Viyo Ltd.' is a company manufacturing textiles. It has a share capital of rupees 60 lakhs. The earning per shares in the previous year was rupees 0.50. for diversification, the company requires additonal capital of rupees 40 lakhs . The company raised funds by issued 10% debentures for the same. During the current year the company earned profit of ruppes 8 lakh on capital employed. It paid tax @40%

(a) State whether the sharesholders gained or lost, in respect of earning per share on diversification. Show your calculations clearly.

(b) Also, state any three factors that favour the issue of debentures by the company as part of its capital structure.

(a) Earning per share before diversification: Rs.0.50

Calculations of Earning per share after issue of Debentures: (assuming face value ofRs. 100 per share)  This clearly shows that the sharekeepers have gained after the issue of debentures since the Earning per share has increased from Rs 0.50 to Rs 4.

This clearly shows that the sharekeepers have gained after the issue of debentures since the Earning per share has increased from Rs 0.50 to Rs 4.

OR

Calculation of Earning per share after issue of Debentures: (assuming face value of Rs. 10 per share)  This clearly shows that the sharesholders have lost after the issue of debentures since the Earning per share has decreased from Rs. 0.50 to Rs. 0.40.

This clearly shows that the sharesholders have lost after the issue of debentures since the Earning per share has decreased from Rs. 0.50 to Rs. 0.40.

[Note: In case, a student has calculated Return on Investement as 8%(8,00,000/Rs.1,00,00,000) and compared it with the rate of interest which is 10% and concluded that the sharesholders have lost after the issue of Debentures since the interest rate is greater than the return of Investment, 1 mark is to be awarded]

[In case the examinee has assumed any other face value and has shown correct calculations and given the correct conclusion, full credit be given]

(b) Factors that favour issue of debentures by the company: (Any three)

(i) A good cash flow position makes debt funding more viable.

(ii) High Interest Coverage ratio lowers the risk of company failing to meet its interest payment obligations

(iii) High debt service coverage ratio indicates better ability to meet the debt service obligations

(iv) If Return on Investment of the company is higher than the interest rate on debt, its ability to use debt is greater.

(v)Lower the cost of debt higher is the ability to employ debt.

(vi) High tax rate makes debt relatively cheaper.

(vii) If the stock market conditions are bearish, a company may be able to easily raise funds through debt.

(viii) If the company does not want dilution of control, it will favour debt as a source of finance.

(ix) Inclusion of debt in the capital structure makes the capital structure flexible.

(x) If the business risk is lower, its capacity to use debt is higher.

(xi) Raising funds through debt involves low floatation costs.

Topper's Solved these Questions

- PART : B BUSINESS FINANCIAL MANAGEMENTBook:SUBHASH DEYChapter:PART : B BUSINESS FINANCIAL MANAGEMENTExercise:Previous years Examination Question (2014-2018) One Mark Questions

Explore 15 Videos

- ORGANISINGBook:SUBHASH DEYChapter:ORGANISINGExercise:Six Marks Questions

Explore 6 Videos

- PLANNINGBook:SUBHASH DEYChapter:PLANNINGExercise:GUIDELINES TO NCERT QUESTIONS

Explore 3 Videos

Similar Questions

KAY Ltd is a company manufacturing texiles. It has a share capital of ₹60 lakh in the previous year its earning per share was ₹0.05. Four diversification, the company required additional capital of ₹ 40 lakh. The company raised funds by issuing 10 % Debentures for the same. During the year the company earned profit of ₹8 lakh on captial employed. It paid tax @40%.

(i) State whether the shareholders gained or lost, in respect of earning per share on diviersification. show your calculations clearly.

(ii) Also, state any three factors that favour the issue of debentures by the company as part of its capital sturcture.

View SolutionViyo Ltd. ' is a company manufacturing textiles. It has a share capital of ₹60 lakh. The earning per share in the previous was ₹0.50. For diversification requires additional captial of ₹40 lakh. The company raised funds by issuning ₹10% debentures for th same. During the current year the company earned profit of ₹8 lakh on capital employed. It paid tax ∘40%.

View Solution

Knowledge Check

Last year our company made a _______ of several lakhs of rupees.

AprofitBgainCriseDraiseIn case of private placement of shares, to raise the amount of capital a company:

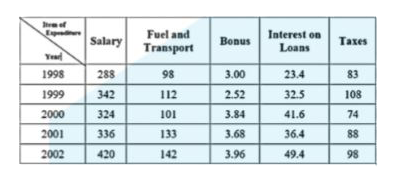

Ainvites the public through prospectusBdoes not invite the publicCinvites the public through advertisementDinvites the public through memorandum of associationTable shows the annual Expenditure of a Company ( in Lakh Rupees ) over the years.

What is the average amount of Tax ( in Lakh rupees) which the company paid during the period 1998 to 2002 ?A82.2B90.2C100D88.2

A company has earned Rs. 5,00,000 as profit before interest and tax. Its ROI is 20%. State the capital employed in the company.

View SolutionA certain company has 80 employees who are engineers. In this company engineers constitute 40% of its work force. How many people are employed in the company?

View SolutionA certain company has 80 employees who are engineers. In this company engineers constitute 40% of its work force. How many people are employed in the company?

View SolutionA portion of share capital that is reserved by the company and will be utilized only on the happening of winding up of the company is called ________.

View Solution

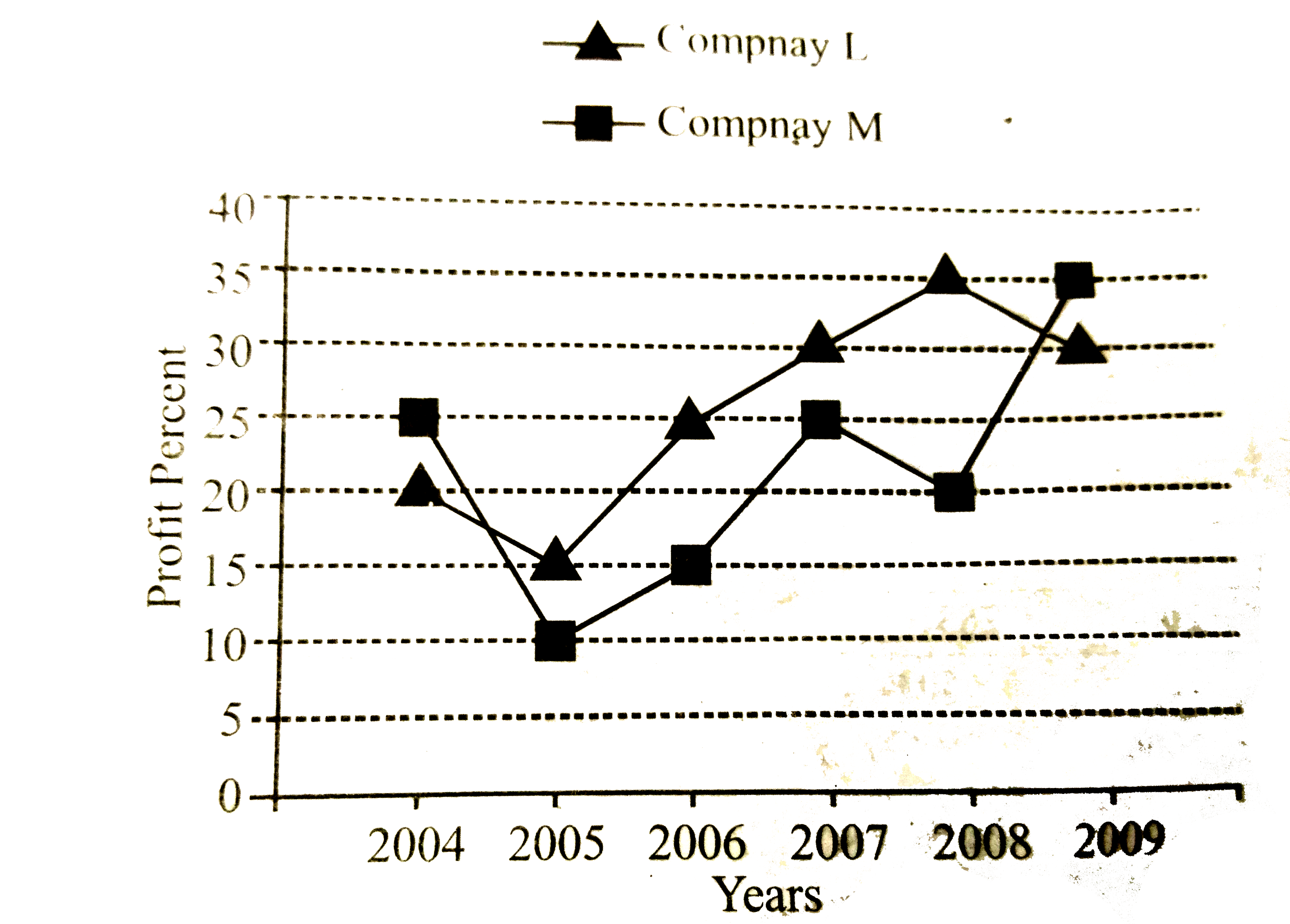

if the profit enarned by company L in the year 2005 was Rs. 1.84 lakh what was the profit earned by the company in the year 2006?

View Solution