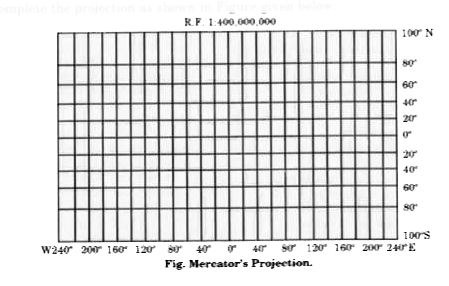

Draw a Mercator Projection for the world map when the R.F. is 1 : 400, 000, 000 and the interval between the latitude and longitude is 20∘.

Calculation

250,000,000400,000,000=0.625..

Radius of the reduced earth R is 0.625.. is

1 : 400, 000, 000

Length of the equator 2πR or

2×227×0.625

=3.93.. inches

Complete the projection as shown in Figure given below :

Interval along equator

3.93×20360∘=0.218..

Construction

(i) Draw a line of 3.93.. inches representing the equator as EQ.

(ii) Divide it into 24 equal parts. Determine the length of each division using the following formula: Length of the equator multiplied by interval divided by 360∘.

(iii) Calculate the distance for latitude with the help of the table given below :

Latitude Distance20∘218..×0.625=0.136inch40∘0.437..×0.625=0.273 inch

and so no.

Similar Questions

Knowledge Check

If total revenues is ₹ 1,00,000 when 20,000 units are sold, then average revenue is equal to :

A₹ 1,00,000B₹ 20,000C₹ 5D₹ 1,20,000For any four points O(0,0,0),P(1,2,1),Q(2,3,0),R(0,1,-1), the angle between the planes OPQ and PQR is

Acos−1(5√28)Bsin−1(5√28)Ccos−1(5√14)Dsin−1(5√14)

Prepare graticule for a Cylindrical Equal Area Projection for the world when R.F. is 1 : 150,000,000 and the interval is 15∘ apart.

View SolutionRam and mohan two partners drew for their parsonal use Rs. 1,20,000 and Rs. 80,000 interest is chargeable @6% p.a on the drawing what is the amount of interes chargeable from each partner ?

View SolutionOn March 31, 2017 after the close of accounts, the capitals of Mountain, Hill and Rock stood in the books of the firm at Rs. 4,00,000,Rs.3,00,000 and Rs. 2,00,000, respectively. Subsequently, it was discovered that the interest on capital @ 10% p.a. had been omitted. The profit for the year amounted to Rs. 1,50,000 and the partner’s drawings had been Mountain: Rs. 20,000, Hill Rs. 15,000 and Rock Rs. 10,000.

Calculate interest on capital.

View SolutionP , Q and R commenced business on 1st April , 2018 with capitals of : P - ₹ 2,00,000 , Q - ₹ 2,00,000 and R - ₹ 1,00,000 .

Profits are shared in the ratio of 4:3:3 . Capital carried interest @ 5% p.a. During the year 2018-19 , the firm suffered a loss of ₹ 1,50,000 before allowing interest on capital. Drawings of each partner during the year were ₹ 20,000.

On 31st March , 2019, the partners agreed to dissolve the firm as it was no longer profitable . The creditors on that date were ₹ 40,000 . The assets realised a net value of ₹ 3,20,000 and the expenses of realisation were ₹ 7,000 .

Prepare Realisation Account , Partner's Capital Accounts and Cash Account along with necessary working to close the books of the firm .

View SolutionOn 31st March , 2014 Balances in the capital Accounts Of Eleen Monu And Ahmad after making adjustments for profits and drawings were Rs. 1,60,000 Rs. 1,20,000 and Rs, 80,000 respectively . Subsequently ,it was Discovered that the interest on capital and drawings had been omitted .

(i) Profit for the year ended 31st March ,2014 was Rs. 40,000.

(ii) During the year Eleen Monu And Monu Each withdrew a total sum Of Rs . 24,000 in equal instalments in the begining of each month and ahmad withdrew a total sum of Rs. 48,000 in equal instalments at the end months .

(iii) the interest on drawings was to be chaged @ 5% p.a and interest on capital was to be allowed @ 10% p.a

(iv) THe profit- sharing ratio among the partners was 2:1:1.

Showinng your working notes clearly , pass the necessary rectifying entry .

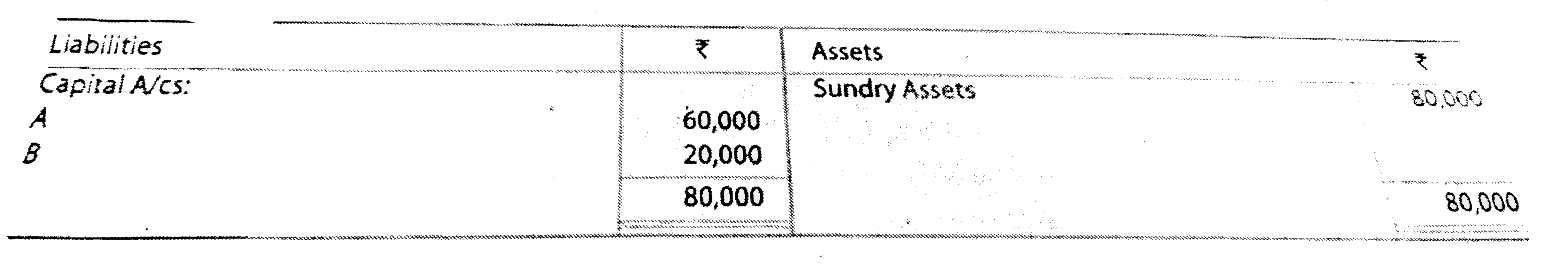

View SolutionA and B are partners in a firm sharing profits and losses in the ratio of 3: 2 Following was the Balance sheet of the firm as at 31 st Marach , 2018:

Profit Rs. 30,000 for the year ended 31st March ,2018 was divided between the PArtners without allowing interest on capitals @ 12% p.a and salary to A @ Rs. 1,000 per month ,During the year A withdrew Rs. 10,000 And B Rs. 20,000

Pass necessary adjustment journal entry and show your working Clearly .

View Solution