:

The stock on 31st March, 2019 was valued at Rs 2,40,000

You are required to prepare Trading Account, Profit and Loss Account and Balance Sheet as at 31st March, 2019

View SolutionThe following are the balances as on 31st March, 2019 extracted from the books of Dass:

The stock on 31st March, 2019 was valued at Rs 2,40,000

You are required to prepare Trading Account, Profit and Loss Account and Balance Sheet as at 31st March, 2019

View Solution