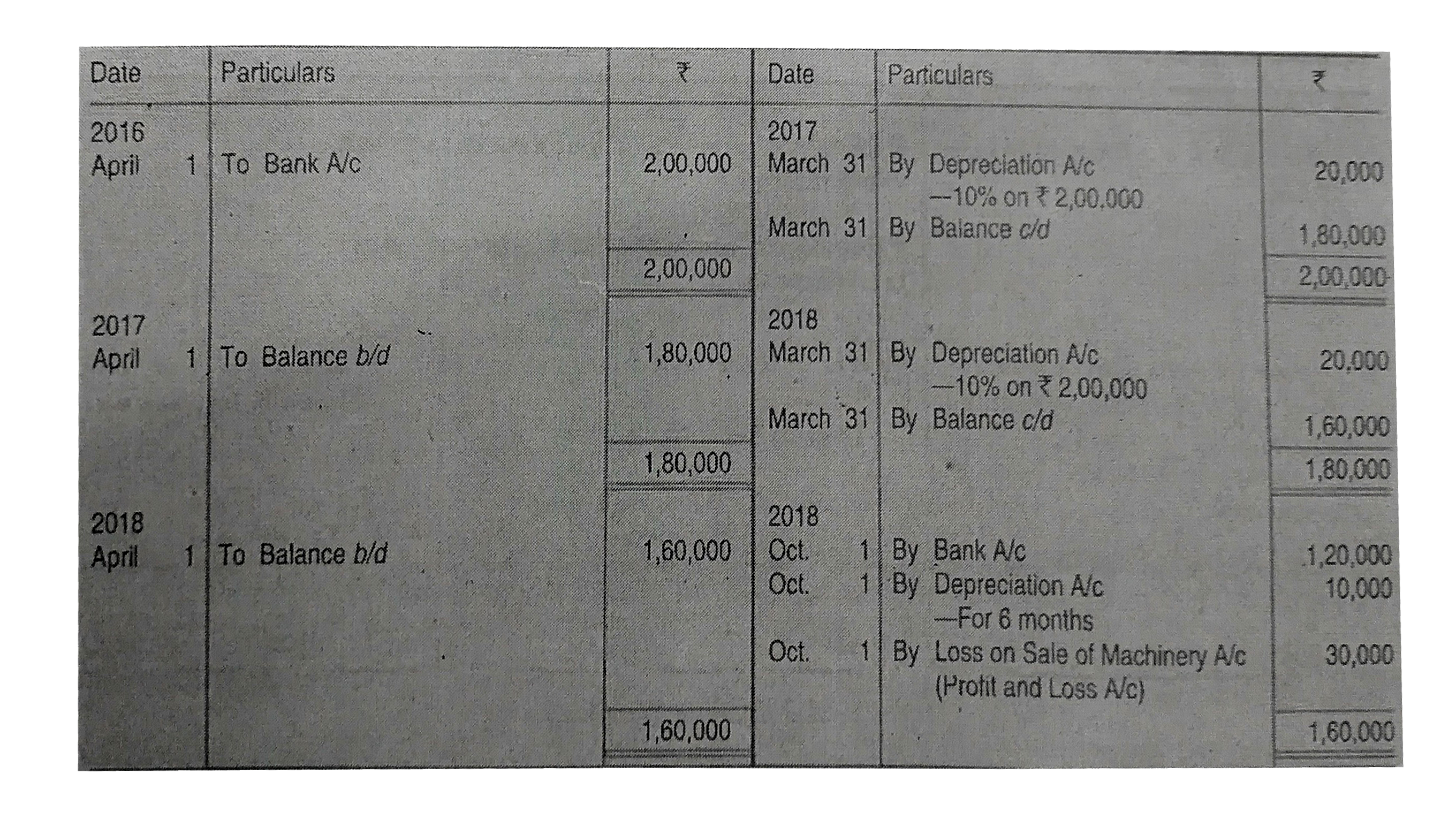

A company purchased machinery for Rs 2,00,000 on 1st April, 2016. The machinery is depreciated @ 10% p.a. of cost. On 1st October, 2018, the machinery was sold for Rs 1,20,000. Draw the Machinery Account for the years ended 31st March 2017, 2018 and 2019.

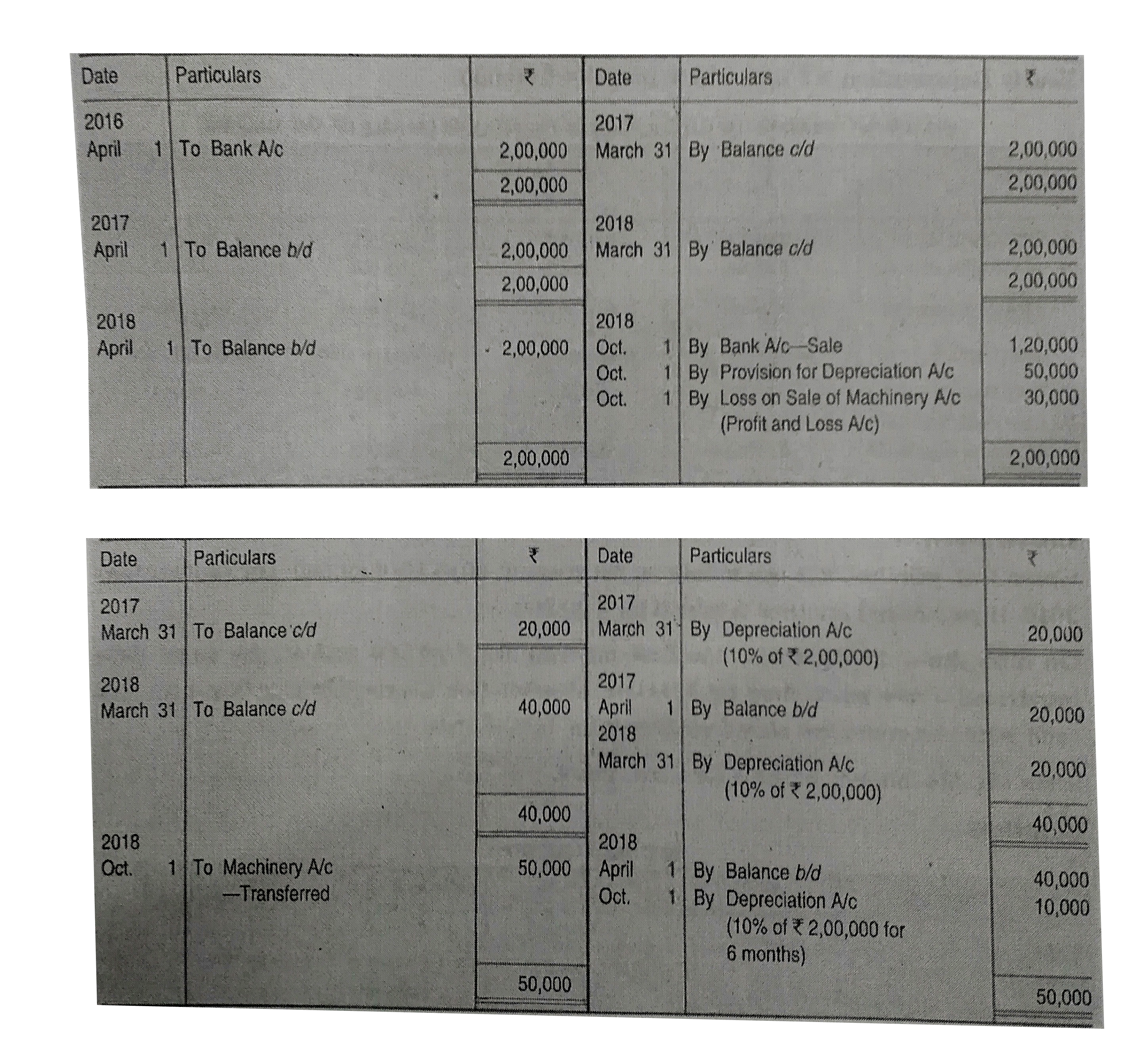

If Provision for Depreciation Account is maintained, credit balance of the Provision for Depreciation Account is transferred to the credit side of the Asset Account. The balance in the Asset Account will show gain (profit) or loss on sale of the asset, it is transferred to the Profit and Loss Account. In this case, the solution to the pervious illustration will be as follows:

Similar Questions

A firm purchased an old truck for Rs 2,00,000 on 1st April, 2016. It charged depreciation @ 20% per annum following Written Down Value Method. The truck was sold on 1st October, 2017 for Rs 1,60,000. Prepare Truck Account for the years ending 31st March, 2017 and 2018.

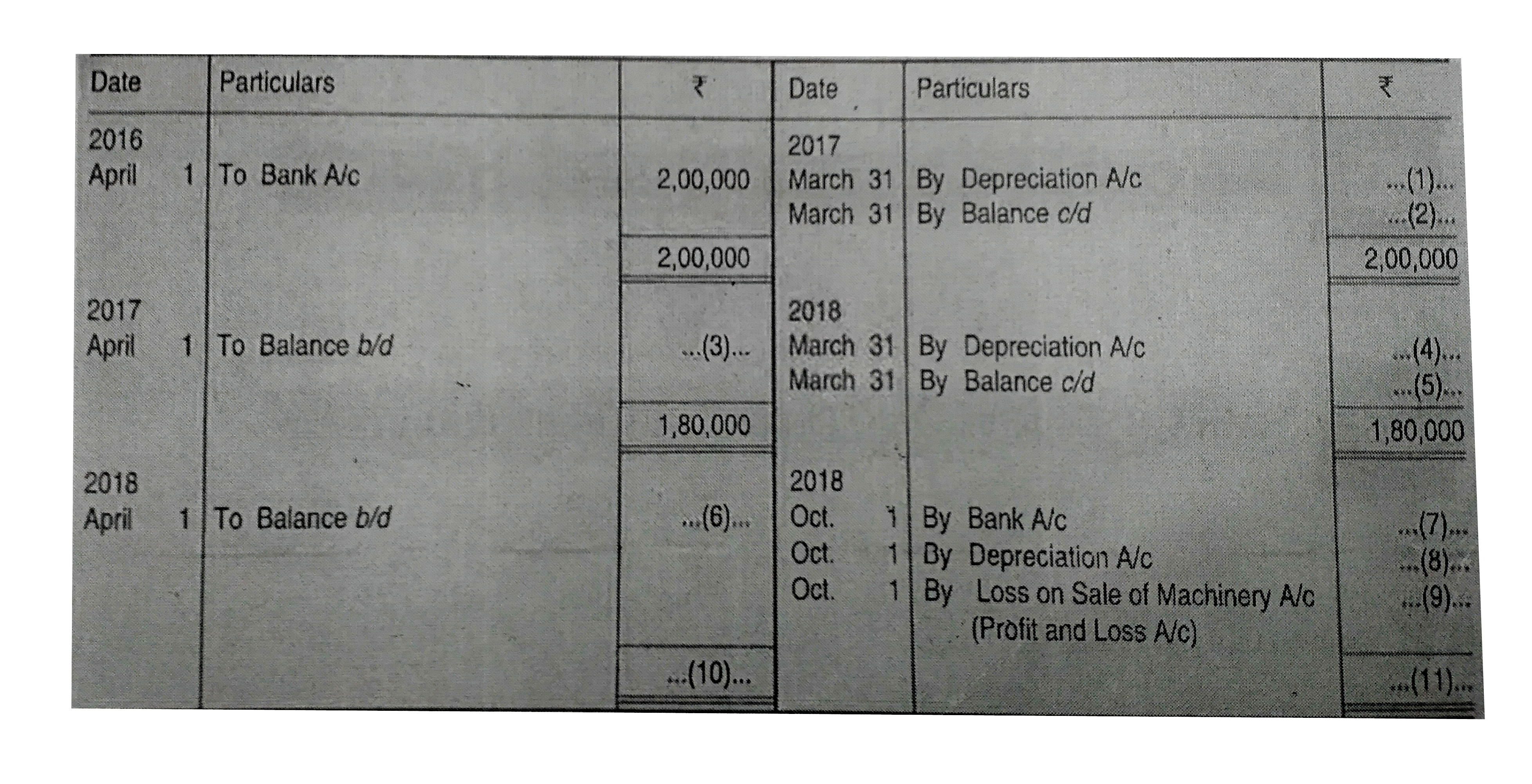

View SolutionIn the following Machinery Account, determine the missing values, if depreciation is to be charged @ 10% p.a. on the Original Cost. On 1st October, 2018, the machinery was sold for Rs 1,20,000.

View SolutionAstha Engineering Works purchased a machine on 1st July, 2015 for Rs 1,80,000 and spent Rs 20,000 on its installation.

On 1st April, 2016, it purchased another machine for Rs 2,40,000. On 1st October, 2017, the machine purchased on 1st July, 2015 was sold for Rs 1,45,000 plus CGST and SGST @ 6% each. On 1st January, 2018, another machine was purchased for 4,00,000 plus IGST @ 12%. Prepare the Machinery Account for the years ended 31st March, 2016 to 2018 after charging Depreciation @ 10% p.a. by Diminishing Balance Method. Accounts are closed on 31st March every year.

View SolutionSharma & Co. whose books are closed on 31st March, purchased a machinery for Rs 1,50,000 on 1st April, 2016, Additional machinery was acquired for Rs 50,000 on 1st October, 2016 was sold for Rs 40,000 on 30th September, 2018.

Prepare the Machinery Account and Accumulated Depreciation Account for all the years up to the year ended 31st March, 2019. Depreciation is charged @ 10% p.a. on Straight Line Method. Also, show the Machinery Disposal Account.

View SolutionM/s. P & Q purchased machinery for Rs 40,000 on 1st October, 2016. Depreciation is provided @ 10% p.a. on the Diminishing Balance. On 31st January, 2019, one-fourth of the machinery was found unsuitable and disposed off for Rs 5,600. On the same date new machinery at a cost of Rs 15,000 was purchased. Write up the Machinery Account for the years ended 31st March, 2017, 2018 and 2019. Accounts are closed on 31st March each year.

View SolutionOn 1st April, 2016, a machinery was purchased for Rs 20,000. On 1st October, 2017 another machine was purchased for Rs 10,000 and on 1st April, 2018, one more machine was purchased for Rs 5,000. The firm depreciates its machinery @ 10% p.a. on the Diminishing Balance Method. What is the amount of Depreciation for the years ended 31st March, 2017, 2018 and 2019? What will be the balance in Machinery Account as on 31st March, 2019?

View SolutionOn 1st April, 2016 a firm purchased machinery for Rs 3,00,000. On 1st October, 2016, additional machinery costing Rs 1,50,000 was purchased on 1st October, 2017, the machinery purchased on 1st April, 2016 having become obsolete, was sold for Rs 1,35,000. On 1st October, 2018, new machinery was purchased for Rs 3,75,000 while the machinery purchased on 1st October, 2016 was sold for Rs 1,27,500 on the same day. The firm provides depreciation on its machinery @ 10% per annum on original cost on 31st March every year.

Show Machinery Account, Provision for Depreciation Account and Depreciation Account for the period of three accounting years ending 31st March, 2019.

View SolutionA company purchased a machinery for Rs 50,000 on 1st October, 2016. Another machinery costing Rs 10,000 was purchased on 1st December, 2017. On 31st March, 2019, the machinery purchased in 2016 was sold at a loss of Rs 5,000. The company charges depereciation @ 15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year. Prepare the Machinery Account for 3 years.

View SolutionABC Ltd. Purchased a plant on 1st April, 2017 for Rs 1,00,000. On 1st October, 2017, an additional plant was purchased costing Rs 50,000 plus CGST and SGST @ 6% each. On 1st October, 2018 the plant purchased on 1st April, 2017, having become obsolete, was sold for Rs 40,000, charging CGST and SGST @ 6% each. Depreciation is provided @ 10% p.a. on cost on 31st March every year. Show the Machinery, Machinery Disposal and Provision for Depreciation Accounts for the years ended 31st March, 2018 and 2019. Also show CGST and SGST Accounts for the two years.

View SolutionOn 1st April, 2015, machinery was purchased for Rs 80,000. On 1st April, 2016 new machinery costing Rs 40,000 was purchased. On 30th June, 2017, machinery purchased on 1st April, 2015 was sold for Rs 65,000 and on 30th September, 2017 machinery purchased on 1st April, 2016 was sold for Rs 26,750. On 1st October, 2017 another machinery for Rs 50,000 was acquired. On 1st October, 2018 new machinery costing Rs 40,000 was purchased. Depreciation was charged @ 10% p.a. on the Diminishing Balance Method. Prepare Machinery Account for your years ending on 31st March, 2019.

View Solution