Mehtab purchased a machine on 1st October, 2018 for rupee 5,00,000 plus CGST and SGST @ 6% each. He paid rupee 20,000 for loading/unloading and carriage expenses to bring the machine to factory. He further incurred rupee 25,000 for installing the machine. Determine:

(a) How much amount did Mehtab pay to the vendor of machine?

(b) How much amount will be debited to Machinery Account?

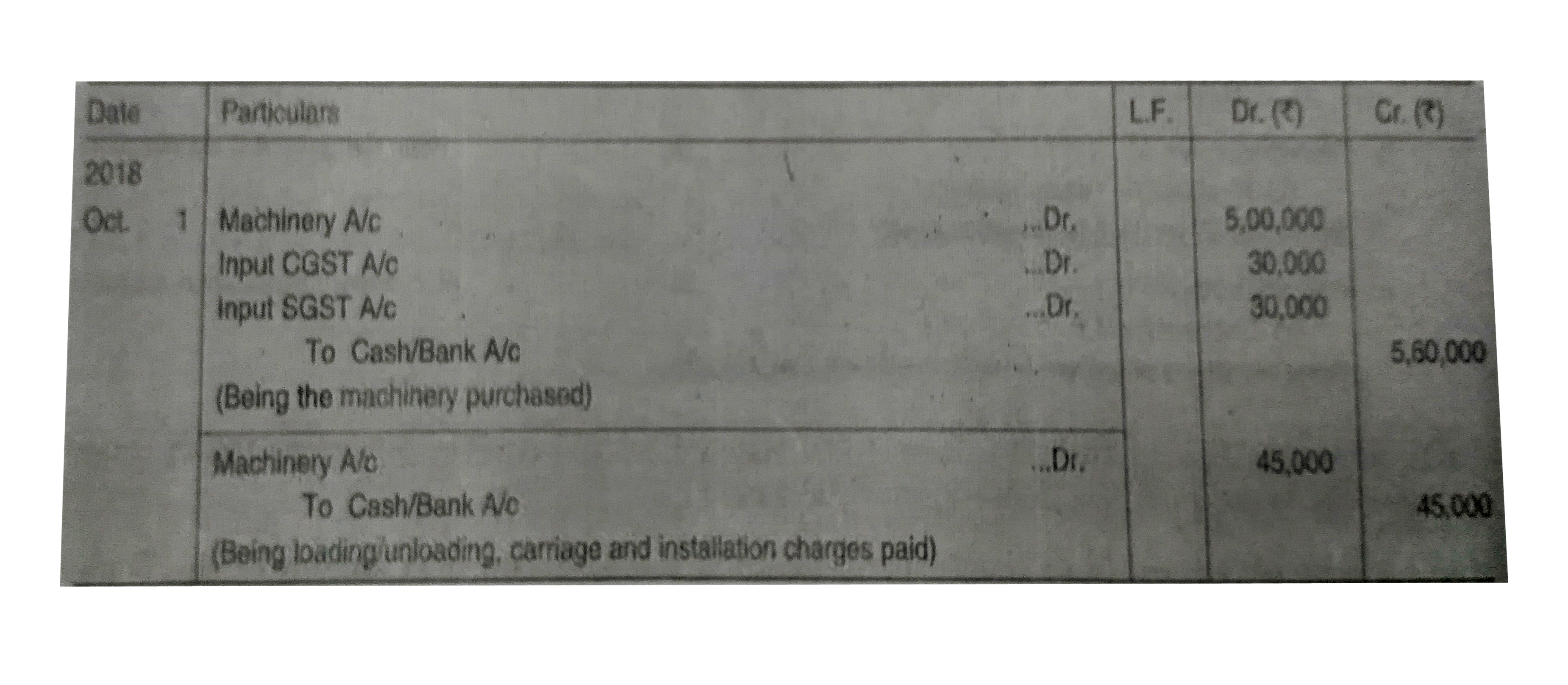

Pass the Journal entries giving effect to the transaction.

{:((a)"Amount Paid to Vendor of Machine": , ₹), ("Value (Cost) of Machine","5,00,000"),( Add. CGST " @ " 6%,"30,000"),(SGST " @ "6%,"30,000"):}

(b)Amount to be Debited to Machinergy Account:₹Cost of Machine (Without CGST and SGST)5,00,000Loading//Unloading and Carriage Expenses20,000Installation Charges25,000

Similar Questions

Which account should be debited, if wages are paid for installation of a machine ?

View SolutionModern Ltd. Purchased a machinery on 1st August, 2016 for Rs 60,000. On 1st October, 2017, it purchased another machine for Rs 20,000 plus CGST and SGST @ 6% each. On 30th June, 2018, it sold the first machine purchased in 2016 for Rs 38,500 charging IGST @ 12%. Depreciation is provided @ 20% p.a. on the original cost each year. Account are closed on 31st March every year. Prepare the Machinery Account for these years.

View Solution

Knowledge Check

Rs. 2,000 paid as wages for installing a machine should be debited to

AWages AccountBMachinery AccountCCapital AccountDAny of theseRs. 2,000 paid as wages for installing a machine should be debited to

AWages Account.BMachinery Account.CCapital Account.DNone of these.P, a partner , is to bear all expenses of realisation for which he is to be paid Rs, 2,000 . P had to pay realisation expenses of Rs, 2,500 .How much amount will be debited to Realisation Account ?

ARs, 500BRs, 2,500CRs,4,500DRs,2,000

Ram Bros. purchased a machine on 1st October, 2016 at a cost of rupee 1,50,000 and spent rupee 10,000 on its installation. The realisable value or scrap vlaue at the end of its estimated useful life of 10 years is estimated at rupee 10,000. The books are colsed on 31st March every year. Show the Machinery Account and Depreciation Account for three years.

View SolutionRoshan purchased form Prem 500 items @ Rs.100 each at 20% Trade Discount plus CGST and SGST @6% each. He is further given 2% Cash Discount as he made payment for the purchases immediately. Determine the amount that Roshan will debit to Purchases Account.

View SolutionR. Kanitkar had purchased a machinery for rupee 1,00,000 on 1st October, 2016. Another machine was purchased for rupee 60,000 plus IGST @ 12% by cheque on 1st April, 2018. Depreciation is charged @ 10% p.a. by the Straight Line Method. Accounts are closed every year on 31 st March. You are required to pass necessary Journal entries for the years ended 31st March, 2017, 2018, and 2019 and show Machinery Account and Machinery in the Balance Sheet:

(i) When Provision for Depreciation Account is not maintained.

(ii) When Provision for Depreciation Account is maintained.

View SolutionShekher bought a washing machine having printed price Rupees 25,000.28% GST was charged. Find the amount paid by Shekhar for the washing machine.

View SolutionP, a partner, is to bear realisation expenses for which he is to paid Rs 2,00. p had to pay realisation expenses of Rs 2,500. How much amount will be debited to Realisation Account ?

View Solution