What was the profit of NHX group this year?

I. Last year the profit of NHX was Rs. 692 cr.

II. There are three units of the NHX group.

III. The average profit of the units this year was Rs. 253.7cr.

IV. NHX has witnessed a 10% growth in profit over that last year.

Either I and IV, or II and III sufficient

Either I and III, or II and IV sufficient

All the four are needed

Only I and IV sufficient

The correct Answer is:A

I give us last year.s profit. IV gives us the percentage I growth on it. The result is this year.s profit. Similarly III gives us the no. of units and III the average. Thus total = average × no of units.

Topper's Solved these Questions

Similar Questions

Calculate the value of firm's goodwill on the basis of one and half years' purchase of the average profit of the last three years. The profit for first year was Rs. 1,00,000, Profit for the second year was twice the profit of the first year and for the third year profit was one and half times of the profit of the second year.

View Solution

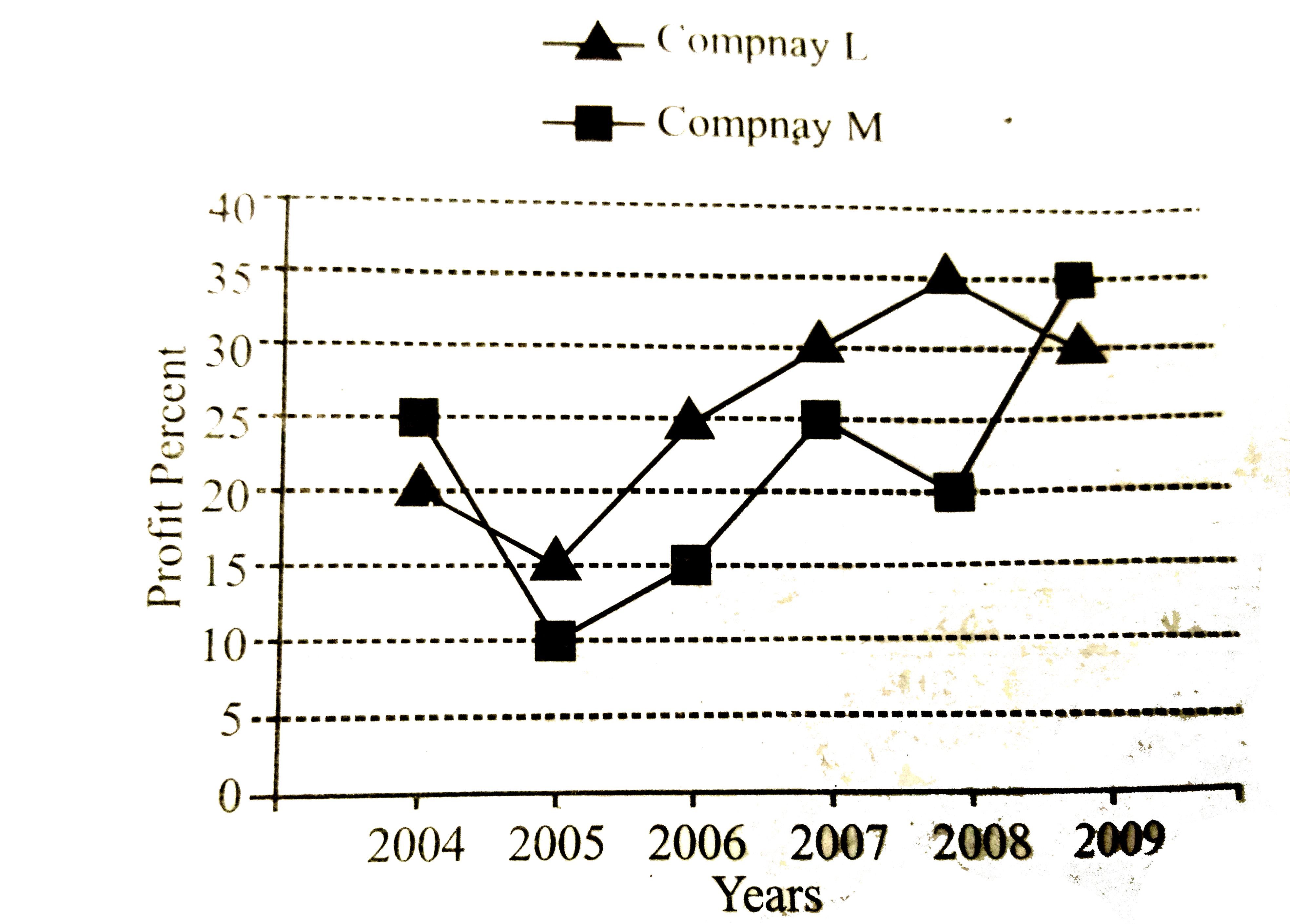

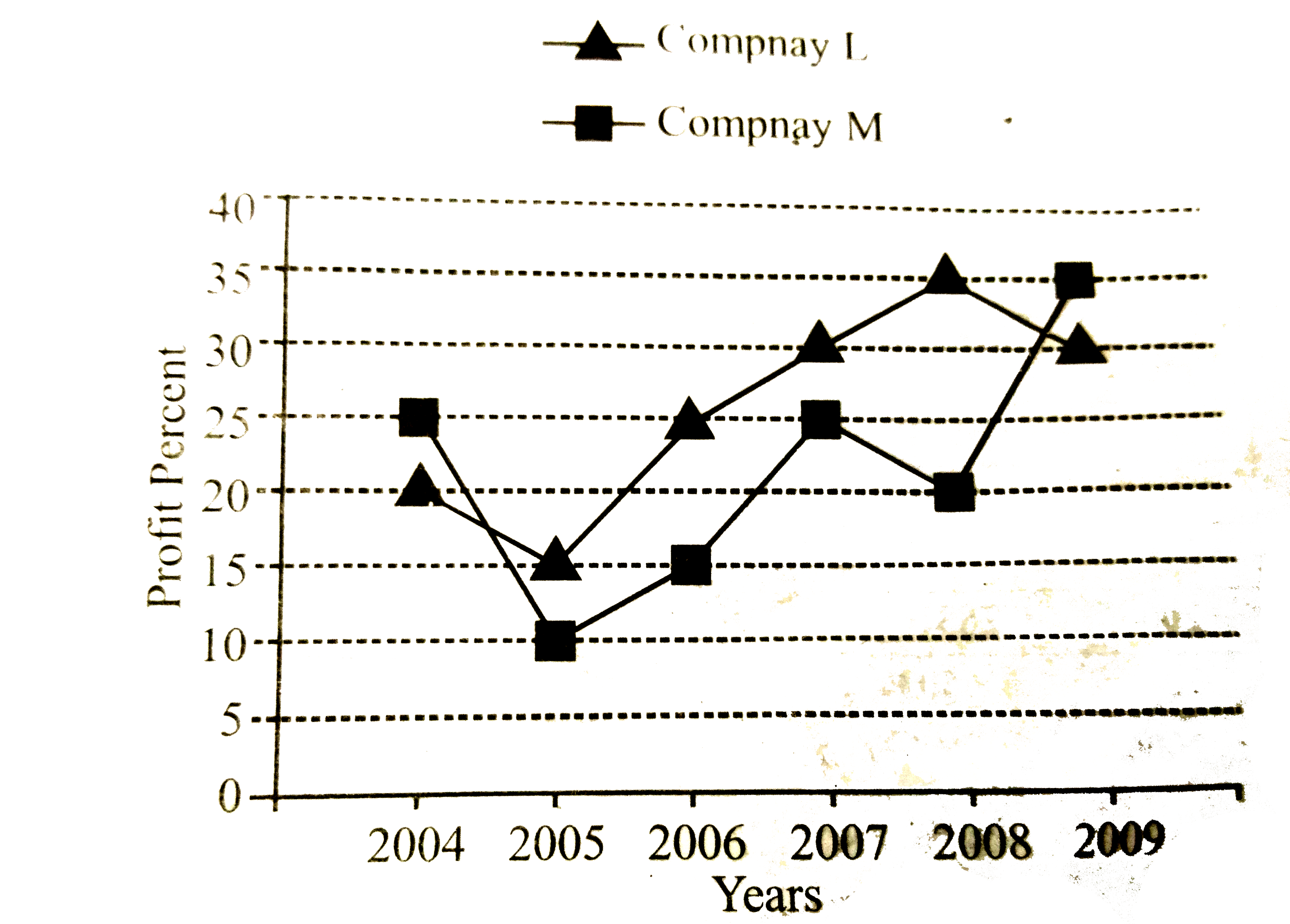

If the profit earned by Company L in the year 2008 was Rs. 3.63 lakhs, what was the amount of prorfit earned by it in the year 2006?

View Solution

Knowledge Check

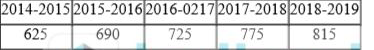

The following table shows the annual profit of a company (in Rs. lakh).

The period which has the maximum percentage increase in profit over the previous year is:A2018-2019B2015-2016C2017-2018D2016-2017

if the profit enarned by company L in the year 2005 was Rs. 1.84 lakh what was the profit earned by the company in the year 2006?

View SolutionVikas, Vishal and Vaibhav were partners in a firm sharing profits in the ratio of 2:2:1. The firm closes its books on 31st March every year. On 31st December, 2015 Vaibhav died. On that date his Capital Account showed a credit balance of Rs 3,80,000 and Goodwill of the firm was valued at Rs 1,20,000. There was a debit balance of Rs 50,000 in the Profit and Loss Account. Vaibhav's share of profit in the year of his death was to be calculated on the basis of the average profit of last five years. The average profit of last five years was Rs 75,000.

Pass necessary Journal entries in the books of the firm on Vaobhav's death.

View SolutionCalculate the value of goodwill at 2 year's purchase of the average profits of the last 3 years. The profit for the first year was Rs. 50,000, for second year twice the profit of first year and for the third year on and times the profit of the second year.

View SolutionThe Balance Sheet of Sudha, Rahim and Kartik who were sharing profit in the ratio of 3:3:4 as on 31st March, 2012 was as follows:

Sudha died on 30th June, 2012. The Partnership Deed provided for the following on the death of a partner:

(i) Goodwill of the firm be valued at two year's purchase of average profits for the last three years.

(ii) Sudha's share of profit or loss till the date of her death was to be calculated on the basis of sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1st April to 30th June, 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000.

(iii) Interst on capital was to be provided @6% p.a.

(iv) The average profits of the last three years were Rs 42,000.

Prepare Sudha's Capital Account to be rendered to her executor.

View SolutionX and Y are partners sharing profit and losses in the ratio of 2: 3 with capitals of Rs. 2,00,000 and Rs. 1,00,000 respectively pass the necessary Journal entery or enteries for the distributaion of profits / loss for the year for the year 31st March , 2019 in each of the of the alternative cases :

case If PArtnership Deed is silent as to the interest on capital and the profit for the year is Rs. 20,000.

Case 2. if partnership Deed provides for interest on capital @ 6% p.a and loss for the year is Rs. 15,000.

Case 3. if partnership Deed provides for interest for interest on capital @ 6% p.a and the profit for the the year is Rs. 21,000 .

Case 4. if partnership Deed provides for interest for interest on capital @ 6% p.a as a charge on on profit and the profit for the year is Rs. 20,000.

Case 5. if partnership Deed provides for interest on capital @ 6% p.a as a charge on profit and th profit for the year is Rs. 2,000

Case 6. if partners Deed provides for interest o capital @ 6% p.a as a charge on profit and th profit for the year is Rs. 18.000.

View SolutionThe following is the Balance Sheet of A,B and C as on 31st March, 2014:

'C' died on 30th June, 2014 Under the terms of Partnership Deed, the executors of the deceased partner were entitled to:

(i) Amount standing to the credit of Partner's Capital Account.

(ii) Interest on Capital @6% per annum.

(iii) Share of goodwill on the basis of twice the average of past three years profits.

(iv) Share of profit from the closing of last financial year to the date of death on the basis of last year's profit. The profits of the last three years were as follows:

The fiem closes its books on 31st March every year. The partners shared profits in the ratio of their capitals. Prepare C's Capital Account to be presented to her executors.

View Solutionthe firm of harry porter and ali who have been shaing profit in the ratio of 2:2:1 have existed for some years Ali wants that he should get equal share in the profits with Harry and porter and he further wishes that the change in the profit -sharing ratio should come into effect retrospectively for the three year Harry and porter have agreed ot it profit for the last three years ended 31st MArch , were :

year 2015−16216−172017−18profit (Rs.)2,00,0002,40,0002,90,000

show adjustment of profit by menas of an adjustment journal entry .

View Solution