Mr Pankaj took health insurance policy for his family and paid Rs 900 as SGST. The total Annual Premium paid by him for this policy rate of GST being 18% is

Rs 1,800

Rs 10,000

Rs 5,000

Rs 3,600

The correct Answer is:B

Topper's Solved these Questions

- SAMPLE PAPER 4Book:ICSEChapter:SAMPLE PAPER 4Exercise:Question (section C)

Explore 12 Videos

- SAMPLE PAPER 4Book:ICSEChapter:SAMPLE PAPER 4Exercise:Question (section C)

Explore 12 Videos

- SAMPLE PAPER 3Book:ICSEChapter:SAMPLE PAPER 3Exercise:Question (Section -C)

Explore 12 Videos

- SAMPLE PAPER 5 (MATHEMATICS)Book:ICSEChapter:SAMPLE PAPER 5 (MATHEMATICS)Exercise:SECTION C

Explore 8 Videos

Similar Questions

Mr. Pankaj took Health Insurance Policy for his family and paid Rs. 900 as SGST. Find the total annual premium including GST, paid by him for this policy rate of GST being 18%

View SolutionMadhav took a fire insurance policy of Rs.20 lakh for his factory at the annual premium of Rs. 24,000 . In order to avoid premium more than this amount , he did not discloe that highly explosive chemical are being manufactured in his factory. Due to a fire, his factory gets severely damaged. The insurance company refused to make the payment tor claim as it became aware about the highly explosive chemicals . Is Madhav entitled to received the claim ? Give reason in support of your answer.

View Solution

Knowledge Check

The annual income of Tabish (excluding HRA) is Rs 350000. He contributes Rs 5000 per month in his provident fund and pays an annual premium of Rs 8000 towards his life insurance policy. He also purchases NSC for Rs 10000. The income tax paid by Tabish in the last month of the year if his earlier deductions for the first 11 months for income tax were at the rate of Rs 1000 per month is

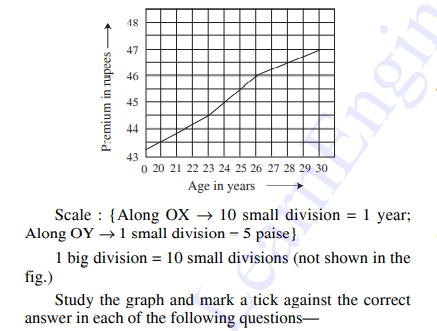

ARs 11BRs 110CRs 10980DRs 21865The following graph shows the annual premium of an insurance company. Charged for an insurance of Rs.1000 for different ages.

Two members of a family aged 20 years and 25 years are to be insured for Rs.10000 each. The total annual premium to be paid by them is -----ARs.836.75BRs.845.50CRs.870.60DRs.885A manufacturer buys raw material worth Rs. 12,000 for his articles @ 5% GST. He sell the finished product to a dealer at 50% profit. If the sale is intra-state and the rate of GST on the finished product is 18%, then answer the following:

If the dealer sell the finished product for 20,000 to a consumer with rate of GST 18%, then the amount paid by the consumer for this purchase is:ARs.25,400BRs.23,600CRs.26,300DRs.26,500

Rohit purchased a pair of shoes costing Rs 850. Calculate the total amount to be paid by him, if the rate of Tax is 6%.

View SolutionHarish took a fire insurance policy of Rs 20 Lakh for his factory at the annual premium of

Rs 24,000. In order to avoid higher premium, he did not disclose that a highly explosive chemical

is being used in his factory . Due to an accidental fire, his factory gate severely damaged . The

insurance company refused to pay the claim as it came to know about the fact. Is company

justified in doing so? Also state the principle of insurance involved here.

View SolutionThe marked price of an article = Rs. 9,000 and rate of GST on it =18%. A shopkeeper buys this article at a reduced price and sells it at its marked price. If the shopkeeper paid Rs. 162 as CGST to the government, find the amount (inclusive of GST) paid by the shopkeeper.

View SolutionMr Mahajan Purchased 100 shares each of FV Rs 100 when the MV was Rs 45 per share paying 2% brokerage if the rate of GST on brokerage is 18% find the amount he spent

View SolutionA manufacturer buys raw material worth Rs. 12,000 for his articles @ 5% GST. He sell the finished product to a dealer at 50% profit. If the sale is intra-state and the rate of GST on the finished product is 18%, then answer the following:

Amount paid by the dealer for the finished product is:

View Solution