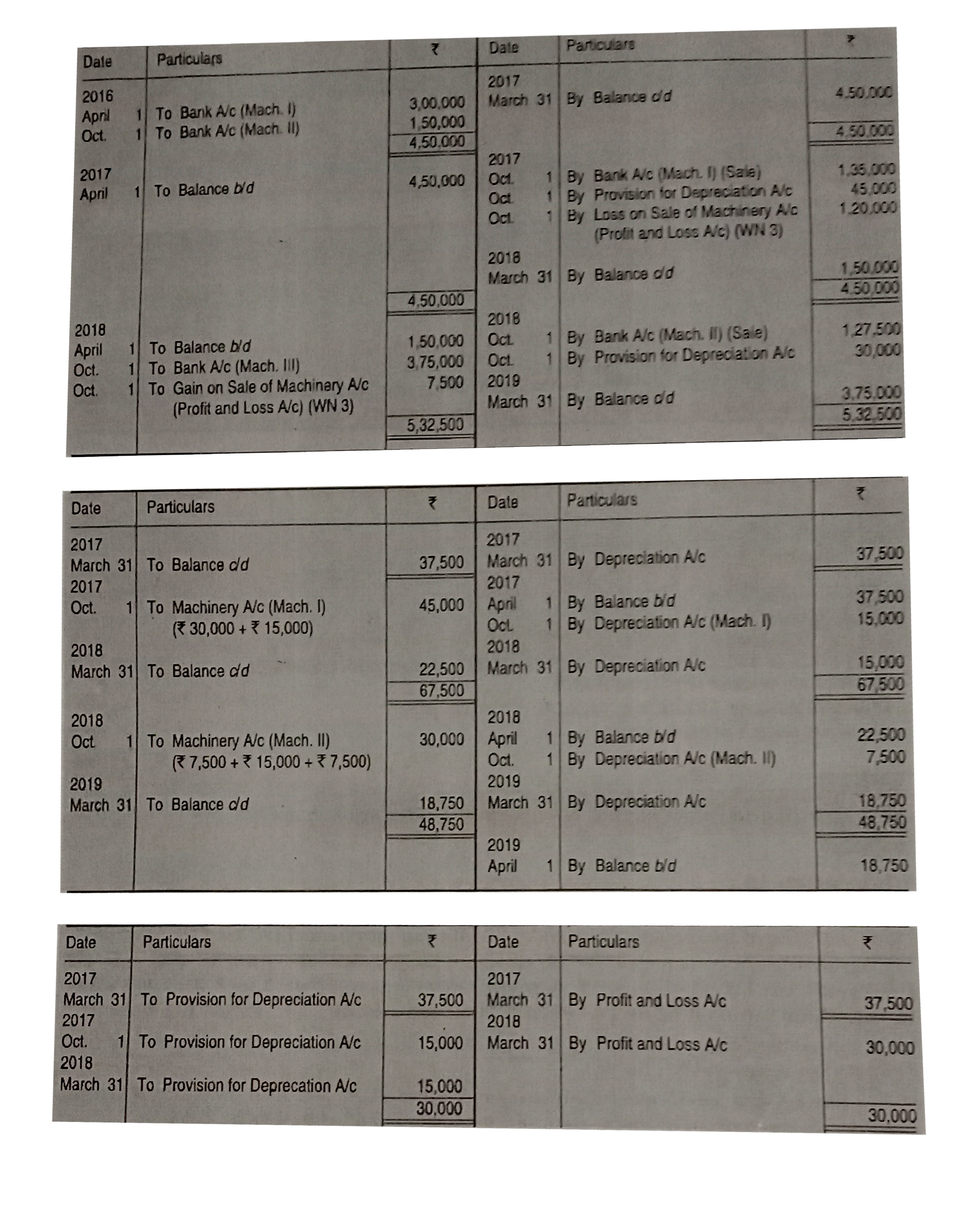

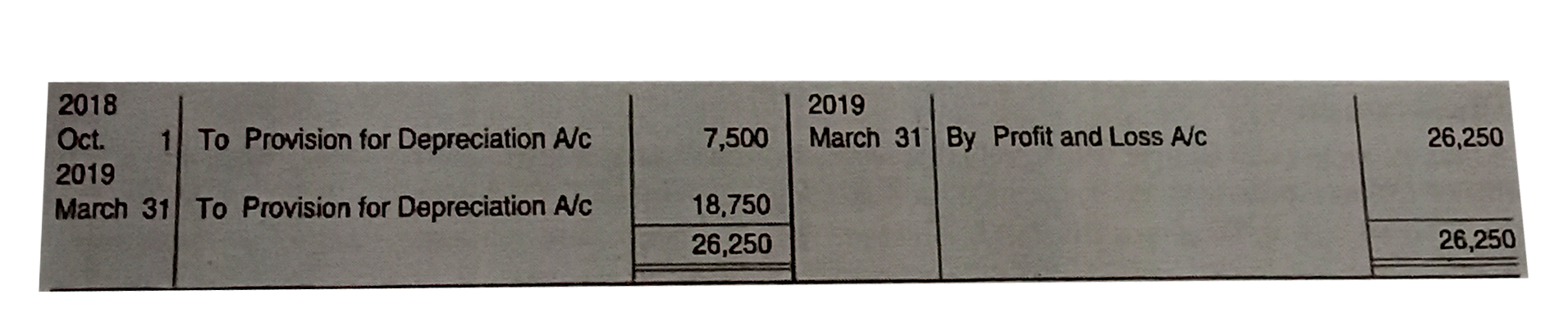

On 1st April, 2016 a firm purchased machinery for Rs 3,00,000. On 1st October, 2016, additional machinery costing Rs 1,50,000 was purchased on 1st October, 2017, the machinery purchased on 1st April, 2016 having become obsolete, was sold for Rs 1,35,000. On 1st October, 2018, new machinery was purchased for Rs 3,75,000 while the machinery purchased on 1st October, 2016 was sold for Rs 1,27,500 on the same day. The firm provides depreciation on its machinery @ 10% per annum on original cost on 31st March every year.

Show Machinery Account, Provision for Depreciation Account and Depreciation Account for the period of three accounting years ending 31st March, 2019.

Similar Questions

On 1st April, 2015, A Ltd. Purchased a machine for Rs 2,40,000 and spent Rs 10,000 on its erection. On 1st October, 2015, an additional machinery costing Rs 1,00,000 was purchased. On 1st October, 2017, the machine purchased on 1st April, 2015was sold for Rs 1,43,000 and on the same date, a new machine was purchased at a cost of Rs 2,00,000.

Show the Machinery Account for the first four financial years after charging Depreciation at 5% p.a. by the Straight Line Method.

View SolutionOn 1st April, 2015, machinery was purchased for Rs 80,000. On 1st April, 2016 new machinery costing Rs 40,000 was purchased. On 30th June, 2017, machinery purchased on 1st April, 2015 was sold for Rs 65,000 and on 30th September, 2017 machinery purchased on 1st April, 2016 was sold for Rs 26,750. On 1st October, 2017 another machinery for Rs 50,000 was acquired. On 1st October, 2018 new machinery costing Rs 40,000 was purchased. Depreciation was charged @ 10% p.a. on the Diminishing Balance Method. Prepare Machinery Account for your years ending on 31st March, 2019.

View SolutionOn 1st April, 2016, a firm purchased a machinery for Rs 12,00,000. On 1st October, 2018, a part of the machinery purchased on 1st April, 2016 for Rs 80,000 was sold for Rs 45,000 and a new machinery at a cost Rs 1,58,000 was purchased and installed on the same date. The Company has adopted the method of providing depreciation @ 10% p.a. on the diminishing balance of the machinery.

Show the necessary Ledger accounts assuming that:

(i) 'Provision for Depreciation Account' is not maintained,

(ii) 'Provision for Depreciation Account' is maintained.

View SolutionA company purchased machinery for Rs 2,00,000 on 1st April, 2016. The machinery is depreciated @ 10% p.a. of cost. On 1st October, 2018, the machinery was sold for Rs 1,20,000. Draw the Machinery Account for the years ended 31st March 2017, 2018 and 2019.

View SolutionA company purchased a machinery for Rs 50,000 on 1st October, 2016. Another machinery costing Rs 10,000 was purchased on 1st December, 2017. On 31st March, 2019, the machinery purchased in 2016 was sold at a loss of Rs 5,000. The company charges depereciation @ 15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year. Prepare the Machinery Account for 3 years.

View SolutionDowra Bros. purchased on 1st April, 2015 a second-hand machinery for Rs 36,000 and spent Rs 4,000 on its installation.

On 1st October in the same year, another machinery costing Rs 20,000 was purchased. On 1st October, 2017, machinery bought on 1st April , 2015 was sold off for Rs 12,000 and a fresh machine was purchased for Rs 64,000 on the same date. Depreciation is provided annually on 31st March @ 10% p.a. on the Written Down Value Method. Show Machinery Account for 3 years ending 31st March, 2018.

View SolutionOn 1st April, 2016, a machinery was purchased for Rs 20,000. On 1st October, 2017 another machine was purchased for Rs 10,000 and on 1st April, 2018, one more machine was purchased for Rs 5,000. The firm depreciates its machinery @ 10% p.a. on the Diminishing Balance Method. What is the amount of Depreciation for the years ended 31st March, 2017, 2018 and 2019? What will be the balance in Machinery Account as on 31st March, 2019?

View SolutionABC Ltd. Purchased a plant on 1st April, 2017 for Rs 1,00,000. On 1st October, 2017, an additional plant was purchased costing Rs 50,000 plus CGST and SGST @ 6% each. On 1st October, 2018 the plant purchased on 1st April, 2017, having become obsolete, was sold for Rs 40,000, charging CGST and SGST @ 6% each. Depreciation is provided @ 10% p.a. on cost on 31st March every year. Show the Machinery, Machinery Disposal and Provision for Depreciation Accounts for the years ended 31st March, 2018 and 2019. Also show CGST and SGST Accounts for the two years.

View SolutionOn 1st April 2018, X's Capital was 2,00,000. On 1st October 2018, he introduces additional capital of Rs.1,00,000. Interest on capital @6% p.a. on 31st March, 2019 will be :

View SolutionBabu purchased on 1st April, 2017, a machine for Rs 6,000. On 1st October, 2017, he also purchased another machine for Rs 5,000. On 1st October, 2018, he sold the machine purchased on 1st April, 2017 for Rs 4,000.

It was decided that Depreciation @ 10% p.a. was to be written off every year under Diminishing Balance Method.

Assuming the accounts were closed on 31st March every year, show the Machinery Account for the years ended 31st March, 2018 and 2019.

View Solution