KAY Ltd is a company manufacturing texiles. It has a share capital of ₹60 lakh in the previous year its earning per share was ₹0.05. Four diversification, the company required additional capital of ₹ 40 lakh. The company raised funds by issuing 10 % Debentures for the same. During the year the company earned profit of ₹8 lakh on captial employed. It paid tax @40%.

(i) State whether the shareholders gained or lost, in respect of earning per share on diviersification. show your calculations clearly.

(ii) Also, state any three factors that favour the issue of debentures by the company as part of its capital sturcture.

(ii) Three factors that favour issue of debentures by the company as part of its capital sturcture are :

(a) Debenture interset payable is a charge to the profits. Hence , a company stands to gain in terms of tax - benefits.

(b) Issue of debentures help the shareholders o f teh company to gain through ' Trading on Equity.

(c) Debenture is a cheaper source of finance as compared to equity.

Similar Questions

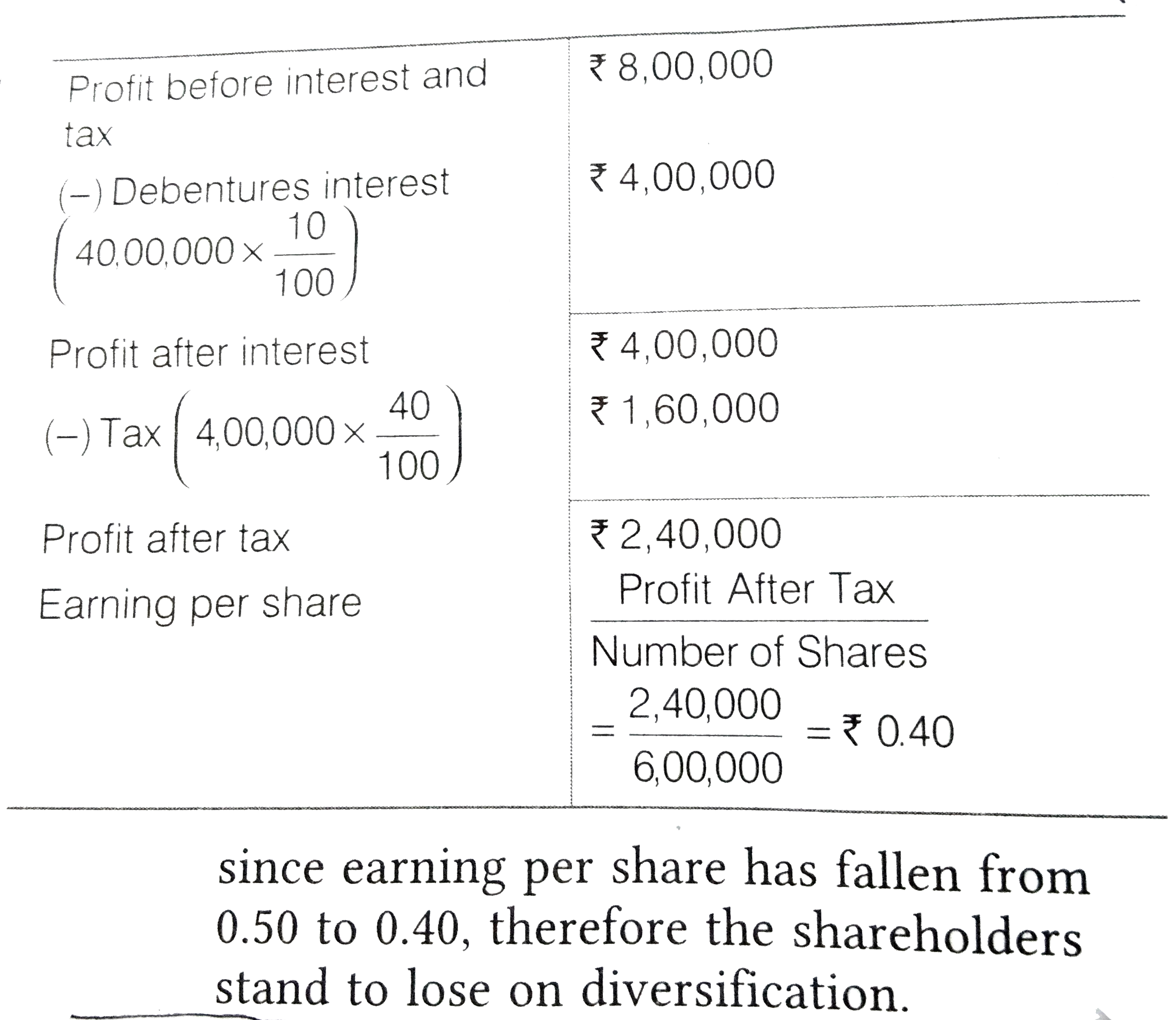

Viyo Ltd.' is a company manufacturing textiles. It has a share capital of rupees 60 lakhs. The earning per shares in the previous year was rupees 0.50. for diversification, the company requires additonal capital of rupees 40 lakhs . The company raised funds by issued 10% debentures for the same. During the current year the company earned profit of ruppes 8 lakh on capital employed. It paid tax @40%

(a) State whether the sharesholders gained or lost, in respect of earning per share on diversification. Show your calculations clearly.

(b) Also, state any three factors that favour the issue of debentures by the company as part of its capital structure.

View SolutionViyo Ltd. ' is a company manufacturing textiles. It has a share capital of ₹ 60 lakh. The earning per share in the previous was ₹0.50. For diversification requires additional captial of ₹40 lakh. The company raised funds by issuning ₹10% debentures for th same. During the current year the company earned profit of ₹8 lakh on capital employed. It paid tax ∘40%.

View Solution

Knowledge Check

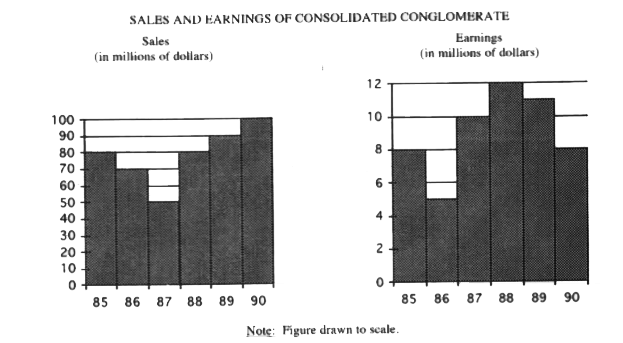

During which year was the company's earning 10 percent of its sales?A85B86C87D88Last year our company made a _______ of several lakhs of rupees.

AprofitBgainCriseDraiseIn case of private placement of shares, to raise the amount of capital a company:

Ainvites the public through prospectusBdoes not invite the publicCinvites the public through advertisementDinvites the public through memorandum of association

The capital of a company is Rs.250,000. If this capital is raised by issuing shares of Rs.8 each, then how many shares are there ?

View SolutionA company has 5 lakh shares of Rs. 15 each. The capital of the company is _________.

View SolutionA company has earned Rs. 5,00,000 as profit before interest and tax. Its ROI is 20%. State the capital employed in the company.

View SolutionA certain company has 80 employees who are engineers. In this company engineers constitute 40% of its work force. How many people are employed in the company?

View SolutionRaja Ltd. Purchased securities for ₹50 lakh. At the end of the year, the market value of such securities was ₹40 lakh. While preparing the financial statement, the company valued the securities at cost i.e. at ₹50 lakh. Is it a correct treatment?

View Solution