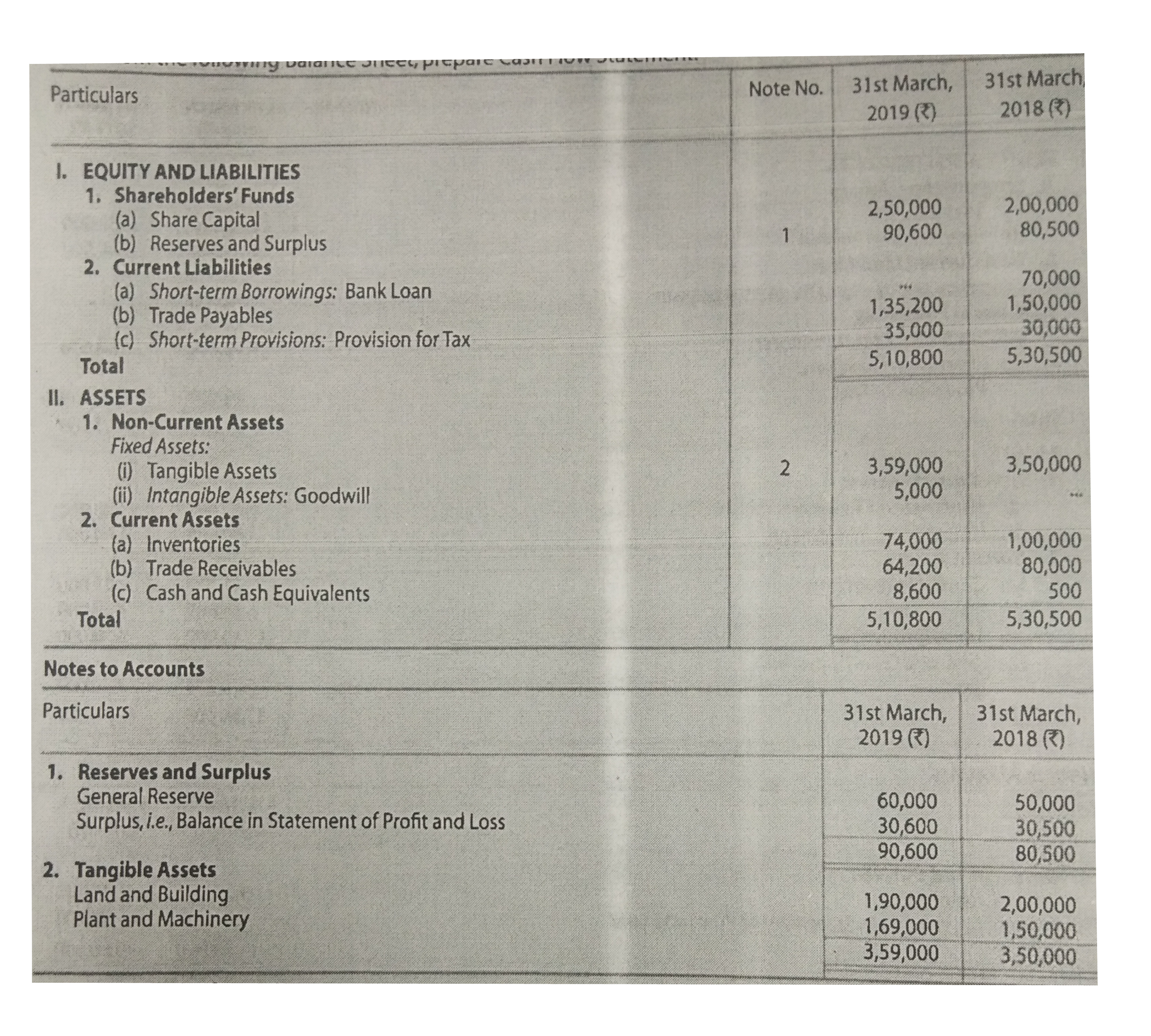

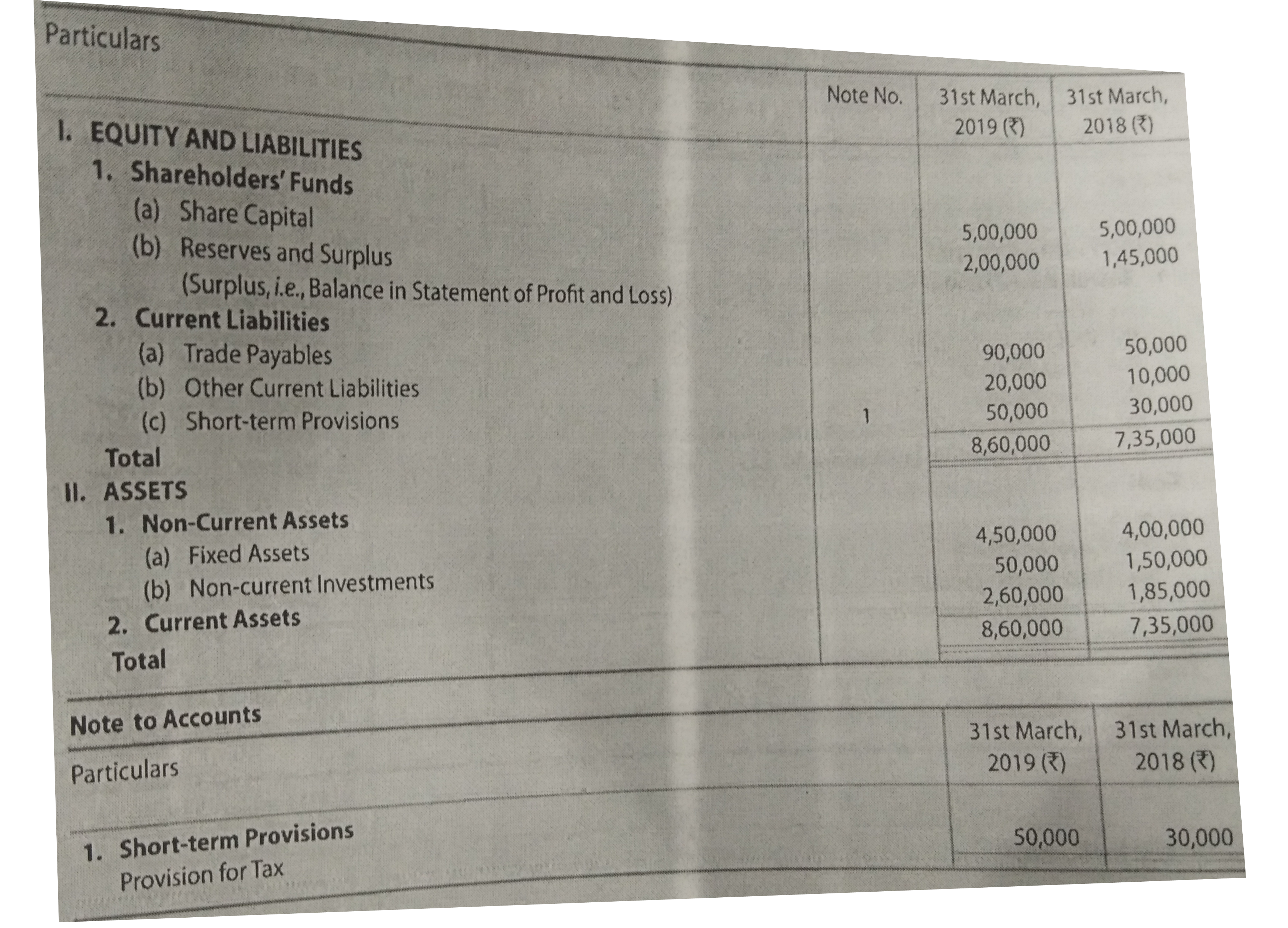

Form the following Balance Sheet prepare Cash Flow Statement:

Additional Information:

1. Proposed Divident for the year ended 31st March, 2019 was ₹ 25,000 and for the year ended 31st March , 2018 was ₹ 14,000.

2. Interim Divided paid during the year was ₹ 9,000.

3. Income Tax paid during the years ₹ 28,000.

4. Machinery was purchased during on machinery ₹ 33,000.

5. Deprection to be charged on machinery ₹ 14,000 and on buliding ₹ 10,000.

The correct Answer is:Cash Flow from Operating Activities = ₹ 89,100; Cash Used in Investing Activities = ₹ 38,000; Cash Used in Financing Activities = ₹ 43,000.

Step by step video, text & image solution for Form the following Balance Sheet prepare Cash Flow Statement: Additional Information: 1. Proposed Divident for the year ended 31st March, 2019 was ₹ 25,000 and for the year ended 31st March , 2018 was ₹ 14,000. 2. Interim Divided paid during the year was ₹ 9,000. 3. Income Tax paid during the years ₹ 28,000. 4. Machinery was purchased during on machinery ₹ 33,000. 5. Deprection to be charged on machinery ₹ 14,000 and on buliding ₹ 10,000. by Accounts experts to help you in doubts & scoring excellent marks in Class 12 exams.

Updated on:21/07/2023Similar Questions

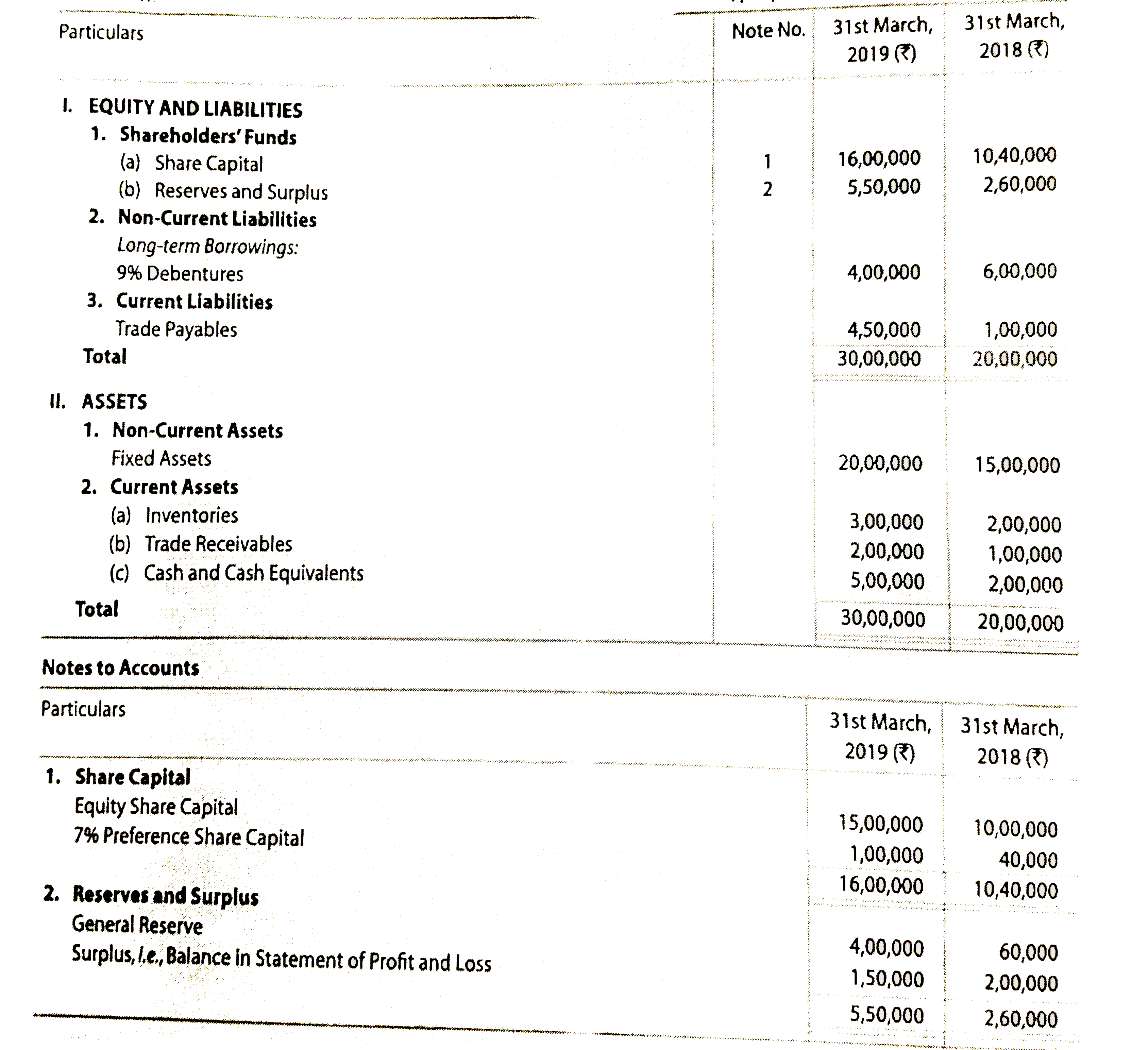

From the following Balance Sheet of L.M.R. Ltd. As at 31st March, 2018, prepare Cash Flow Statement:

Notes to Accounts

Additional Information:

1. Proposed dividend for the year ended 31st March, 2017 was Rs. 35,000 and for the year ended 31st March, 2018, it was Rs. 70,000.

2. During the year equipment costing Rs. 50,000 was purchased Loss on Sale of Equipment amounted to Rs. 6,000. Rs. 9,000 depreciation was charged on equipment.

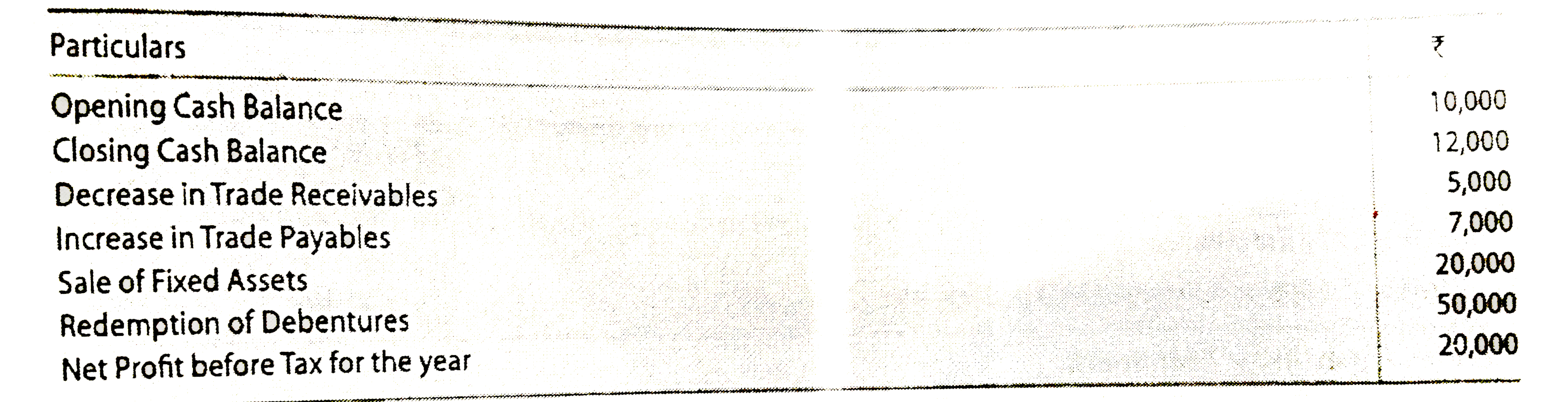

View SolutionFrom the following Balance Sheet of Kumar Ltd., as 31st Marach, 2019, prepare Cash Flow Statement:

Additional Information:

1. During the year, a machinery costing ₹ 20,000 was sold ₹ 6,000.

2. Dividend paid during the years ₹ 50,000.

View Solution

Knowledge Check

Salaries paid during the year ended 31 st March , 2019 is Rs. 36,000 . Salaries paid in advence at the end of previous year ended 31 st March , 2019 will be

ARs. 54,000.BRs. 36 ,000.CRs. 90, 000.DRs.18,000.

From the following Balance Sheets of Vijaya Ltd. As at 31st March, 2013, prepare Cash Flow Statement:

Additional Information:

1. Depreciation on Fixed Assets for the year 2012-2013 was Rs. 14,700.

2. An interim dividend Rs. 7,000 has been paid to the shareholders during the year.

View SolutionFrom the following information,prepare Cash Flow Statement for the year ended 31st March, 2019.

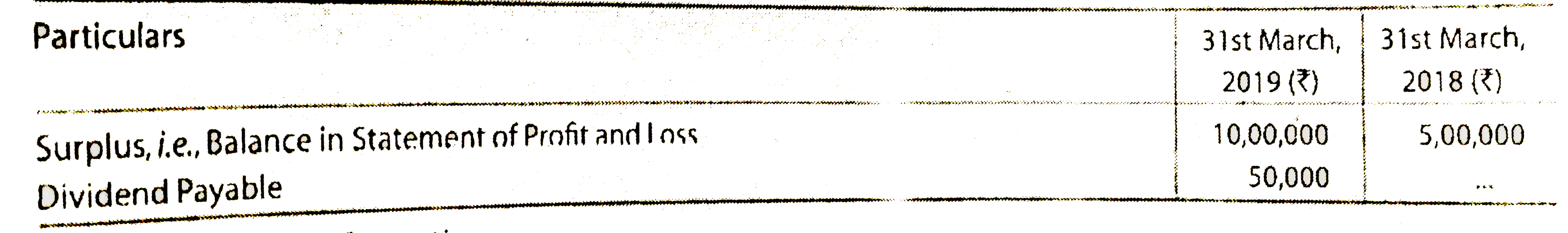

View SolutionFollowing are the extracts from the Balance Sheet of MAH Ltd. as at 31st March, 2019:

Additional Information : Proposed divided for the years 31st March, 2018 and 2019 are ₹ 4,00,000 and ₹ 5,00,000 respectively.

View SolutionCalculate Net Profit before Tax and Extraordinry Items of Perimer Sales Ltd. From its Balance Sheet as at 31st March, 2019:

Additional Divided for the years ended 31st March , 2018 and 2019 are ₹ 75,000 respectively.

(ii) Interim Dividend paid during the year was ₹ 10,000

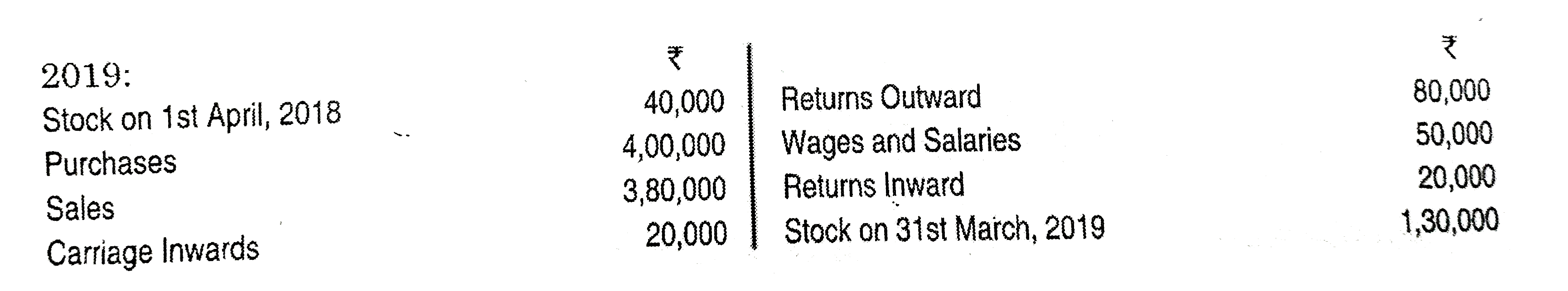

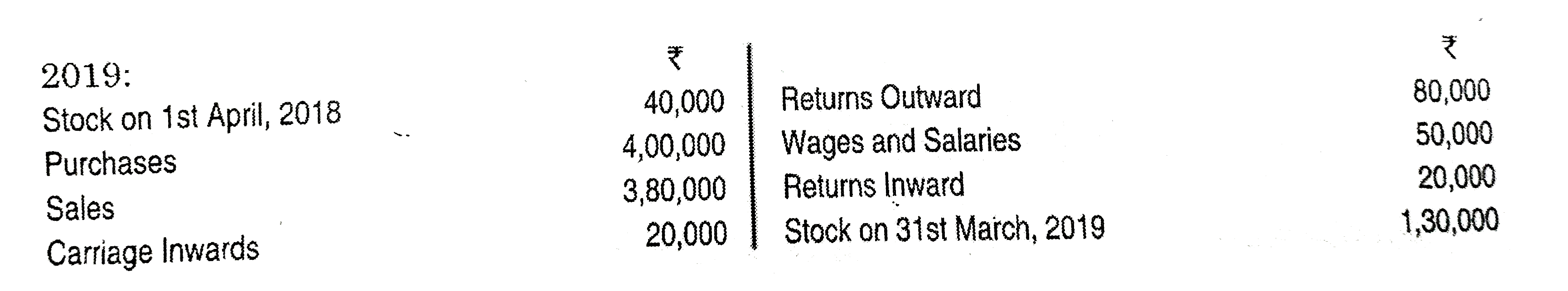

View SolutionFrom the following information, prepare Trading Account for the year ended 31st March, 2019:

Net Realisable Value (Market Value) of stock as on 31st March, 2019 was Rs 1,20,000

View SolutionFrom the following information, prepare Trading Account for the year ended 31st March, 2019:

Net Realisable Value (Market Value) of stock as on 31st March, 2019 was Rs 1,20,000

View SolutionFollowing is the Trial Balance of Virat as on 31st March 2019.

Additional Information: Closing Stock as on 31st March, 2019 was Rs 42,000.

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date by vertical form

View Solution