P,Q and R are partners in firm their capital Account stod at Rs. 30,000 ,15,000 and Rs. 15,000 respectiely on 1st April ,2018 .

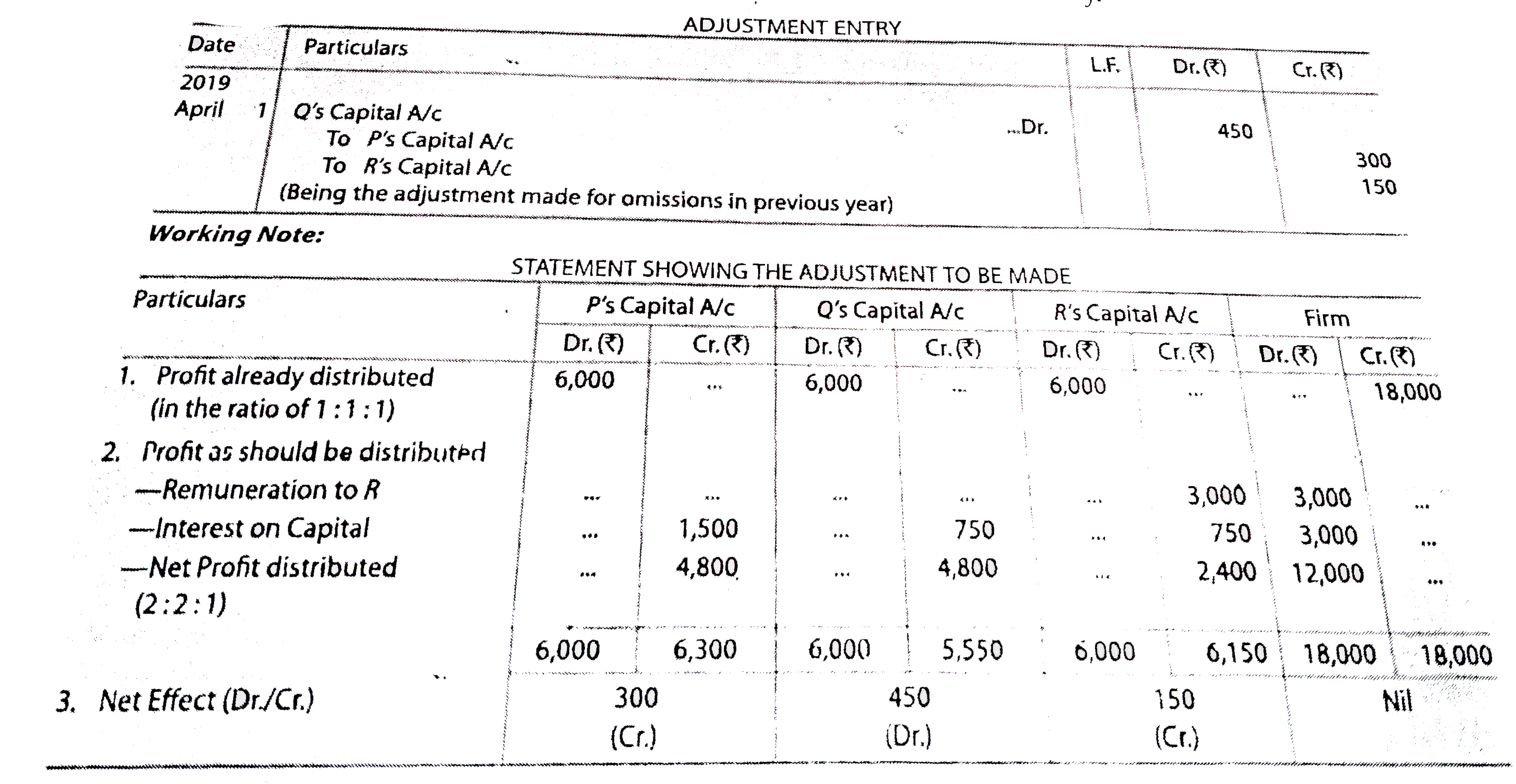

As per parnership deed :(i) R was to be allowed remuneratuion of Rs. 3,000 per annum ,(ii) interest @5% p.a was to be allowed oncaptal and (iii) Pfofits were to be distributed in the ratio of 2:2:1:1 ignoring th above terms net profit fo Rs. 18,000 for the ended 31s march 2019 was distributed among three partners equally .

Pass an adjustment entry to Rectify the error . shw the Working clealy .

Similar Questions

P,Q and R are aprtners in a firm their capital Accounts stood at Rs. ,3,00,000, Rs. 1,50,000 and Rs. 1,50,000 respectively on 1st spril , 2018

As per the provisions of the Deed ,(I) R was to be allowed a remuneration of Rs. 36,000 per annum (ii) inereset @ 5% p.a was to be provided on capital and (iii) profits were to be distributed in the ratio of 2:2:1:1 ignorring the above terms net profit of Rs. 1,80,000 for the year ended 31 st MArch ,2019 was distributed among the three partners equally .

Pass the journal entries to rectify the above errors.

View SolutionA, B and C were partners in a firm. On 1st April, 2012 their capitals stood as Rs 5,00,000, Rs 2,50,000 and Rs 2,50,000 respectively. As per provisional of the Partnership Deed:

(i) C was entitled for a salary of Rs 5,000 per month.

(ii) A was entitled for a commission of Rs 80,000 p.a.

(iii) Partners were entitled to interest on capital @6% p.a.

(iv) Partners will share profits in the ratio of capitals.

Net profit for the year ended 31st March, 2013 was Rs 3,00,000 which was distributed equally, without taking into consideratin the above provisions.

Showing your workings clearly, pass necessary adjustment entry for the above.

View SolutionX and Y are partners in the ratio of 3 : 2. Their capitals are Rs.2,00,000 and Rs.1,00,000 respectively. Interest on capitals is allowed @8% p.a. Firm incurred a loss of Rs.60,000 for the year ended 31st March 2019. Interest on Capital will be :

View SolutionX and Y are partners in the ratio of 3 : 2. Their capitals are Rs.2,00,000 and Rs.1,00,000 respectively. Interest on capitals is allowed @8% p.a. Firm earned a profit of Rs.60,000 for the year ended 31st March 2019. Interest on Capital will be :

View SolutionAmit and vijay started a partnership business on 1st April , 2018 their capital contributions were Rs. 2,00,000 and Rs, 1,50,000 respectively ,the Deed provided as follows:

(A) interest n capials be allowed @ 10% p.a

(b) amit to get a salary of Rs. 2,000 per month and vijay Rs. 3,000 per month .

(c ) Profit are to be shared in the ratio of 3:2

Net profit for year ended 13st MArch ,2019 was Rs. 2,16,000 interest on amounted to Rs. 2,200 for amit and Rs. 2,500 for vijay .

prepare profit and loss appropriation Account .

View SolutionX and Y are partners in the ratio of 3 : 2. Their capitals are Rs.2,00,000 and Rs.1,00,000 respectively. Interest on capitals is allowed @8% p.a. Firm earned a profit of Rs.15,000 for the year ended 31st March 2019. As per partnership agreement, interest on capital is treated a charge on profits. Interest on Capital will be :

View SolutionA , B and C were partners , their capitals were A -Rs. 30,000 ,B -Rs. 20,000 and Rs. 10,000 respectivley according to the partnership Deed they were entitled to an interest on capital @5% in additon B was also entitled to drew a salary of Rs, 500 per month C was entitled to a commission of 5% p,a on the profit after charing the interest on capital but before charing the salary payable to B the net profit for the year were Rs. 30,000 distributed in the ratio captials without providing for any of the above adjustment the pass necessary adjustment entry showing the workings clerly .

View Solutionbhanu and partap are partners sharings profits equally their fixed capitals as on 1st April 2018 are Rs. 8,00,000 and Rs. 10,00,000 respectively their drawing during the year were Rs. 50,000 and Rs. 1,00,000 respecticvely interest on capital is a charge is to allowed @10% p,a and interest on drawings is to be charged @15% p.a Net profit for for the year ended 31st MArch , 2019 was Rs. 1,20,000.

prepane profit and Loss apppropriatin account .

View SolutionAsgar ,chaman and ddholu are partners in a firm their capital account stood at Rs. 6,00,000 Rs.5,00,000 and Rs, 4,00,000 respectively on 1st april ,2017 they shared profit and losses in the proporation of 4:2:3 partners are entitled to interest on capital @8% psrannum and salary to chaman and dholu @ Rs, 7,000 per month and Rs. 10,000 per quarter espectivley as per the provision of the partnership Deed.

dholu 's share of profit (excluding interest on capital but including salary )is guaranteed at a minimum of Rs. 1,00,000 p.a any deficinecy arising on that account shall be met by asgar the profit for the ended 31st March 2018 amounted to Rs, 4,24,000

Prepare profit and loss appropriation Account fo the year ended 31st March ,2018

View SolutionA and B are partners sharing profit and loss in the ratio 3:2 having capital Account balance of Rs. 50,000 and Rs. 40,000 on 1st April ,2018 A introduced Rs. 10,000 as his additional capital capital whereas interest on capital for the financial year ended 31st March ,. 2019

View Solution