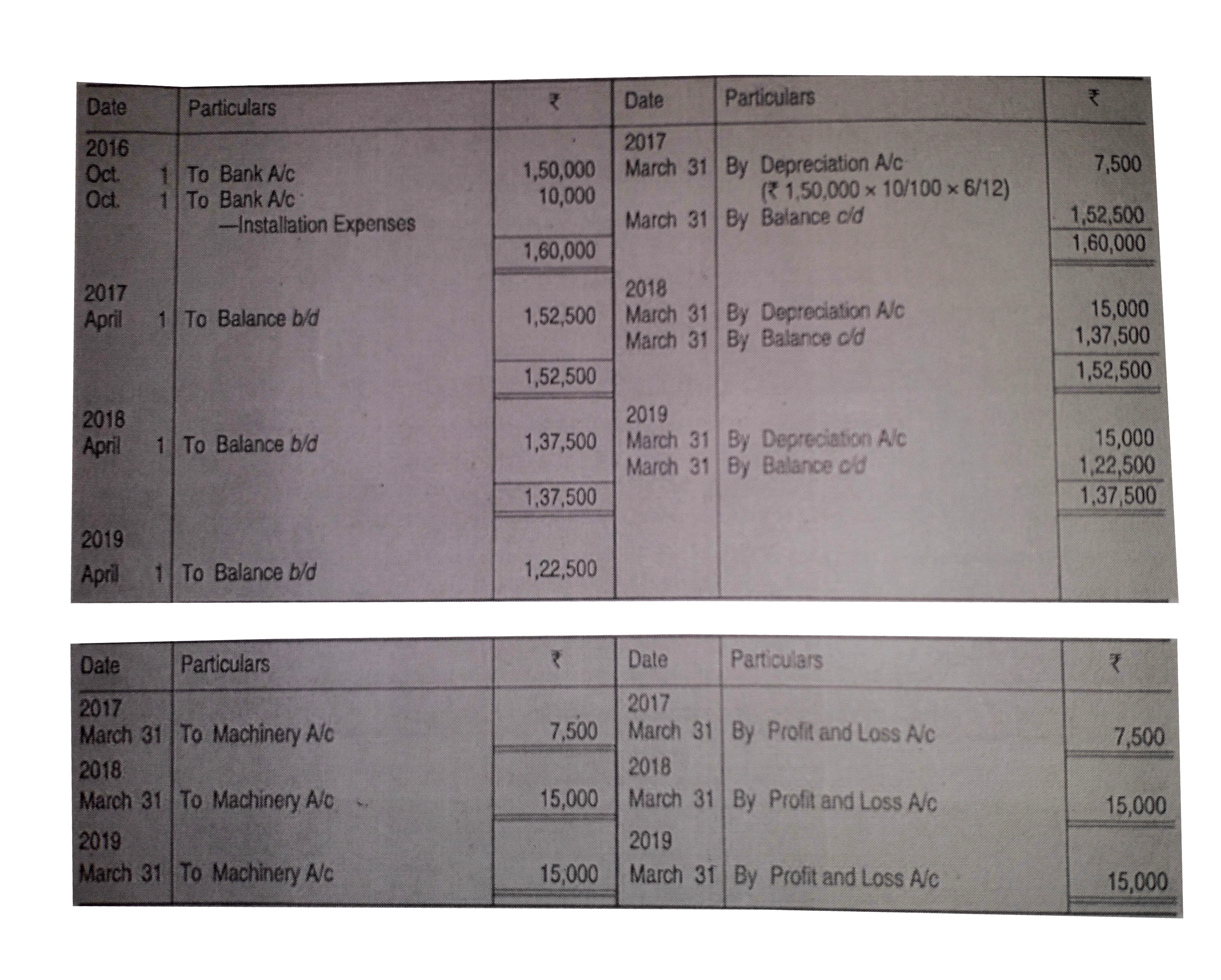

Ram Bros. purchased a machine on 1st October, 2016 at a cost of rupee 1,50,000 and spent rupee 10,000 on its installation. The realisable value or scrap vlaue at the end of its estimated useful life of 10 years is estimated at rupee 10,000. The books are colsed on 31st March every year. Show the Machinery Account and Depreciation Account for three years.

Solution : Annual Depreciation =Rs1,50,000+Rs10,000−Rs10,00010=Rs15,000.

First year (year ended 31st March, 2017) Depreciation will be charged for 6 months since the machinery was purchased on 1st October, 2016.

Similar Questions

M/s Singhania and Bros. purchased a plant of Rs. 5,00,000 on April o1.2017. and spent Rs.50,000 for its installation. The salvage value of the after its useful life of 10 years is estimated to be Rs. 10,000. Record journal entries for the year 2016-17 and draw up Plant account and Depreication Account for first three given theat the depreciation is charged using straight line method if :

(i) The books of account close on March 31 every year, and

(ii) The firm charges depreciation to the asset account

View SolutionOn July 01, 2010, Ashok Ltd. Purchased a Machine for Rs. 1,80,000 and spent Rs. 12,000 on its installation. At the time of purchase it was estimated that the effective commercial life of the machine will be 12 years and after 12 years its salvage value will be Rs. 12,000

Prepare machine account and depreciation Account in the books of Ashok Ltd. For first three years, if depreciation is written off according to straight line method. The account are closed on December 31st, every year

View SolutionA firm bought a machinery for rupee 7,40,000 on 1st April, 2018 and rupee 60,000 is spent on its installation. Its useful life is estimated to be of 5 years. Its estimated realisable or scrap value at the end of the period was estimated at rupee 40,000. Find out the amount of annual Depreciation and rate of Depreciation.

View SolutionA Plant was purchased on 1st July, 2015 at a cost of Rs. 3,00,000 and Rs. 50,00 were spent on its installation. The depreciation is written off at 15% p.a. on the straight line method. The plant was sold for Rs. 1,50,000 on October Rs. 4,00,000. including purchasing value. The accounts are closed on December 31 every year.

Show the machinery account and provision for depreciation account for 3 years.

View SolutionOn 1st April, 2016 a firm purchased machinery for Rs 3,00,000. On 1st October, 2016, additional machinery costing Rs 1,50,000 was purchased on 1st October, 2017, the machinery purchased on 1st April, 2016 having become obsolete, was sold for Rs 1,35,000. On 1st October, 2018, new machinery was purchased for Rs 3,75,000 while the machinery purchased on 1st October, 2016 was sold for Rs 1,27,500 on the same day. The firm provides depreciation on its machinery @ 10% per annum on original cost on 31st March every year.

Show Machinery Account, Provision for Depreciation Account and Depreciation Account for the period of three accounting years ending 31st March, 2019.

View SolutionOn 1st October, 2015, Ram & Bros. purchased a second-hand machine for Rs 1,80,000 and spent Rs 20,000 on its repair and installation. On 30th September, 2018, the machinery was sold for Rs 1,40,000 and an amount of Rs 4,000 was paid as dismantling charges. The books are closed on 31st March every year and depreciation is charged @ 10% p.a. on the written down value. Show Machinery Account from the date purchase of machinery till the date of sale of machinery.

View SolutionM/s Mehra and Sons acquired a machine for Rs. 1,80,000 on October 01,2016 and spent Rs. 20,000 for its installation. The firm writes -off depreciation at the rate of 10% on original Account and Depreciation Account ofr first three years given that :

(i) The book of accounts closes on March 31 every year, and

(ii) The firm charges depreciation to aseset account.

View SolutionGanga Ltd. purchased a machinery on January 01, 2014 for Rs. 5,50,000 and spent Rs. 50,000 on its installation. On September 01, 2014 it purchased another machine for Rs 3,70,000.On May 01,2015 it purchased another machine for Rs. 8,40,000 ( including installation expenses).

(a) Machinery account and depreciation account for the years 2014, 2015, 2016 and 2017.

(b) If depreciation is accumulated in provision for Depreciation account then prepare machine account and provision for depreciation account for the years 2014, 2015, 2016 and 2017.

View SolutionBerlia Ltd. Purchased a second hand machine for Rs. 56,000 on July 01, 2015 and spent Rs. 24, 000 on its repair and installatio and Rs. 5,000 for its carriage. On September 01, 2016, it purchased another machine Rs. 2,50,000 and spent Rs. 10,000 on its installation.

(a) Depreciation is provided on machinery @10% p.a on original cost method annually on December 31. Prepare machinery account and depreciation account from the year 2015 to 2018.

(b) Prepare machinery account and depreciation account from the year 2011 to 2018, if depreciation is provided on machinery @10% p.a. on written down value method annually on December 31.

View SolutionOn 1st April, 2016, X Ltd. Purchased a machine costing Rs 4,00,000 and spent Rs 50,000 on its installation. The estimated life of the machinery is 10 years, after which its residual value will be Rs 50,000 only. Find the amount of annual depreciation according to the Fixed Instalment Method and prepare Machinery Account for the first three years. The books are closed on 31st March every year.

View Solution