A shareholder holding 600 shares paid the amount of call @ Rs. 5 per share on 1st November 2013 whereas the call was due on 1st March 2014. Maximum interst on calls in advance will be :

Rs. 45

Rs. 120

Rs. 50

Rs. 60

The correct Answer is:B

Step by step video, text & image solution for A shareholder holding 600 shares paid the amount of call @ Rs. 5 per share on 1st November 2013 whereas the call was due on 1st March 2014. Maximum interst on calls in advance will be : by Accounts experts to help you in doubts & scoring excellent marks in Class 12 exams.

Updated on:21/07/2023Similar Questions

On 1st January, 2016 the first call of Rs. 3 per share became due on 1,00,000 equity shares issued by Kamini Ltd. Karan a holder of 500 shares did not pay the first call money. Arjun a shareholder holding 1,000 shares paid the second and final call of Rs. 5 per share along with the first call.

Pass the necessary Journal entry for the amount received by opening 'Calls-in-Arrears' and 'Calls-in-Advance' Account in the books of the company.

View SolutionOn 1-1-2016 the first call of Rs. 3 per share became due on 1,00,000 equity shares issued by Kamini Ltd., Karan, a holder of 500 shares, did not pay the first call money. Arjun, a shareholder holding 1,000 shares, paid the second and final call of Rs. 5 per share along with the first call. Pass necessary Journal entry for the amount received by opening 'Cals-in-arrear' and 'Calls-in-advance' account in the books of the compay.

View Solution

Knowledge Check

Metacaf Ltd. issued 50,000 shares of Rs. 100 each payable Rs. 20 on application (on 1st May 2012), Rs. 30 on allotment (on 1st January 2013) , Rs. 20 on first call (on 1st July 2013) and the balance on final call (on 1st February 2014). Shankar, a shareholder holding 5,000 shares did not pay the first call on the due date. The second call was made ans Shankar paid the first call amount along with the second call. All sums due were received. Total amount received on 1st February was :

ARs. 15,00,000BRs. 16,00,000CRs. 10,00,000DRs. 11,00,000Anothony Ltd. Issued 40,000 equity shares of Rs 20 each payable as Rs 5 on application, Rs 7 on allotment and Rs 8 on final call. Company received the due amount but one shareholder holding 250 shares did not pay the allotment money and another shareholder holding 150 shares failed to pay the amount due on final call. Total amount of Calls-in-Arrears is

ARs 1,750BRs 3,200CRs 6,000DRs 4,950

Sun Pharma Ltd. is registered with an authorized capital of Rs. 1,00,00,000 divided into 1,00,000 equity shares of Rs. 100 each. The company issued 50,000 shares at a premium of Rs. 40 per share. A shareholder holding 500 shares did not pay the final call of Rs. 20 share. A shareholder holding 500 shares did not pay the final call of Rs. 20 per share. His shares were forfeited. Present the 'Share Capital in the Balance Sheet of the Company as per Schedule III Part I of the Companies Act, 2013. Also prepare notes to accounts.

View SolutionSun Pharma Ltd. is registered with an authorised capital of Rs. 1,00,00,000 divided into 1,00,000 equity shares of Rs. 100 each. The company issued 50,000 shares at a premium of Rs. 40 per share. A shareholder holding 500 shares did not pay the final call of Rs. 20 per share.

His shares were forfeited.

Present the 'Share Capital' in the Balance Sheet of the Company as per Schedule III, Part I of the Companies Act, 2013. Also prepare Note to Accounts.

View SolutionOn 1st February 2016, Raj Ltd. received in advance the first call of Rs. 25 per share on 400 equity shares. The first casll was due on 31st March 2016. Journalise the above transactions.

View SolutionDuring the year 2014-15, ABC Ltd., issued 10,000 Equity Shares of Rs. 50 each at Rs. 55 per share, payable as follows :

On ApplicationRs. 15On AllotmentRs. 120 (including premium Rs. 5)On 1st and Final CallRs. 20

All the issued shares were subscribed for by the public. On shareholder holding 500 shares did not pay the amount due on allotment and his shares were immediately forfeited. Another shareholder holding 100 shares paid the amount of the 1st and Final Call with allotment. After the company had made the 1st and Final Call, 200 of the forfeited shares were reissued as fully called up at Rs. 45 per share. The share issue expenses were Rs. 7,000 which were written off at the end of he year. You are required to pass journal entries in the books of the company for the year ending 31st March, 2015. Also prepare the Opening Balance Sheet.

View SolutionOn 28-2-2016 the first call of Rs. 2 per share became due on 50,000 equity shares allotted by Kumar Ltd. Komal, a holder of 1,000 shares, did not pay the first cal money. Kovil, a holder of 750 shares, paid the second and final call of Rs. 4 pershare alongwith the first call. Pass necessary Journal entry for the amount received by opening call-in-arrear and calls-in-advance accounts in the books of the company.

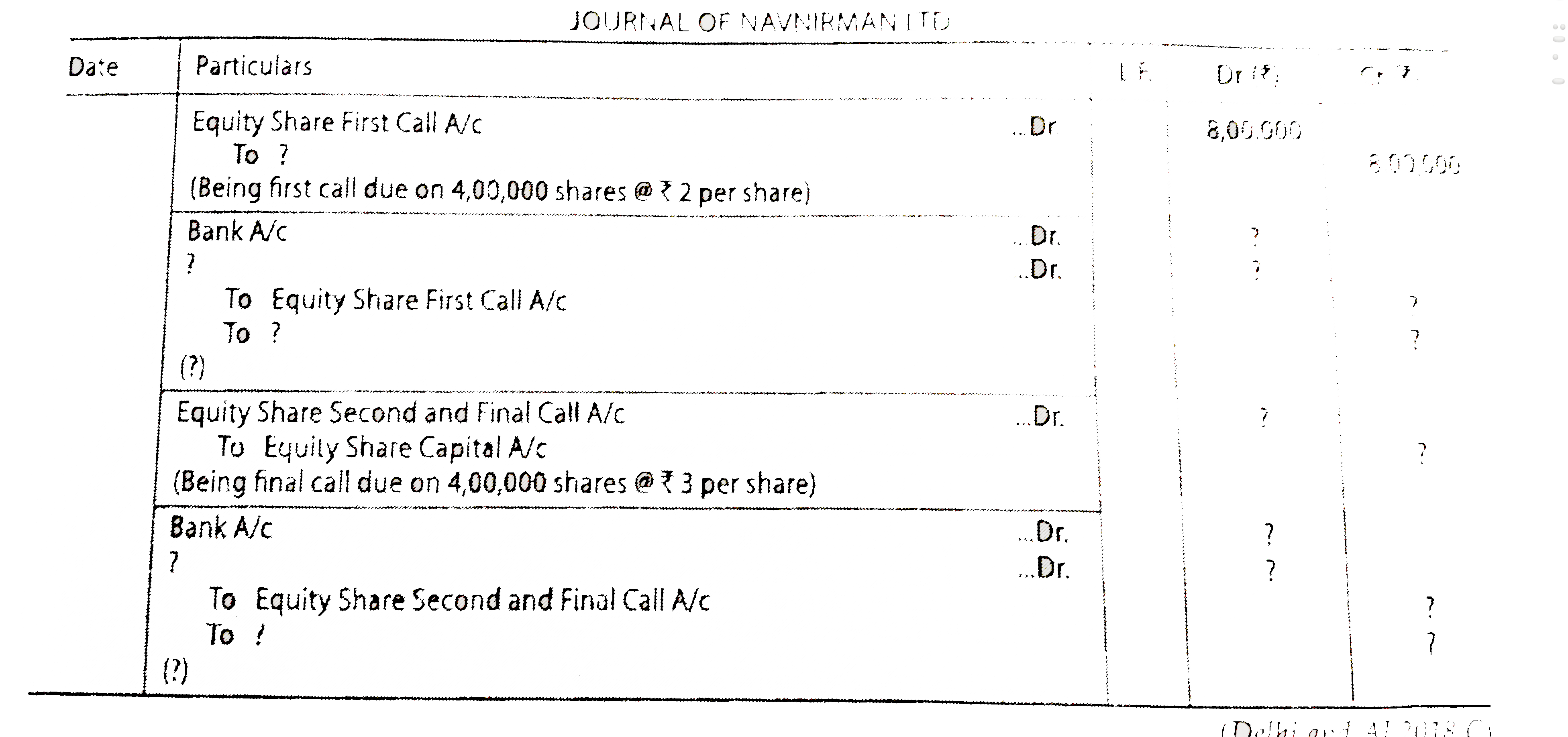

View SolutionNavnirman Ltd. issued 4,00,000 equity shares of Rs. 10 each at per. The amount per share was payable as follows:

Rs. 3 on application, Rs. 2 on allotment, Rs. 2 on first call and Rs. 3 on final call.

The issue was fully subscribed and the shares were allotted fully to all the applicants. All calls were made. Mahi, a shareholder holding 6,000 shares paid the final call money along with the first call. Shrey holding 700 shares did not pay the first call on the due date. Shrey paid the first call along with the final call. The accountant of the company had correctly passed the entries till receipt of allotment money. After that the following entries were left incomplete by him. Complete these entries.

View Solution