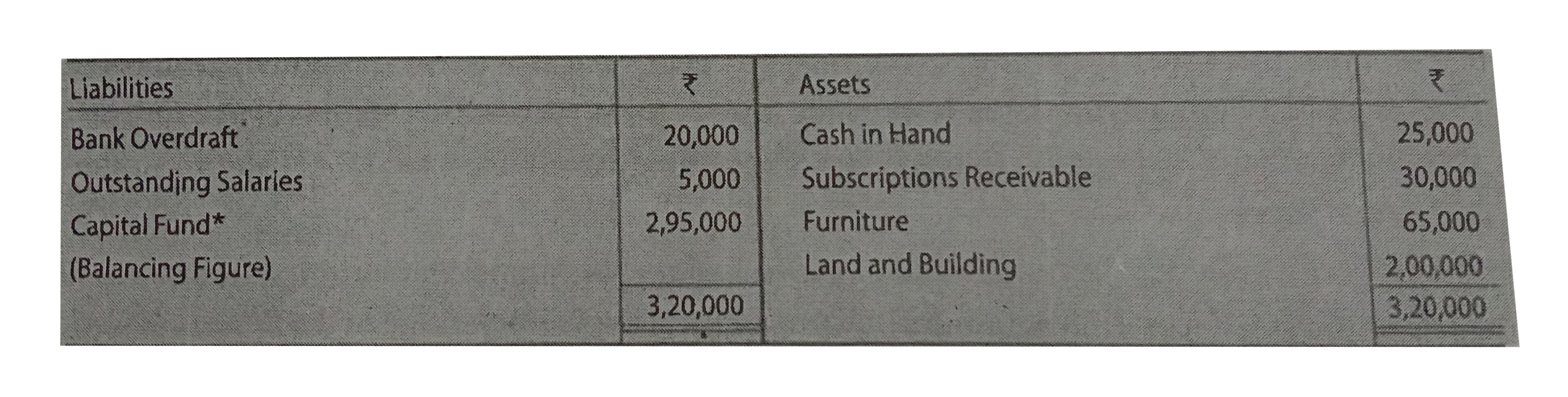

1st April 2019 Assets and Liability of the Young Club are as follows :

Assert :

RsLand and Building2,00,000Furniture65,000Cash in Hand25,000Subscriptions Receivable30,000

Liabilites :

Bank Overdraft20,000Outstanding Salaries5,000

Detemine Capital Fund as on 1st April 2019

The correct Answer is:N/a

Capital Fund =Total Assets -Total Liabilites =Rs 3,20,000 -Rs 25,000= Rs 2,95,000.

Similar Questions

From the following information calculate amount of subscriptions to be credited to the income and expenditure Account for the year ended 31st March 2019:

Rs1st April 2018Subscriptions in Arreats30,000Subscriptions Received in Advance30,00031st March 2019Subscriptions in Arrears25,000Subscriptions Received in Advance70,000

Subscription received during the year ended 31st March 2019-Rs 3,00,000.

Subscription still in arrears for the year 2017-18-Rs. 10,000.

View SolutionSrinvas did not maintain the Books of Accounts properly. From the following data, prepare final accounts for the year ended 31st March, 2019:

∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣Rs.Opening Stock1,00,000Creditors on April, 2018 40,000Cash in Hand on 31st March, 2018 60,000Furniture on 1st April, 2018 20,000Salaries 68,000Rent 24,000Other expenses 48,000Cash Sales 80,000Credit sales8,00,000∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣Rs.Cash received from debtors6,40,000Cash paid to creditors3,60,000Cash purchases 40,000Credit purchases6,00,000Closing stock 80,000Debtors on 31st March, 20192,40,000Debtos on 1st April, 20181,00,000Drawings1,00,000Discount allowed to debtors 20,000∣∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣ ∣∣

View Solution

Knowledge Check

X, Y and Z are partners sharing profits in the ratio of 5:3:2 . They decide to share future profits in the ratio of 2:2:5 with effect from 1st April , 2019 . They also decide to record the effect of following revaluations without affectig the book values of assets and liabilities , by passing adjustment entry :

Book Value (Rs.) Revised Value (Rs.)Land and Building 3,00,000 4,50,000Plant and Machinery 4,50,000 4,20,000Trade Creditors 1,50,000 1,35,000Outstanding Rent 1,35,000 1,80,000

The necessery adjustment entry will be :ADr. Z's Capital A/c and Cr,X's Capital A/c by Rs. 27,000.BDr. X's Capital A/c and Cr,Z's Capital A/c by Rs. 27,000.CDr. Y's Capital A/c and Cr,X's Capital A/c by Rs. 27,000.DDr. X's Capital A/c and Cr,'s Capital A/c by Rs. 27,000.

Prepare Trading Account for the year ended 31st March, 2019 from the following balances:

RsRsStock(1st April, 2018)1,00,000Purchases10,00,000Wages50,000Carriage Inwards10,000Sales15,50,000Returns Inward50,000Returns Outward80,000Freight Inwards5,000

Closing Stock as on 31st March, 2019 was valued at Rs 2,00,000.

Also, pass the Closing Entries.

View SolutionPrepare Trading Account for the year ended 31st March, 2019 from the following balances:

RsRsStock(1st April, 2018)1,00,000Purchases10,00,000Wages50,000Carriage Inwards10,000Sales15,50,000Returns Inward50,000Returns Outward80,000Freight Inwards5,000

Closing Stock as on 31st March, 2019 was valued at Rs 2,00,000.

Also, pass the Closing Entries.

View SolutionPass the Opening Entry on 1st April, 2019 on the basis of the following information taken from the books of Raman. Also , post the opening entry.

{:(,₹),("Cash in Hand ","20,000"),("Sundry Debtor","60,000"),("Stock of Goods","40,000"),("Input IGST Account","15,000"),("Input SGST Account","5,000"),("Plant","50,000"),("Land and Building","1,00,000"),("Sundry Creditors","1,00,000"):}

View SolutionGopi Chand maintains his books of account on Single Entry System. Calculate his profit on 31st March, 2019 from the following information:

Liabilities and Assets1st April, 2018 (Rs.)31st March, 2019 (Rs.)Cash in Hand1,500500Bank Balance4,5003,500Fumiture2,0002,000Stock1,0003,000Creditors4,0003,000Debtors3,0004,000

During the year his drawings were Rs. 1,000 and additional capital invested Rs. 2,000.

View SolutionFrom the following items of Receipts and Payments Account of Young Club prepare Income and Expenditure Account for the year endeed 31st March 2019 :

RsSalaries paid5,00,000Electrictiy Expenses50,000Printing and Stationery (including Rs 5,000 for the previous year)35,000Subscriptions revious year) Rs 50,000 for the previous year)4,00,000Net proceeds of Refreshment Room4,50,000Miscellaneous expenses1,16,000Interest paid on Loan of half year12,000Rent and Rates (including Rs 10,000 prepaid)75,000Lockers rent received45,000

Additional Information : Subsscriptions in arrears on 31st March 2019 were Rs 80,000 and half year's interest on loan was also outstanding

View SolutionFrom the following, calculate:

(a) Current Ratio, and

(b) working Capital Turnover Ratio.

RsRevenue from Operations1,50,000Shareholders' Funds60,000Non-current Assets50,000∣∣ ∣ ∣ ∣∣RsTotal Assets1,00,000Non-current Liabilities20,000

View SolutionFrom the following particulars, calculate the value of Land to be shown in the Balance Sheet as on 31st March, 2019.

Rs.Land as on 1st April, 201810,00,000Purchase of land during 2018-201930,00,000Sale of land during 2018-1915,00,000 Rs.Land as on 1st April, 201810,00,000Purchase of land during 2018-1930,00,000Sale of land during 2018-1915,00,000 Rs.Land as on 1st April, 201810,00,000Purchase of land during 2018-1930,00,000Sale of land during 2018-1915,00,000{:(," Rs."),("Land as on 1st April, 2018","10,00,000"),("Purchase of land during 2018-19","30,00,000"),("Sale of land during 2018-19","15,00,000"):}{:(," Rs."),("Land as on 1st April, 2018","10,00,000"),("Purchase of land during 2018-19","30,00,000"),("Sale of land during 2018-19","15,00,000"):}

View Solution