A and B are partners charing profits in the ratio of 2:1 they admitted C, their manager as a partners from 1st April , 2018 for 1/5 th share of profit ,C while being manger ,was getting salary of Rs. 50,000 p,a Plus commission of 10% of net profit after charing such salary and commission it was also agreeed that any excess amount which C reseives as a partners (over his salary and commission ) will be vborne by A profit for the year ended 31st March , 2019 was Rs, 6,44,000 before payment of salary and commission prepare profit and loss appropritation Account .

C',s share as a manager -rS. 1,04,000 C's share as partners -Rs. 1,28,800

Deficviency osRs. 24,800 to be met by A final share of profit A-RS. 3,35,200 ,B -Rs. 1,80,000 ,C -rs. 1,28,800 .

Topper's Solved these Questions

- ACCOUNTING FOR PARTNERSHIP FIRMS-FUNDAMENTALS BOOK - TS GREWALCHAPTER - ACCOUNTING FOR PARTNERSHIP FIRMS-FUNDAMENTALS EXERCISE - EVALUATION QUESTION :QUESTIONSWITHMISSINGVALUES

3 Videos

- ACCOUNTING FOR PARTNERSHIP FIRMS-FUNDAMENTALS BOOK - TS GREWALCHAPTER - ACCOUNTING FOR PARTNERSHIP FIRMS-FUNDAMENTALS EXERCISE - short Answer type Questions

8 Videos

- ACCOUNTING RATIOS BOOK - TS GREWALCHAPTER - ACCOUNTING RATIOS EXERCISE - Exercise

147 Videos

Similar Questions

(commission to partners and Distribution of profit ) X and Y are partners in a firm X get a commmission of 10% on the net profits before charging any ammission an Y get commission fo 10 % on the net profits after charging all commission .

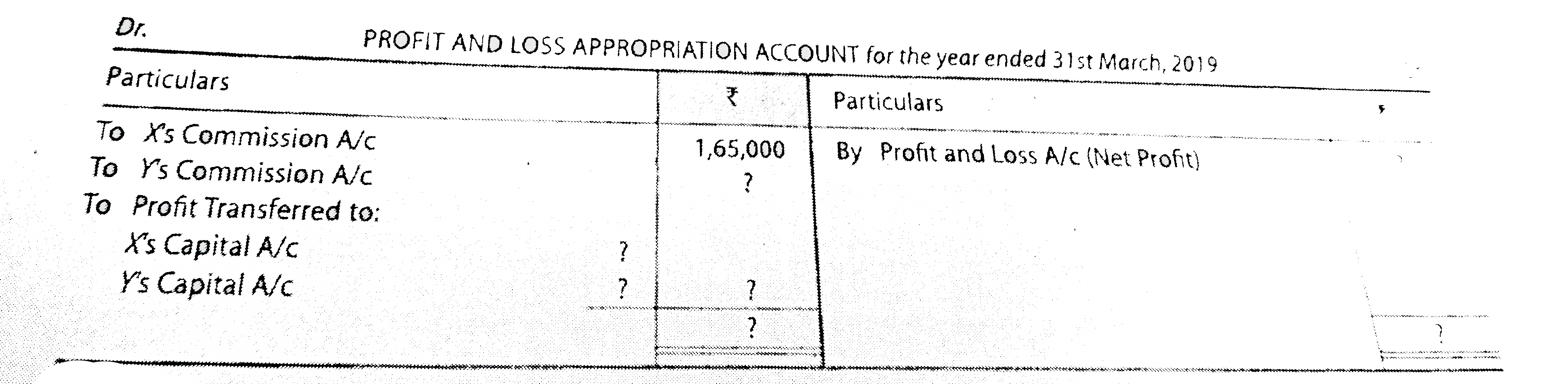

compute the missing figure (?) from the following profit and Loss appropriation Account for the year ended 31st March , 2019 :

View SolutionMention the items that may appear on the credit side of the capital Accounts of a partner when the capitals are fluctuating .

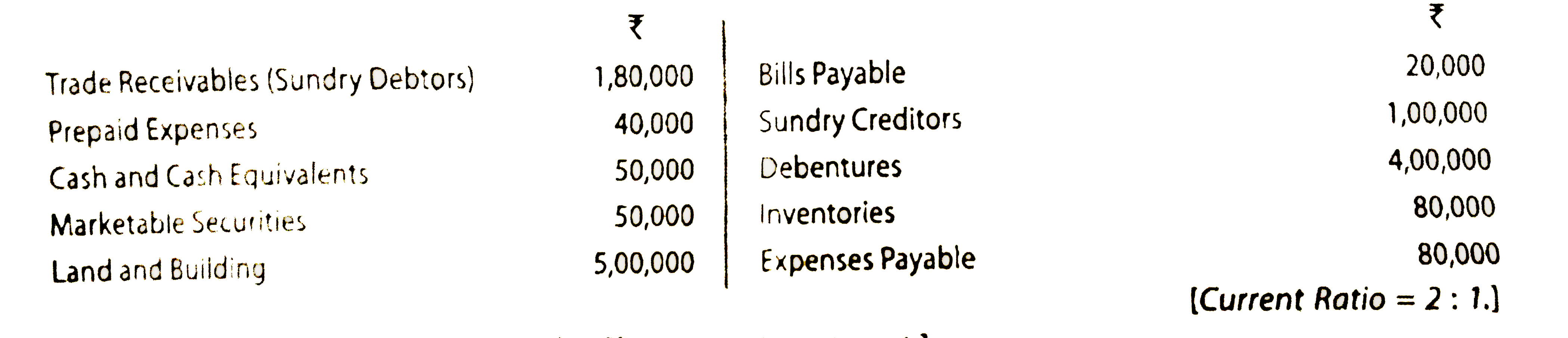

View SolutionFrom the following compute curent ratio:

View Solutionएक राजमार्ग पर दो बिन्दु A और B एक दूसरे से 90 किमी की दूरी पर है। एक कार A से तथा दूसरी कार B से एक साथ चलती हैं। यदि वे एक दिशा में चलती हैं, तो वे 9 घण्टे बाद मिलती हैं और वे विपरीत दिशा में चलती हैं, तो 97 घण्टे बाद मिलती है। उनकी चाल ज्ञात कीजिए।

View Solutiona और b के लिये हल कौजिए :

2a+3b=17 और 2a+2−3b+1=5

View Solutionएक छात्र को A,B,C या D ग्रेड मिलने की सम्भावना है। प्रायिकता ज्ञात कीजिये कि कम से कम B ग्रेड प्राप्त कर सके, जबकि A ग्रेड प्राप्त करने की प्रायिकता : 20,B ग्रेड प्राप् करने की प्रायिकता 40,C ग्रेड प्राप्त करने की प्रायिकता- 30,D ग्रेड प्राप्त करने की प्रायिकता 10 है।

View Solutionअ के एक लाटरी में तीन शेयर हैं जिनमें 3 इनाम हैं तथा 6 रिक्त हैं। ब का एक लाटरी में 1 शेयर है जिसमें 1 इनाम तथा 2 रिक्त हैं। दिखाइये कि अ के जीतने की प्रायिकता का ब के जीतने की प्रायिकता से अनुपात 16 : 7 है।

View Solutionयदि A और B दो घटनाएँ इस तरह से हों कि P(A)=(1)/(3), P(B)=(1)/(4), P(A capB) =(1)/(5)" तो " P(A//B)=

View Solutionनिम्नलिखित कथनों पर विचार करें :

कथन I : यदि A और B प्रतिदर्श समष्टि S के संगत दो घटनाएँ ऐसा है कि P(A)=0.2" और "P((B)=0 cdot 8" तो "A bigcupB एक सुनिश्चित घटना है |

कथन I : यदि A और B परस्पर अपवर्ती हों तो P(A)+P(B)=1 इन कथनो में :

View Solutionसारणिक के गुणों का प्रयोग कर ∣∣ ∣ ∣ ∣∣1a1bc1b1ca1c1ab∣∣ ∣ ∣ ∣∣ का मान निकालें |

View Solutionयदि P(A)=38,P(B)=12,P(A∩B)=14, तो P(A/B)=

View Solutionयदि A तथा B दो स्वतंत्र घटनाएँ हों, तो सिद्ध करें कि P(A∪B)=1−P(A')P.(B')

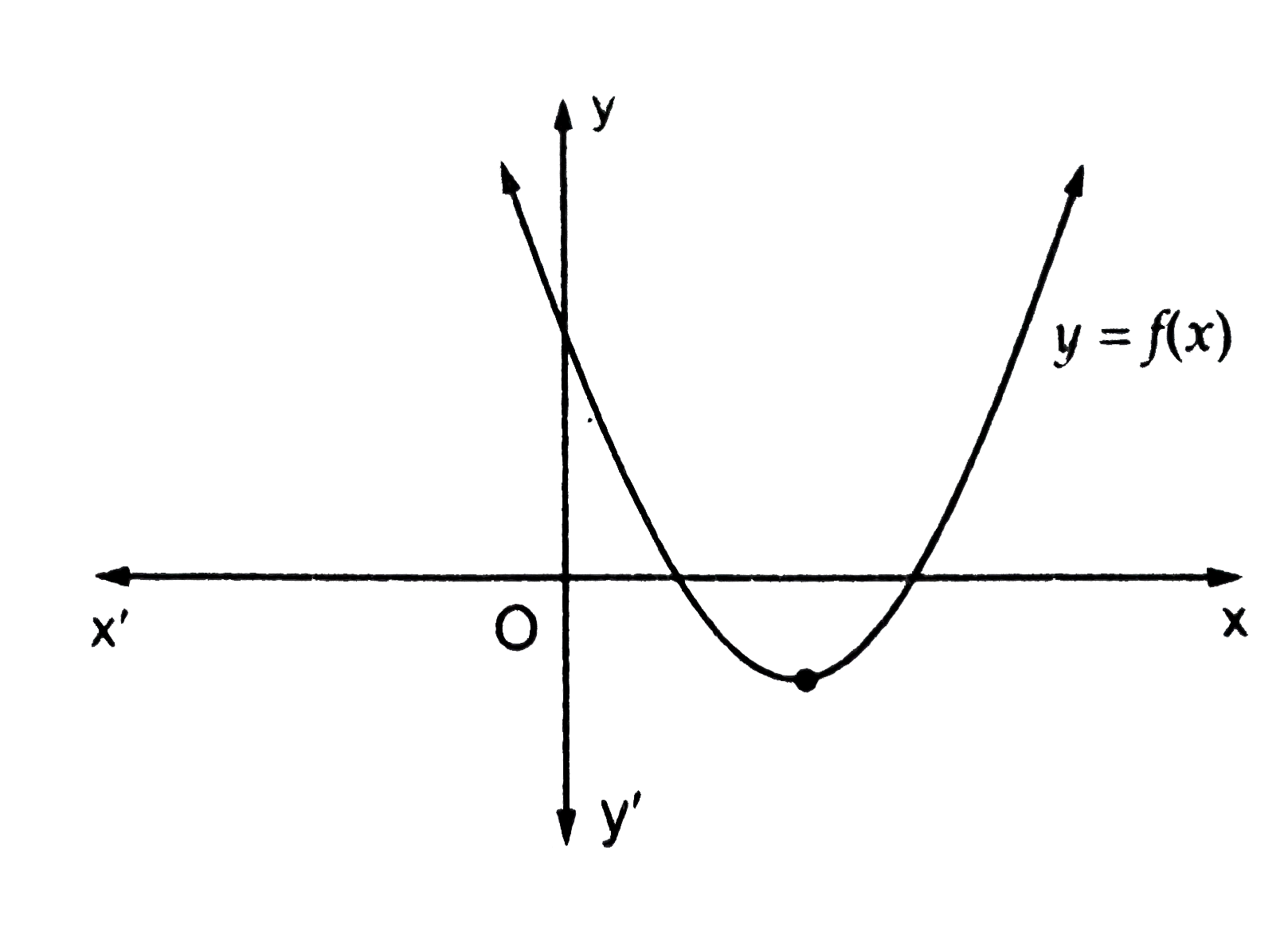

View Solutionबहुपद f(x)=ax2+bx+c का आलेखः चित्र में दर्शाया गया है | 'a' तथा b2−4ac के चिन्ह लिखिए |

View SolutionIf P (A) is the probability for any event A. then P(A)<P(¯¯¯A).

View SolutionFive numbers a,b,c,d and e are in the ratio of 2:3:5:8:9 and their sum is 162. Find the average of all these numbers:

View SolutionAn article was sold at 25% profit. Had it purchased at Rs 20 less and sold at Rs 10 less there would have been profit of 5% more. Find C.P. of article?

View Solution